Crypto Uses & Benefits

Token Classification Framework: Main Types Of CryptoAssets?

Electronic trading has recently taken over as most stock trades are now done virtually. Words like bitcoins and cryptocurrency are being thrown around, but how many people understand what these currencies are?

The framework for the classification of tokens is based on five dimensions. Understanding these dimensions forms the basis for understanding the types of cryptographic tokens and how they are used. These dimensions are purpose, utility, technical layer, legal status, and the underlying value.

The Five Dimensions of Tokens

Technical Layer

Tokens are implemented depending on the technical layer of the blockchain system on which it is based. Under this, we have several types of tokens including the blockchain-native tokens, non-native protocol tokens, and app tokens.

Blockchain native tokens include Bitcoin, Ether and Ethereum, and Steem. These tokens are critical to the operation of the blockchain as they form an integral component of it.

The non-native type of tokens is unlike the former because they are implemented in a crypto economic protocol rather than directly on the token. They are tracked on an underlying blockchain to which it is not integral, and an example of it is the Decentralized Oracle Protocol and the Augur.

App tokens are the other type based on the technical layer dimension of tokens, and an example is Wisdom, Gnosis, and SAFE Network.

Purpose

Tokens can also be classified depending on their goal. Cryptocurrencies are tokens whose use is global, as they are intended to be used as “pure” cryptocurrencies. They also have the advantage of functioning as a store of value.

Another type of token under the purpose dimension is the network one. Network tokens are intended to be used within a specific system. This could be a software or an application. Examples are Gnosis, Stacks, and Blockstack.

Finally, investment tokens, just as their name suggests, are used to invest in entities or assets passively. They act as a promise of share value in an asset or a future success but have little to no significant functionality. Examples are Neufund and Digix Gold.

Underlying Value

Even though most tokens have a monetary value attached to it, the source of this value varies. For example, asset-backed are tied to some asset in the real world, like a piece of land. Network value tokens have their value linked to the value and development of an application or network. An example of an asset-based token is GOLD and GoldMint while Ether and Ethereum are examples of network value tokens.

Utility

What is the usefulness of a particular token? How does the token provide utility to its users? The ways to provide utility can be by giving one access to a digital service or by allowing the user to actively contribute to a work system. Usage tokens give access while work tokens give one the right to participate in a system.

Hybrid tokens are another subdivision under utility, and they provide the user with both access and the right to contribute to a system.

Legal Status

The jurisdiction of a token in a country is dependent on the regulations on electronic trading. As such, tokens can be divided into utility, security, and cryptocurrencies. What can be defined as a cryptocurrency in one country may be a security token in another. Cryptocurrencies can be used as a store of value and medium of exchange while security and utility tokens may not necessarily have the same characteristics. As tokens are a relatively new medium of exchange, some countries may not have regulations regarding them.

The classification above should help one understand how cryptocurrencies are used and how they are valued.

Crypto Uses & Benefits

Initial Coin Offering Investing: Top 7 ICO Research Factors To Study Before Buying

If you have any involvement in the world of cryptocurrency and the ICOs (initial coin offerings) associated with them, there has been substantial evidence of their rapid growth rates. In fact, the numbers reveal that ICOs have elevated to $5.6 billion in 2017 alone and hundreds launched every month. The caveat however, is that over half of the ICOs launched in 2017 have failed due to lack of foresight, extreme emphasis on token value, team mismanagement, ICO structuring, etc.

At CAM, their team carefully evaluates an ICO to invest in through an analytical framework, which typically ratios to less than out of every 100 ICOs that flows into their line of sight. When having made the selection, CAM ventures to support the organization through various funding and shares classes it manages.

That being noted, CAM receives approximately dozens of emails daily from newly established companies requesting funding for each of their ICO launches for the designated cryptocurrencies in order to raise capital.

To clarify the stipulations in the election process, listed below is content which is critical in determining an ICOs’ eligibility for CAM’s support. The company dubbed this the The Seven Pillars of ICO Investing™, which has been conscientiously formulated in the throes of several years of investing in crypto tokens and other assets.

