BlockChain & Smart Contact

Blockchain Distributed Ledger Technology: The Answer to Banking System Issues

Is Blockchain the Answer to Banking System Issues?

It is evident that the banking system in its current state is flawed. The banking system relies too heavily on multiple third-party verification's as well as transferring services for each transaction. The jumble of the third-party services needs to be ironed out, and the best way to do that is through blockchain technology.

By using blockchain technology within the banking system, third-party organizations can be sidestepped. Not only is the blockchain technology useful in smaller banking systems, but it is also helpful for the most prominent and well-known financial institutions. The blockchain is transforming businesses globally by offering to perform various transactions securely in a peer-to-peer manner, cutting out the middleman altogether.

Due to the shabby current state of global banking, we've witnessed multiple government bailouts. These government bailouts are what has spawned the birth of cryptocurrencies. Even in the beginning, when Bitcoin first came on the scene the creator Satoshi, left a reference to the bailout from the London Times in BTC's genesis block, making it abundantly clear that this was his motivation for creating the cryptocurrency.

The First Bank: A Brief History

In order to understand how vital blockchain technology is over the current banking system, you need to understand a brief history of banking. You see in the beginning banks were used as a mean to store gold securely. In fact, the first bank was nothing more than a gold depository. Wealthy individuals would drop the gold off and be issued a receipt. This receipt would then be used around town to purchase items. When the banker of this institution realizes that people never came to collect their gold at the same time, he began to lend out other people's gold with an interest rate.

When the townspeople began to get suspicious of the banker and the wealth that he accumulated, they demanded to see the vault. To their surprise not only was everyone's gold within the vault, but the banker had also collected extra because of the interest that he was charging. After seeing the amount of interest that the banker had made, the wealthy individuals wanted in on the action as well. To this day banks now have to pay you a small interest on your holdings. However not much as changed since the birth of that first bank. It is still considered a third-party institution which makes a profit off of holding your funds.

A New Way

Of course, none of these steps are necessary any more thanks to blockchain technology. Because technology has changed and advanced so much over the last decade, it surprising that the banking system hasn't followed suit. It is apparent that the world cannot continue to bail out fraudulent bankers. Nor can we afford to run on a fiat-based financial system. If we incorporate blockchain technology, we could eliminate many of the banking problems that we see today.

Peer-to-Peer

The idea of peer to peer has no use with the banking system that relies heavily on a combination of verification's and other monitoring platforms to ensure your funds are sent. Did you know that each time you swipe your debit card, there is, are 30 different third-party institutions in place to complete that single transaction? Now multiply that with all the various shops you go to in the course of the day. A coffee at Starbucks, gas at the pump, takeout dinner, and paying the bills. Every transaction where your debit card is swiped goes through the same process.

First, your bank must check the balance to verify that you have the funds to spend. Next, the bank must verify the account where you are sending funds to ensure that it is correct. Once that is done, it has to interact with the merchant processing firms and check Visa or MC, and the list goes on just to make a single purchase. This explains why you can swipe your debit card at any given time, but when it comes to refunds, it can take weeks or even months to process.

The Transparency of Blockchain Technology

The beautiful thing about cryptocurrencies is that it eliminates the middleman. No longer do you have to jump through hoops or wait for third-party verification. Blockchain technology is transparent, which is why it makes it ideally suited for all financial services. There is never a question when it comes to blockchain technology due to its transparency. Anyone at any time can check a wallet on the blockchain. And if the funds are present, they are sent immediately to the individual or company that is involved with the transaction.

Sending Money Internationally

When it comes to sending large amounts of money internationally going through traditional routes of the banking institutions can take days and even weeks to complete. During that holding period, the money is inaccessible to both parties. It is common in the banking world for funds to be on hold for over a week.

However, with the use of blockchain technology, there is no waiting time. Funds are sent automatically regardless of the amount. The ability to send substantial funds through blockchain technology is a considerable advantage compared to the current banking system.

Imagine how much easier it would be if you are a large international company trying to send millions of dollars in capital internationally. With blockchain technology, you would be able to accomplish this task quickly and efficiently without the additional delays. The funds would be transferred more securely, and you would be able to avoid the losses that accumulate when converting your funds. After all, 1 million BTC and China is 1 million BTC in the United States.

Records and Tracking

![]()

Another beautiful thing about blockchain technology is that the funds are traceable and immutable. Hacking of the data is unheard of, yet it's easy to search for a single transaction within the chain. If the banking system integrated blockchain based technology issues like identity theft or disputed transactions would be swiftly dealt with in a timely fashion. There are some banks that are starting to see the advantages of this technology. So don't be surprised in the near future when many more banks will follow suit as the technology continues to advance.

Farewell to Credit Bureaus

By incorporating a blockchain based system credit bureaus would be rendered useless due to the transparency of the technology. Anyone using the blockchain technology searching for a loan will easily be able to bring up their financial history and prove their ability to repay their loans.

Imagine being able to see your credit report anytime you want. As of right now, credit companies are only obligated to provide a free single yearly report. The credit bureaus thrive off the technology that is no longer required or needed.

