Cryptocurrency Information

HitBTC: How To Trade & Exchange Cryptocurrencies User’s Guide

About HitBTC Cryptocurrency Exchange

As claimed on the website, HitBTC is an advanced Bitcoin exchange company. HitBTC is a multi-currency trading platform with support for over 150 tradable digital assets, including cryptocurrencies, tokens and initial coin offerings (ICOs). Besides trading cryptocurrencies, tokens and ICOs, HitBTC provides proper markets for fiat trading, including USD and EUR trading pairs. HitBTC is one of the few exchanges that support direct fiat/cryptocurrency trading in the market.

HitBTC was started in 2013 with 6 million euros in venture capital funding. Since its inception, it has continued to add new currencies and tools to its platform, including features that facilitate adding tokens to the exchange.

An intuitive user interface makes HitBTC a user-friendly exchange for new traders and advanced users to get started with. It also offers a robust API for people to use in third-party applications, especially people that are into creating trade bots. HitBTC can be regarded as an exchange where both newbies and trading professionals will be able to trade with ease. It was built on top of modern technologies to provide fast, secure and reliable service.

Table Of Contents

There are quite a number of outstanding features of the exchange including High liquidity, Core matching engine, No-limits for funding/withdrawal of cryptocurrency, Large selection of tools and High level of security.

One exceptional quality of HitBTC is that it’s focused only on the major markets. Meaning, cryptocurrencies like Bitcoin & Litecoin can be exchanged directly with USD & EUR, but it does require verifications.

Major Features Of HitBTC Exchange

Trading Tools

HitBTC has an information-packed terminal that displays recent trades, currency pairs, and movement over a set period of time.

Executing trades from Market Depth

Users can use the market depth module to place trades. With just a click on the point in the graph with the desired price, the trade is automatically for you at the exact price.

When selling, exactly the same process can be followed. Search for the highest volumes where traders have put their stop orders. With this, users can predict that the price is going to start falling as when a lot of traders sell at the same time the price will drop due to the demand going down significantly.

Stop Order Level on the Chart

Buy and Sell limits are displayed on the price chart to help users keep a better track of orders:

Green line is displayed at the price level of the Buy Order.

Redline sits on the price level of the selected Sell Order.

Guest Mode

Users can explore markets effortlessly. Anyone is allowed to check the very latest market data, charts, and order book, without having to log into an account, providing extra convenience.

Demo Trading.

The Demo Trading option of Hitbtc can be used by novice traders to gain valuable trading experience and gives them an opportunity to learn exactly what Hitbtc has to offer. This feature also allows skilled users API users to test out their third-party applications.

Market Maker contracts

A market maker is a “market participant” of an exchange that also buys and sells securities at prices it displays in an exchange’s trading system for its own account which is called principal trades and for customer accounts which are called agency trades. Using these systems, a market maker can enter and adjust quotes to buy or sell, enter, and execute orders, and clear those orders.

On HitBTC, Market Maker contracts permit API traders to maximize their trading experience. The contracts are accompanied by cash incentives and rebate bonuses. It allows traders to add a new currency to the exchange if two users take Market Makers contracts to support the cryptocurrency on HitBTC. Every contract is valid for one currency pair. HitBTC sends Market makers detailed daily reports with order book snapshot to help them evaluate their performance and develop the most efficient trading strategies. Here is a handy guide to HitBTC market making contracts.

API

HitBTC is popular for its extremely stable API, which satisfies the needs of algorithmic traders. It provides an easy back-office integration, and it is compatible with HFT set-ups, and algorithmic trading systems.

HitBTC API allows you to access the full range of features of the exchange. It also makes it easy to implement into custom software. The interfaces include the RESTful API, socket.io, and Streaming API. RESTful API lets users access market data, perform trading operations, and manage funds. Socket.io is a protocol that lets you receive market data, and Streaming API lets you access market data and trading operations. Also, with the responsive and feature-packed terminal, users can trade effortlessly any of the currency pairs in milliseconds.

Security

The developers have worked on a very impressive set of protection matters as the mentioned state of art cryptography combined with FIPS validation and offers of two-factor authentication.

HitBTC provides two-factor authentication for all users through the commonly used Google Authenticator. This security feature is used for all logins and withdrawals.