Pillar #1: Team

First and foremost of the crucial variables marking a successful ICO launch is the team proposing it. The ideal team will have a strong history in developing and launching blockchain technology, as well as a marketing strategy which caters to its’ audience. The team must display competency, and be versatile in developing, completing and/or further expanding their gameplan.

In addition, a few key points to consider for the marrow of the project:

- Are the advisors for the team taking an active interest in the project and do they have experience in the field?

- Does the campaign have any financial backers? (VCs, other hedge funds?)

- Is there a proper token schedule laid out by the team which will work to incentivize it.

Pillar #2: Idea

How solid is the campaign in the sense of its realistic framework including timeliness? A few key variables CAM seeks to identify:

- Total addressable market: How much can the opportunity expand? A key note is in how large the market is.

- Product-market fit: How are bugs and issues addressed?

- Unique value proposition: What are the features of the technology that facilitate its’ uniqueness? How much competition in comparison? They observe if the token has a proprietary technology, and if there any similar products on the market.

While CAM certainly favors both Pillar 1 and Pillar 2 and their interoperability with one another, the first aspects of the equation they will survey is how effective the team is. CAM’s vision of ideal investment would be for “A” team working towards “B” idea than a “B” team focusing on an “A” idea. Having a reliable and resourceful team is the maker or breaker of a business, regardless of cryptocurrency or otherwise.

Pillar #3: Execution

At the end game, the results are the determining factor.

While a talented team and a superb idea are valuable, the execution of the proposal is truly a paramount component. Is there already a prototype for the product in question, or is it simply a pipedream nebulously projected onto whitepaper?

Trust that when the company says your brand will need some results, they expect it to already in play. In doing so, CAM is more liable to invest in a product which already exists to some degree, be it a cryptocurrency backed campaign or analogously through fiat currency. With these cornerstones in mind, it aids in the search for some proof that the organization will hit the milestones it projects for itself.

Pillar #4: Legal/Regulatory

The Legal end is another highly important pillar, as this is a necessity in the growth period of an unstable industry.

Anyone involved in the market will be aware that various global government agencies (especially the U.S.A.) are taking regulatory actions or creating a new criteria for the distribution and management of ICOs. In that same vein, there are countries considering a legislation toward ICO governance. At this stage in the game, it is crucial that the product and or token in question is able to navigate a continuously changing landscape vigilantly and possible future comprehensive regulation.

A particular point of concern that has proven to be a thorn in mass player’s sides is the jurisdiction issue. A company must ask in what country will it be incorporated and what access will others have to the ICO? This determines the rules and limitations.

In regards to limitations, if you are a U.S. investor seeking reprieve, CAM does tend to apply the methodology of the Howey test’s KYC/AML principles and the securities law surrounding them.

Pillar #5: Tokenization

The crux of this issue usually develops during the last public sale. There is often superfluous activity behind it by way of creating apps (dApps) which would not necessarily require token usage, no matter the claims that the founders may make. NASDAQ’s settlement system is a prime example of token output and its’ views creates a gratuitous and even in some cases, counterproductive move. Truth be told, the tokens are, in most cases, unnecessary if the platform is proposed correctly.

As the industry continues to grow through the perpetually changing value system via blockchain technology and the notion of “free” standard of exchange, it stands to reason why so many entrepreneurs would favor approaching the diving board of ICOs and cryptocurrency under any reasoning.

Therein, another main principle of CAM’s stigma is a business must have legitimized reasons to back the purpose of purporting their tokens into business operations and publicly extending that value system through the market.

Pillar #6: ICO Structure

In correlation to the traditional investing via venture capitalism, the financial underpinnings are the determinant in the choice of investment. In lieu of the decision making process, the characteristics of an ICO have direct impact on implications of the token’s gain. To clarify, this can be split into two categories – ICO mechanics and ICO deal structure.