Increased Security

When it comes to security, blockchain technology is light years ahead of the game. With an unhackable system and the redundant nature of the protocol, your funds are safe, secure, and at your fingertips.

A Blockchain Future

For the first time in history, a decentralized global economy is a reality. With the advantages of the blockchain technology, the central banking system will soon be put out to pasture. This explains why the financial institutions have been so vocal in their opposition towards cryptocurrencies. The people no longer want the long waiting periods for sending funds, nor the third-parties to be involved with their finances. A new day is dawning, and the financial institutions know their time is running short and efficiency will win in the end.

BlockChain & Smart Contact

Top 4 Questions To Ask If Your Business Needs Blockchain Technology

Is A Blockchain Right For Your Project?

Blockchain technology was introduced in 2008 by Satoshi Nakamoto, the pseudonymous creator of Bitcoins. This innovative data structure has since been used to create a wide variety of software ranging from electronic medical records to online voting because of its inherent security, decentralization, and flexibility. However, blockchains are not appropriate for all software applications, and many projects that deploy the technology are pushing it beyond its limits. Before undertaking a project using a blockchain, it's important that developers and investors thoroughly understand how this technology works and where its limitations lie.

What Is A Blockchain?

A blockchain is a permanent record composed of individual “blocks.” Depending on the application, the blocks could contain radically different information, but they typically include at least a timestamp and data about transactions or new data added. The defining feature of blockchains is that each block includes a cryptographic hash derived from the previous block, meaning that records cannot be altered without changing the entire ledger. Thus, blockchains can be shared widely throughout a network without risk of their data being corrupted. This inherent fault tolerance has made them a popular choice for a wide variety applications, including cryptocurrencies, electronic medical records, and copyright management.

Several related architectures have also developed, most notably sidechains and hyperledgers, which expand blockchain's features and improve its speed and security for certain applications. The profundity of blockchain technology is likely still far from being fully realized; Harvard professors Marco Iansiti and Karim Lakhani said in a 2017 paper that that the technology “has the potential to create new foundations for our economic and social systems.”

Does Blockchain Fit Into Your Business Needs

Third Parties

If your service relies on some centralized party to verify users' behavior, blockchains probably aren't the right option. The technology is inherently decentralized: it creates a permanent record with no broker or intermediary. When a user reports their action to the blockchain network, the blocks are verified as soon as the network can handle it and the action is recorded, regardless of whether or not an administrator approves.

Transaction Speed

There are several different ways blockchains verify their transactions, but virtually all of them require at least a few seconds, and some require several minutes or even hours. Users' actions can't be recorded instantly, because this would mean that any fraudulent party could corrupt the system, so blockchains require some sort of verification protocol; a wide variety of verification algorithms exist, but the most common are “proof of work” and “proof of stake.”

Since blockchain transactions require some time to guarantee fault tolerance, the data structure is still not appropriate for applications that require very fast verifications. However, solutions for faster verifications are in development, and it could become more feasible in the near future.

Data Storage

Blockchains aren't designed to store large amounts of data; they are intended to store small sets of information, with the tacit assumption that only a handful of “full” servers will host the entire corpus while “light” users verify new data. The entire Bitcoin blockchain is approaching 200 gigabytes, and even this includes only basic transaction information. If your project requires any substantial data storage, blockchains probably aren't appropriate.

Public vs. Private Blockchains

Private Blockchains:

Private blockchains – which offer some control over their access and functionality – are increasingly popular, and are ideal for many applications that don't need a public record of all actions or which require some control of who can access them.

Public Blockchains:

Public blockchains, like Bitcoin's, merely implement a protocol and the community of users is left to verify its transactions. On the other hand, private blockchains can offer some control over who can add records, and the information can be kept entirely hidden. Thus, private blockchains are perfect for many corporate applications which could embrace the technology's security and stability, but don't need the public and decentralized aspects.

Blockchain Technology in Conclusion

As blockchain technology continues to develop, it will surely find more applications in places its creators never considered. By working to understand blockchains and appreciate this nascent technology for what it is, software developers and entrepreneurs can create powerful solutions that change the world.

BlockChain & Smart Contact

Etherscan: How To Use Ethereum’s Blockchain Explorer & Analytics?