Another additional security feature is the ability to view recent activity at the bottom of the settings page, which lets you check if someone is attempting to access your account from some location maliciously.

Like some other exchange platforms, HitBTC also adopts the use of cold wallets in securing users’ funds. This measure prevents hackers from gaining unauthorized access to users’ funds.

Affiliate Program with HitBTC

You can also be an affiliate with HitBTC, which means that you can earn through your referrals! They actually give a lot back to their affiliates, so if you want to be a part of people that have nice passive income with them, don’t miss it.

Fees Structure

HitBTC used to charge low trading fees. They only charge 0.1% on every market trade and LP orders have a 0.01% rebate. However, it should be noted that users are now being forced to pay a Bitcoin deposit fee. Right now, this fee is 0.0003 BTC. It is unclear if it will remain fixed or change depending on the price of Bitcoin.

For now, these deposit fees will be deducted from incoming BTC amounts, which implies any deposit lower than the fee will be used to pay the fee and not be refunded to customers.

However, the company argued this decision was made to strengthen all Bitcoin processes on the HitBTC platform. Claiming, the company aims to “provide stability in the functioning of the major cryptocurrencies.”

Getting Started With HitBTC

Create an account

In order to create a new account, visit the main page of the site. Then click the ‘Register' button in the upper right corner.

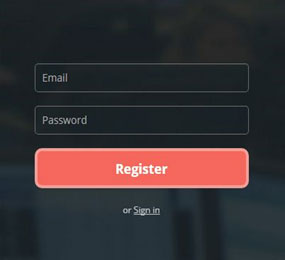

Enter your valid email address in the ‘Email'

Set up a strong password consist of more than 8 characters with uppercase, lowercase and numeric characters in the ‘Password'

As a security measure, make sure you follow the best practices specified by HitBTC here

After filling all fields, click the ‘Register‘ button.

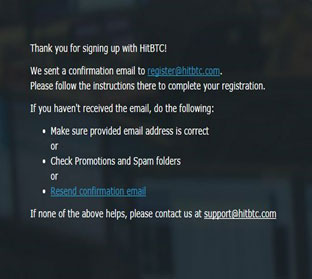

Activate your account by confirming the link sent to your inbox

Note: The confirmation message is sent immediately after registration, so if you do not receive it within 2-5 minutes, please check the spam folder or click on ‘Resend confirmation email’ as shown above

After the confirmation of your account, you will be re-directed to the trading terminal where you can start trading.

Verify your account

There are levels of accounts that you would be able to get with HitBTC – General, Verified, and Qualified. Each of these levels has their own advantage, and the higher the level, the higher the trading volume.

General accounts

For this tier you can traders can only deposit cryptocurrencies. Your daily withdrawal limit is EUR 5,000 worth of cryptocurrency per day.

Verified accounts

For this second-tier, traders can deposit and withdraw a maximum of EUR 25,000 worth of cryptocurrency per day. FIAT deposit/withdrawal would be $2,000 (USD, EUR) per week and $10,000 (USD, EUR) per month.

Qualified accounts

This account can withdraw more than $25,000 worth of cryptocurrency per day. Also, FIAT limit would be $10,000 (USD, EUR) per week and $50,000 (USD, EUR) per month; for deposits and withdrawals.

To verify your account:

- Contact HitBTC at compliance@hitbtc.com with the following information included in your email in order to have your account verified:

- Personal Information (ID’s issued by the government)

- Address

- Bank account information (For those people who want to use FIAT)

- Proof of Residence (PoR) document

- Proof of bank account ownership document/certificate

Note: It’s very important to keep in mind that before you submit any requirements to them, you should take care of the below precautions so that you wouldn’t experience any issues when it comes to your account verifications.

- Make sure you use the email address that you registered with them to send the verification email

- As stated on the website: “Screenshots and/or electronic documents are not accepted. This document should be paper-based and drafted on original bank letterhead.”

Making Deposits to your account

Note: Depending on the volume and type of currency to be deposited or withdrawn, funding your account can take up to fourteen (14) business days, while the withdrawal of funds can take up to twenty (20) business days.