- ICO Mechanics – Truth be told, when it comes to performance, ICOs with a lower cap tend to yield better results than those with a massive hard cap. Funding is of course, imperative in the integral operations, however in order for the entire machine to be functioning, the ICOs must have a solid mechanized plan for the use of their proceeds as the potential upside decreases in ratio to the amount funded. If you recall, the hard cap serves as a measuring device for the circulation of tokens and their value. This first variable is another factor we take into consideration.

- ICO Deal Structure – As for the deal structure, it should be architected in such a way so that investors are not at an unfavorable position to the market. Further elements in CAM’s analyses are accounted for below:

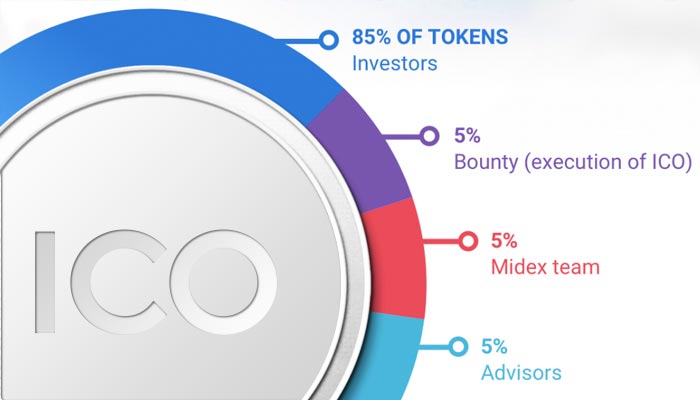

- Distribution: Distribution of tokens should have a compelling structure, appropriate allocation amongst the team and it’s advisors, market updates for programs, etc.

- Distribution Schedule: Timing plays another large role, especially when the cryptocurrency rivers have been unleashing a fast and furious flow. CAM recommends the distribution schedule not favor specific parties. Essentially, this route expands to the market of individuals and their liquidity preferences outside of the long-term distribution durations.

- Discounts: Another touchy and superfluous subject, ICO discounts are pervasive in nature, so ensuring that your variety of discounts provides point of reference for investors so they can determine what their options are to other stakeholders.

- Equity Stakes: Ultimately, yours and Crypto Asset Management’s goal is to take a part in the growth of the company. Investing directly into the equity of the business segues for CAM to play a greater role in the company’s development. Ultimately, the value proposition of the organization in question can be just as great or even greater than its token ecosystem campaign.

Pillar #7: Price Drivers

As a team may propose a great product and an appropriate cause for its token, this does not guarantee that the Crypto Asset Management team will desire to gain the token or invest in the ICO. By standard of application, a token must have a mechanism to instigate price appreciation.

As ebb and flow naturally occurs in the investor’s market, a token which remains constant in its supply and without any incentive for buyers to hold, is subject to lose its value in the long run for sellers. Inquiring minds will reduce their risk if there is high volatility centered around the coin. Again, as was stated earlier, this is one of the underpinnings of an unstable market and price risks. (Kyle Samani has written an in-depth article elaborating on the problem here.)

A few of the price drivers they will look for includes:

- Network Volume: If you have ever paid to the basic mechanics of a blockchain transaction, with their increase, so does the value of a cryptocurrency. This is a basic principle of demand and is indicative of why CAM’S interests lie in protocols rather than dapps.

- Market Leadership: Simply put, CAM is going to only select in tokens that strive for or project an efficable leadership. These cryptocurrencies will have a feature which allows for unique advantage above their competitions, aka Practical VR.

- Incentives to Hold: Naturally, there will be points in which an investor would hold on to their tokens rather than spend them. The reasoning behind this can be related to a number of variables, be it forecasted prices increase or other non-monetary rewards. In short, CAM won't invest in a token in that it’s only purpose is acting as a medium of exchange.

- Supply Changes: As this is a major consideration, when inflation occurs, the token supply should ideally not dilute the value of the tokens over a duration, or token burning, where the supply of tokens in the system decreases over time.

- Profit Sharing: Naturally, the values in which the system extracts is offered back to token holders. Make sure it is a value which your patrons are satisfied with.