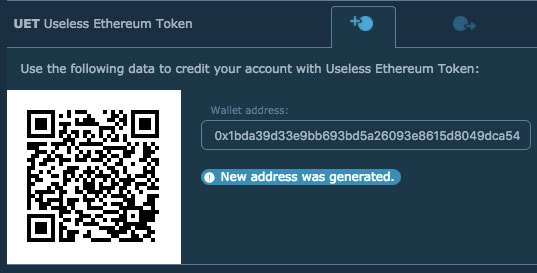

From your account page, click the green “Deposit” button.

Find a row of currency you want to deposit and click the fund button. This will generate your wallet address.

Copy the address generated, and paste it into the wallet from which you are transferring your fund.

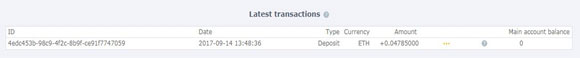

Once your funds reach HitBTC, you will see a pending transaction at the very bottom of the Account page, in the “Latest transactions” section.

You can contact the HitBTC support in case you are experiencing any issue.

Executing Trades on HitBTC

Transfer your funds to the trading

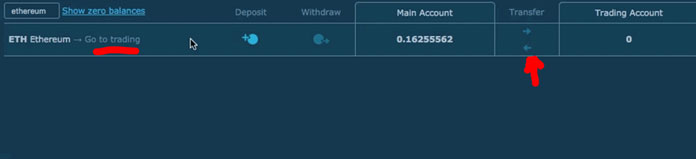

To start trading, you would need transfer funds from your Main account to your Trading account. Depending on the destination of your transfer, click either of the blue arrows between the accounts. Specify the necessary amount and click “Transfer”. In the example below, we are transferring to the trading account as specified in the diagram below:

Set up an order

After your funds have been transferred to the Trading account, navigate to the trading terminal, and select a trading pair in the “Instruments” tab as shown below.

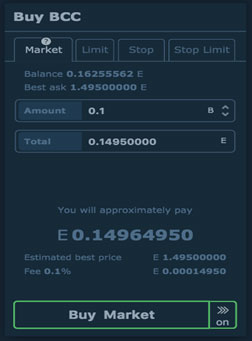

Fill-up the order by specifying the amount and price you are willing to buy depending on the type of order you are placing.

Note that there are four types of orders available. Market, Limit, Stop and Stop Limit.

Market order

The market price is defined as the best available price for the trade at the moment when the order is placed.

Limit order

A limit order to buy would be at the limit or lower, and a limit order to sell would be at the limit or higher. Limit orders are used by traders who have decided on the price at which they are willing to trade. A limit order requires a specified amount of funds to be reserved on your account.

Stop order

Unlike the limit order, when the stop price is reached, a stop order becomes a market order. Stop order doesn't require reserved funds and will not appear in the order book before it's activated.

Stop limit order

Stop limit order means you are creating a limit order at a specific price. That is when the stop price is reached, a stop-limit order becomes a limit order. So, you're specifying two prices: stop price, thereof reaching triggers a creation of a limit order, and a limit price for that limit order. This type of order doesn't require reserved funds and will not appear in the order book before it's activated.

An example below shows how to create a market order for BCC:

Making Withdrawal from your HitBTC Account

To withdraw your digital assets:

- From the account tab, specify the amount you'd like to withdraw and paste the receiving address into the “Address” field.

- Make sure that the amount you'd like to withdraw is stored on your main account by transferring it from your trading account if needed, then click the “Withdraw” button.

- Type the authentication code from your Google authenticator app if 2FA for withdrawals is enabled on your account

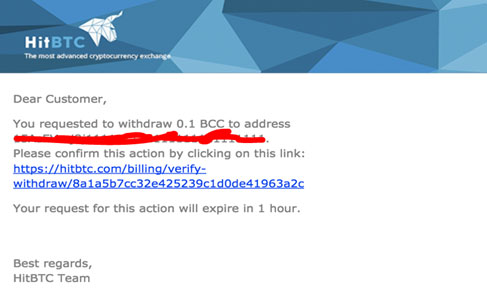

After clicking the withdrawal button, the following notification is going to be displayed: “Your withdrawal request requires a confirmation by e-mail.” Kindly proceed to your email inbox and locate a new message from support@hitbtc.com, titled “Withdraw verification”. As shown below:

Note: Make sure the link is directly from HitBTC before clicking on it, to avoid a phishing attack

Confirm your withdrawal request from your e-mail by clicking this link.

Note that some digital assets require extra options for sending transactions. For example, to withdraw XMR you would need to specify wallet address and payment ID. You must make sure you have followed the instructions correctly to avoid any mistake.

Cryptocurrency Information

Bitcoin Volumes Finally Grow Again and Bitfinex/Tether Issues Spark Systemic Risks, New Diar Report Affirms

Diar has recently published its report of the crypto market for April. According to the company, Bitcoin volumes are finally growing again and the whole situation with Tether and Bitfinex showed the industry some of its systemic risks. DAI fee hikes and stablecoin projects were also highlighted in the report.

Bitcoin Goes Back To Growing Again

The main highlight of the month is, obviously, that Bitcoin is back on the action. After facing lows which started in 2018, the token has finally been able to effectively reverse the trends and have an actual price surge this month, going from less than $4,200 USD to over $5,200 USD during this short timeframe.

With this, the number of on-chain transactions has spiked for three months in a row, since prices started to get some of their value back in March and April. Now, transaction volumes are around their levels in June 2018 when the price of the asset was around $7,000 USD.

However, charts indicate that Bitcoin is yet to find more footing outside of speculative trading, so the bull market may not be as near as some think.

When looking at the volume of the whole quarters, Q1 2019 had lower volumes than Q4 2018, but Q2 2019 started considerably well.

Bitfinex and Tether Start Concerns of Systemic Risks

As you may have heard, Bitfinex was accused of using Tether funds to cover up its losses. According to Diar, there is a 26% shortfall of in-cash reserves to back Tether tokens (USDT). Tether loaned $850 million USD to Bitfinex to cover up losses and its general counsel Stuart Hoegner has affirmed that the company is operating with fewer reserves than the total market cap of the token.

This happened because Bitfinex had the $850 million USD “seized” by Crypto Capital, one of its payment processors. Unless Hoegner is lying, though, the company had the assets to back the stablecoin until recently.

While it is clear now that Tether simply does not have the money to back the funds, people simply keep buying the tokens. Now, instead of all cash, some shares of Bitfinex are being used to represent the rest of the value, which makes the stablecoin enter securities territory for the first time.

Curiously, the markets are all very tolerant now since the prices are still stable but the systemic risks are clear, especially if other companies are to follow Tether’s path.

DAI Hikes Fees Once More

Another situation highlighted by the reports is that DAI has decided to upgrade its stability fees once again as the community is desperately trying to make the prices of the so-called stablecoin go up again. DAI tokens are being sold for less than $1 USD, their official price, on secondary markets.

At the moment, the fees are 16.5%, after increasing three times in only one month. Before April, the fees were only 7.5%. This has resulted in a decrease of 4.9% in the circulation of DAI tokens.

Stablecoins Eye Wider Use Cases

Gemini and Harbor, a A16Z tokenized securities platform, have started a partnership in order to get more clients for the Harbor stablecoin. However, this was deemed “too soon” by Diar, as Harbor does not have any known token right now. The only one the company had was canceled.

TrustToken is also trying to get more stablecoins on its list, especially the ones that are not focused on USD, but on several other fiat currencies like HKD, CAD or GBP instead.

Cryptocurrency Information

#DropGold Campaign to Hit Your TV, Here’s A Breakdown of the Underlying Bitcoin Message(s)

Grayscale, a leader in digital currency investing, launched an ad on Wednesday, May 1, telling investors that money should be contributed to Bitcoin holdings as opposed to gold. In a number of interviews, CEO of Grayscale’s parent company (Digital Currency Group), Barry Silbert and Managing Director of Grayscale, Michael Sonnenshein, have since expressed the underlying message of the ad.

The #DropGold Ad

According to news outlet, U Today, the ad starts off with a man holding gold bars in his arm, which he decides to drop. While doing so, a woman also does the same. Throughout the ad, people supposedly have their gold bars stacked in shopping carts, while “losing their gold coins.” Watching what’s about to unfold, the two individuals try to find their way out.

Advertising Bitcoin or Grayscale’s Services?