- Staking: Another game play which determines quantitative token and company value is to designate users in a certain network to lock up their tokens either for network consensus or as a safety measure for certain processes.

- Sufficient Liquidity: As a team resource, if your members are not proactive about your product’s presence on multiple exchanges, particularly top-tier ones, chances are high CAM will not make an investment.

It is important to note that Crypto Assets Management generally do not carry interest in asset-backed tokens. The justification behind this decision is that there is very little driving force to be had once a campaign has received a minute boost for its growth convenience. Generally, the opportunity cost is too high, while there is better options to be had in the grand scheme of things.

Furthermore, implementing strong incentives in the ICO launch or project proposal is indicative of higher rate of return. The formula has shown that the price increase will be driven by the inherent design of tokenomics, but also potentially influenced by the implementation of these drivers.

In lieu of the plethoras of one-hit-wonder ICOs, it seems a guarantee that a tokenized future is in our midst. It certainly is an evolution in capital development and also has produced literal overnight fortunes in some cases. CAM does offer warning to those who have minimal to no experience in investing that the cryptocurrency avenue could potentially rocket you in a direction of financial ruin. Those however who operate with proper due diligence have an opportunity to earn brilliant returns on your investments in the projects.

Crypto Uses & Benefits

Top 10 Bitcoin Facts Every Cryptocurrency User Should Know in 2018

Top Bitcoin Facts You Should Know

The undisputed cryptocurrency leader and the coin on which all other cryptos depend for their existence, bitcoin is the world’s most popular cryptocurrency.

In fact, it is often synonymous with cryptocurrencies as a whole. It is not unusual to hear people refer to cryptos as bitcoin, when in reality, they are different.

Bitcoin became the talk of the town last year, when it shot up from less than a $1,000 per token to as high as $18,000+.

For many, the sheer growth triggered a huge inflow of cash into cryptocurrencies resulting in the biggest cryptocurrency growth since its inception.

Table Of Contents

In this article, we’ll be examining the most common and befuddling facts surrounding the cryptocurrency.

1. Bitcoin’s Founder Is An Enigma

Most people have heard of the mystery person called Satoshi Nakamoto. But no one really knows who he/she/they is/are. This entity designed was singlehandedly responsible for building, designing and launching the bitcoin project in 2009.

Satoshi Nakamoto is actually a pseudonym. One that many people have busied themselves with, trying to figure out who he/she/they is/are (as you can see, even we aren’t sure of their sex, identity or organization).

There are rumors that the name Satoshi Nakamoto is actually a combination of the names of multiple organizations. These organizations include Samsung (Sa), Toshiba (toshi), Nakamich (Naka) and Motorola (Moto). Combined together, you can see how they spell the founder’s name.

Then, there are those who posit that the person is a male enigma. Whatever the case, the founder’s real identity isn’t known –forget about usurpers like Craig Wright as he’s a known scammer and “shillster” or the bespectacled older Asian man– and remains hidden until they/he/she choose to reveal themselves.

Whatever the case, just know that the founder is currently worth over $16 billion in bitcoin and has/have been nominated for a Nobel prize in economic sciences. Not bad for an enigma, eh?

2. Transactions Are Traceable And Untraceable

Depending on who you ask and how much information you know. Bitcoin has a public permanent blockchain ledger that details how much a bitcoin wallet or public address is holding.

But, that’s all the information there is about that. You cannot find an associated name, address or phone number of the individual. Now you understand why we said it can be both traceable and untraceable at the same time.

Before anyone can determine your public address, they’ll need to know that it’s your first. That’s the only way they can determine that you own the wallet. This is how the FBI caught the founder of Silk Road, the world’s erstwhile biggest online drugs market.

3. Bitcoin Mining Is Getting Harder

Some people prefer mining bitcoin as a means of generating passive income. In the heydays, that used to be a moneymaker. Nowadays, not so much.

Because there’s a limit to the amount of bitcoins that can be in circulation -21 million- it’s getting harder to mine bitcoins. As a result, you have many people jumping ship and mining other less limiting cryptocurrencies.