Despite being the one to have introduced this campaign, Silbert argues that it isn’t entirely about Grayscale services, but rather said services being a result of consumers’ decision. Yahoo Finance has since quoted the following comment made by Silbert himself:

“We do not see this as a Grayscale commercial. For us #DropGold is our ‘Got Milk’. This campaign is first and foremost focused on starting a conversation about bitcoin vs gold. If the ad makes people want to get into Bitcoin, we’re completely indifferent about how they go about doing it.”

Having said this, the commercial is evidently portraying Grayscale as an option, as towards the end, one is told, “Go Digital. Go Grayscale.”

Silbert’s and Sonnenshein’s Arguments Regarding Gold’s Limitations

Silbert believes that this campaign works towards addressing the fact that Bitcoin can serve as an equal asset class as gold, if not better. In particular, he was quoted saying, “But now you have Bitcoin, which, in our opinion, provides all the same attributes as gold – it’s fungible and scarce and you can’t counterfeit it – but the big difference is that Bitcoin has utility. Gold doesn’t have much utility beyond jewelry.”

He further argued that the goal here isn’t to replace fiat currency for shopping purposes, but rather to show the world that Bitcoin does a better job at doing gold’s job and this will be evident in the long run. Although he has acknowledged Bitcoin’s volatility as being concerning, he is hopeful that it will one day serve as both an ideal utility token and store of value.

As for Sonnenshein’s viewpoint, he sees this ad as revealing the “absurdity” associated with gold. More specifically, he said:

“We’re going after a narrative around gold being where investors should go when markets turn south or as a hedge against inflation […] we’re highlighting the absurdity of gold.”

As per The Block Crypto, Grayscale also tries to convince investors that the return earned from redistributing 5% of gold to Bitcoin will be greater than 5% yearly.

What are your overall thoughts on this ad? Did it leave you asking yourself, “Why did you invest in gold? Are you living in the past?” Share your thoughts below!

Cryptocurrency Information

Huobi Pro Bitcoin Exchange: Cryptocurrency Asset Trading Platform?

Huobi Pro Cryptocurrency Exchange

Founded in 2013, Huobi Pro allows for a myriad digital currencies to be exchanged, at a 0.2 percent trading commission. Loyal users point to the low fees and stellar service that make the exchange stand out above others.

Although pitched at dedicated cryptocurrency enthusiasts since the site doesn’t accept fiat currencies many who enter the realm on the back of fiat end up at Huobi Pro, largely due to its diverse offering and favorable fee structure.

Huobi Pro in A Nutshell

A victim of China’s clampdown on digital currencies, the company might be registered in the Seychelles, but was originally founded in Beijing. As testament to the broad appeal of the platform, after the Chinese regime effectively banned all things crypto at the beginning of 2018, trading volumes have only grown.

While at first very much a Chinese company looking at the home market, Huobi Pro has been forced to find a wider marketplace on the international scene. Indeed, even prior to the official cessation of altcoins and their trading, the company heard the rumblings in 2017 and took its cryptocurrency interests abroad.

Huobi now provides exchange services to users in over 130 countries. Company offices are located in the USA, Korea, Japan, Singapore and Hong Kong. Although the Huobi Group also owns and manages the Huobi Autonomous Digital Asset Exchange (HADAX), Huobi Pro is more of a pure “login and trade” exchange.

Users can employ network tokens to cast votes on adding new altcoins on HADAX. On the Huobi Pro exchange, a simplified offer encompassing all of the mainstream altcoins greets visitors. Some more popular coins offered are Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), NEM (XEM), NEO (NEO), Qtum (QTUM) and Ripple (XRP).

That said, when one actually tallies the number of altcoins available for exchange, it becomes apparent why loyal followers value the site. A marriage of both simple ease of use and diversity in trading, the platform is largely welcomed by newcomers and experienced enthusiasts alike. In the current melee of regulation being contemplated, implemented and tweaked all the while, some users may be precluded from trading on the exchange based on their country of residence.

Huobi Pro accepts the funding of accounts only in digital currencies, and accepts deposits in any of its listed altcoins. Unlike other exchanges that have opted for a midway between crypto and fiat, Huobi Pro traders deal strictly in digital coins at every point of a transaction. Funds need to be withdrawn to a wallet, and fiat users looking to buy in will have to establish a wallet first in order to fund their Huobi Pro trading account.

Traders pay a maker or taker fee of just 0.02 percent using the exchange. There are more detailed offers, worth looking at for daily traders with volume.

Huobi Pro Membership Levels

VIP users get preferential platform trading fees if they buy the privilege with Huobi tokens. The Huobi Token (HT) was never an ICO token, but rather a system token that users only obtain by buying “Point Cards” on the Huobi Pro platform. Point Card is essentially a pre-paid Huobi card that keeps users liquid on service fees. One HT = 1 USD, therefore one “point” = 1 USD. The more points purchased, the more free points are added, although savings on 1000 points, for example, means only 10 HT for free.

Huobi Global minted a fixed total of 500 million tokens, with 300 million employed to facilitate the in-house VIP structure. A mark of the business group behind the platform is seen in their practice of buying back-sold tokens from the open market each quarter. Not only that, but those funds go towards the Huobi Investor Protection Fund (HIPF).

This is a planned fund that will compensate investors who suffer platform disruption and subsequent losses. It’s a tool that minimizes risk, smooths out the market overall and also goes towards protecting investor interests. This transparent and pleasing aspect of the platform is one reason traders have confidence in the exchange, and its popularity is rising worldwide.

By way of example, in order to glean a VIP status, a trader will pay 120 HT a month for First Level membership. This enables a 20 percent discount on trading fees. Running through toward the top end, a pricier option of 6,000 HT a month secures a 50 percent discount on fees. Overall, a diligent trader can optimize the system and come out with a substantial discount on the already low 0.02 percent base offer.

The company charges no fees to deposit funds, but there are withdrawal fees. Although there are reviews online listing withdrawal fees, it appears that, especially within the membership structure, users are advised to ascertain exact fees when establishing their account. Likewise, transfer limits need to established upfront to avoid disappointment later. There exist order size limits on the platform too, again becoming more malleable as one moves up the ranks of the VIPs.

Security And UX On Huobi Pro

All of the standard protocols including two-step Google Authenticator verification are at play on the platform. Unlike many other exchanges that offer a simple crypto-exclusive platform, Huobi Pro will need your personal details in the form of a passport copy and chat room comments are not devoid of complaints, although almost all of them take issue with the structure of the platform and its potential pitfalls. There are few allegations of lost funds or other negligence on behalf of the company. On the whole, Huobi Pro seems to be rubbing off its decidedly corporate ethos onto the exchange – good news for traders overall.

Another serious boon for the cryptosphere as a whole is that over 98 percent of holdings are stored in an offline cold wallet or vault. Imbued with a strict customer service ethic, the platform probably sports the best customer service to date for crypto exchanges. Available 24/7 365, there is a live chat option onsite.

The platform intel is sufficient although newbies might have to scratch to paint a clear picture of how exactly everything works. The FAQs are thoughtful and, again, testament to a polished offering. Huobi used to be one of the biggest Chinese crypto exchanges, based in Beijing. Started by entrepreneur Leon Li in 2013, since the move there has been mutual appreciation of its value. Worldwide users have taken to the exchange, as it too realized that it had global appeal.

Huobi Pro Conclusion

Huobi claims to have exceeded BTC 500,000 in daily trading approaching 2014. Although only in its fifth year, that’s a long time in cryptocurrency. Although frequently accused of embellishing trading volumes, these allegations have never been proven. In comparison to other digital exchanges that have suffered persistent user complaints and even been shut down due to criminal activity, Huobi Pro shines.

As an offering, it has low fees, great diversity and an unbeatable crypto-energy. No trader on the platform feels like they’re missing out on something else somewhere else, by most accounts. Possibly due to their prior involvement in the fintech world, the platform got it right first time around and user numbers prove it. The company Huobi also owns another trading platform, BitYes, more focused on USD/BTC and USD/LTC pairs trading. Great customer service and minimal technical glitches have made it appear positively top-tier, again in comparison to less polished outfits.

With a detailed offering, great client liaison – very unusual for most digital exchanges so far – and no legitimate proof of anything even vaguely dark hanging about them, the Huobi Pro project is recommended. Users are advised to always ascertain costs prior to trading – not hard with the customer support in this case – and sample a platform with small trades before trading greater amounts. To learn more, you can head to their official website: huobi.pro