Eventually, chances are people would mine that amount of bitcoins, resulting in max supply. When that happens, bitcoin mining as an income generating strategy will be retired.

4. 10,000 BTC For Two Pizzas

One of the most popular facts about bitcoin is, about a year after it was created, someone paid 10,000 BTC for two pizzas on May 22, 2010 –this is why Bitcoin Pizza day is marked on the same date every year.

At the time, the 10,000 BTC was valued at $41. Today that 10,000 would be valued at over $70 million, while its value would have been over $180 million in December 2017.

5. Guess Who Has The World’s Largest Known Bitcoin Stash

The Federal Bureau of Investigation is what it is. Yes, the same FBI that you know. They were able to amass such huge amount when they arrested the founder of Silk Road, shut down the black market site and seized his bitcoin wallet, valued at over $100 million at the time. We’re pretty sure it’s grown in value since then, given bitcoin’s incredible growth rate.

6. Bitcoin’s Network Is Incredibly Powerful

You know how the world’s best supercomputers are thought of as something of a legend? Well, turns out bitcoin’s network is 500 times more powerful. This is because the network has a computing power of 2,046,364 Pflops/s. This is more power than 500 of the world’s fastest and most powerful supercomputers.

7. Transactions Are Irreversible

Here’s why you need to be careful about the address you’re sending money to. If you send some funds to the wrong address, you better pray real hard that the receiver is kind enough to send your money back.

And if you send it to a nonexistent address, your funds are gone all the same. In conventional payment networks, you just have to request a refund if you send money to a wrong account.

With bitcoin, that money is gone. And it’s worse because there’s no way to reach the receiver because, that information is not public at all. So, be careful with sending funds.

8. Bitcoin Investment Can Be Financially Rewarding

Early adopters of bitcoin made a fortune from the cryptocurrency. Even those who invested early 2016, made at least 6 times their money. The returns from bitcoin is singlehanded responsible for the term “cryptomillionaire”, as it has made quite a few guys millionaires.

If you bought just 100 BTC in 2013 for about $400, that 100 BTC would be valued at $750,000 today. And if you had sold in December, that’d have been an easy $1.8 million.

While the cost of getting into bitcoin is pretty high now, it still has the potential to grow over the next few years. There are speculations that it could it the $100k mark within a few years.

So, if you’ve got the cash, bitcoin is still the most financially rewarding and stable cryptocurrency to invest in.

9. Lost Wallets Are Irretrievable

Retrieving lost wallets is almost impossible. The same goes for losing your private keys or password. There’s no way to request a password reset or get your private keys back.

This is why you need to keep your private keys, passwords and wallets safe. Many people who bought bitcoins in the early days and promptly forgot about it, or were unable to retrieve their details have regretted that decision.

Don’t be one of those people. Keep those wallets really close.

10. Costs Nothing To Send Funds

You know how you would have to pay some fees to send funds through your conventional financial institutions?

Well, that’s nonexistent with bitcoin transactions. You can send any amount of bitcoins you want without paying a dime in network fees. Now, sending funds was really fast in the past –more like instant.

But with the increased transaction volumes, your transactions can take some time to reflect.

Crypto Uses & Benefits

Cryptocurrencies Taxes Guide: How Bitcoin & IRS Reporting Works?

Tax season is right around the corner. That means, filing taxes, lots of paperwork and everything that makes us all dread the tax season. As if it’s not enough that you already have to deal with so much, you now need to worry about the role that cryptocurrencies play in your taxes.

For many people, the question often is, are cryptos taxable?

Should I include them when I’m filing my taxes?

Does the IRS even recognize cryptos as an investment or financial instrument, considering that even the SEC hasn’t really decided on what to make of it?

Well, the answer is yes, unfortunately.

You see, the IRS has determined that cryptocurrencies are in the same category as property. The document outlining this is the Notice 2014-21, which is accessible on the IRS website.

In summary, the document highlights the IRS’s recognition of cryptos as property and refers to it as a Convertible Virtual Currency. This means that it can be exchanged for FIAT currencies like the dollar.

What they didn’t highlight however, is how to go about filing the taxes for cryptos. It is assumed that the process will be in a manner similar to that of properties.

Whatever the case, the IRS considers every action involving the buying, selling and exchange of cryptocurrencies as taxable events. So, if you were to buy some Tether (USDT) with cash, that’s a taxable event.

If you exchange that for Ethereum (ETH), that’s another taxable event. However, if you move the Ethereum from the exchange e.g. Binance to your personal Myetherwallet, that’s not considered a taxable event.

Bottom line, any FIAT to Cryptocurrency or Cryptocurrency to Cryptocurrency exchange you make within a fiscal year, will be taxable. So, as long as it implied reward of some sort –whether you profit from it or not is moot- you will pay taxes on it.

However, if you hold it in keeping without selling or exchanging, you will not be taxed –this is even more so when you move from one of your wallets to another.

So, How Do You Determine How Much To Pay The IRS?

Well, since cryptocurrencies are taxed pretty much the same way as your property, assets, investments, stocks or bonds, you will need to factor in your capital gains and losses before paying the taxes.

This means that to determine the correct amount you need to pay, you’ll have to first determine the following:

- Date of initial cryptocurrency purchase or exchange

- The exact costs involved in the transaction (this also includes any costs, charges or fees accrued in the process; not just the cost of the cryptocurrency you purchased)

- Date of cryptocurrency exchange for cash or sale

- Exact price at which cryptocurrency was sold and total income/revenue from the sale (this also includes charges and fees)

While it’s true that tracking your trades might be somewhat overwhelming particularly if you do a lot of trading, the reality is this might be one of the best ways to protect yourself from the IRS.

The IRS will not accept negligence or ignorance as an excuse. So, you should actively seek to document all your trades. Also, there’s the added advantage of tax reports provided by certain exchanges.

These exchanges understand that there could be tax problems associated with their traders’ accounts. So, they have taken the initiative of making tax reports of their trades available on the exchange. Check your exchange to see if they offer such services –usually comes free of charge too.

How About Capital Gains and Losses For Taxes?

When it comes to cryptocurrency tax filings, there are different types of gains and losses. For the capital gains, there’s the

- Short term gains

- Long term gains

Short term gains are usually placed in the same category as income. So, whatever you make from your trades will most likely be subject to tax at your current tax bracket. Long term gains however, are taxed differently, and are usually lower than your short term capital gains. Long term capital gains often refer to the profits you make from “hodling” your cryptocurrency.

So, if you bought 10 ETH when it was priced at $7.95 in November 2016, and then stored it until December 2017, when it was valued at over $1,300, you will pay taxes on the profit made from holding the cryptocurrency. In this instance, that would be the $1,292.05 you made per ETH after subtracting the $7.95 from the $1,300.

Losses on the other hand is how much you lost from the investment. If, using the earlier example of 10 ETH, you bought at $1,300 in December 2017, and sold recently at $800, your capital losses would be valued at $500 per ETH.

You’ll need to report this too in your tax filing and deduct it from your taxes. Please note however, that you can only claim up to $3,000 in losses.

Also, with the Tax Cuts and Jobs Act kicking in this year, this might be the last time to claim tax losses on property –remember cryptocurrencies are categorized as property. So, if your ethereum wallet was hacked or you lost your cryptocurrency, this is the right time to claim those losses. You won’t get that opportunity in 2019.

Cryptocurrencies Taxes Guide Conclusion

If you had a great year with cryptocurrencies last year, chances are you might be tempted to completely skip the inclusion of your cryptocurrency gains and proceeds from your tax declarations and filings.

Well, we wouldn’t recommend that. The IRS is pretty serious about cryptocurrency proceeds tax as evidenced in their requisitioning of date from Coinbase. It’s only a matter of time before they do the same for all other popular exchanges. Once they do, you could potentially be in trouble.

It’s best to just file the taxes and be done with it. Better to be free and solvent so you can take advantage of the opportunities that 2018 will present, than be in jail because you omitted your crypto portfolio.