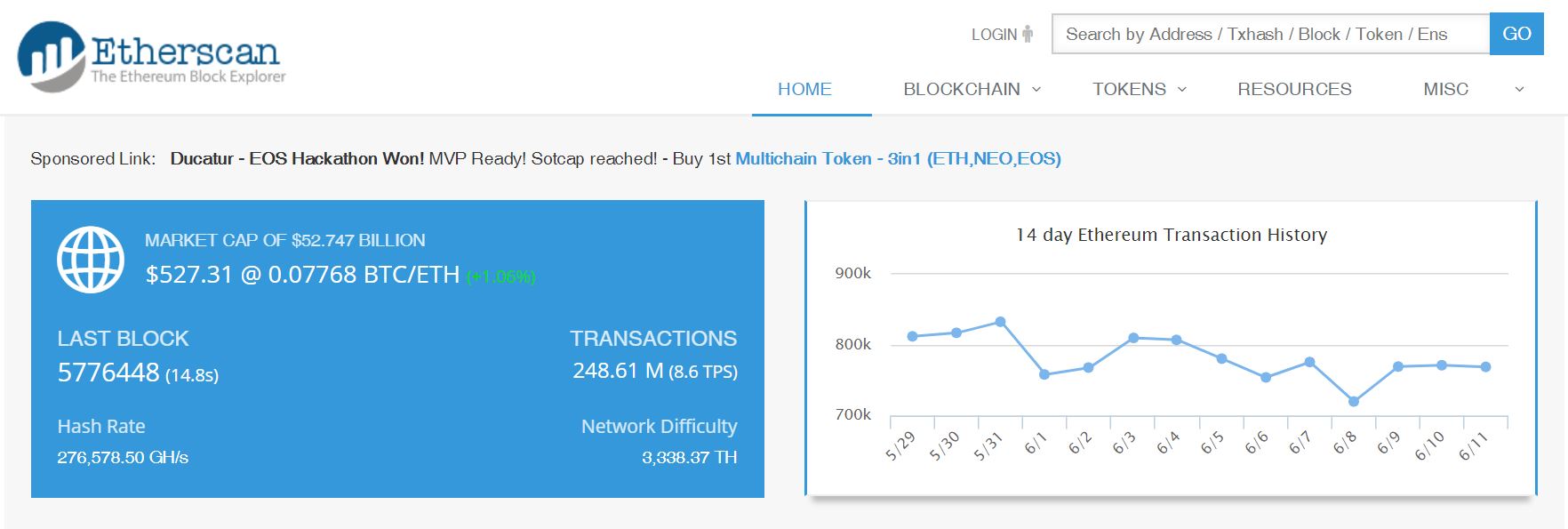

An intuitive and valuable block explorer, Etherscan is also an Ethereum analytics platform. While seemingly a bit technical for some cryptocurrency users, a block explorer is simply a search engine that allows users to search for, confirm and validate transactions that have occurred on a blockchain.

Etherscan is the principal block explorer for the Ethereum blockchain network. Still a sleeping giant, Ether’s ERC-20 token protocol has been employed in the vast majority of ICOs. Now established as the malleable foundation of much blockchain exploration and copious development overall, the Ethereum platform and its ERC-20 token play massive albeit often silent roles in the crypto market.

An independently operated project, Etherscan is the product of a collective of passionate developers, fired up about the future of blockchain technology. With expertise centered on “decentralized information and infrastructure applications” enabled by the Ethereum platform, the team has put a detailed, polished site together for enthusiasts.

What Is Etherscan?

Etherscan is an independent project, and joins the ranks of numerous other Ethereum block explorers already out there. The company receives no funds nor does it take management or direction from the Ethereum project.

In a nutshell, Etherscan indexes the Ethereum blockchain. Indexing this decentralized, public ledger, Etherscan then makes this information available on its site. If anything, a step away and a boon for users intimidated by very technical issues, Etherscan draws intel from the decentralized database that the Ethereum blockchain constitutes. Subsequently indexing and also simplifying it, the app then presents the information on the Etherscan site in an accessible, transparent manner. The site’s essential aim is to maintain searchability on every single transaction on the Ethereum blockchain.

Etherscan is not a trading platform or brokerage, nor does the company supply a wallet facility or any other such user facility. For the reassurance of users, the company does not store users’ private keys. Possibly for the benefit of newcomers or tentative users, the company states onsite that they have no control over Ethereum network transactions.

Etherscan is a librarian. If you want to know where to find a certain book, or in this case blockchain transaction, log on.

The team punt their “load-balanced robust API services” that users can employ to serve as data feeds for Ethereum blockchain information, or build decentralized apps.

Etherscan Growing Through Fintech Services

The project faces many competitors and is not a sole appointee of Ethereum’s, nor does it have any exclusivity in conducting its business. Nonetheless, Etherscan fills the niche of ‘tech geek build’ made good for the citizenry. While there are more colorful and even smarter sites out there, Etherscan is a sweet spot combination of logical and smart presentation with a host of intel that is pertinent, useful and eminently valuable to users.

Anyone looking to research Ethereum blockchain transactions will find the platform comprehensive, easy to use and most importantly riddled with small touches only a fellow user would have built in. An organic emergence from the lives of the development team, drop down menus feature rewardingly useful information.

There is a large amount of user-aiding intel to be found onsite, starting with the FAQs. Experienced users will recognize the cautionary tone that permeates the site copy. The team has done well to make things plain to those perhaps employing a block explorer for the first time. They also manage not to weigh more experienced users down with irrelevant information, having built the site with an intuitive flow.

Snippets such as that explaining the “irreversible nature of digital currency protocols,” meaning that “transactions can neither be canceled nor reversed once they have been sent,” abound.

While not overdone, they speak volumes for the intent and integrity of the project because, as they point out on the site:

“As a free blockchain explorer, we can only provide and display information on transactions on the Ethereum blockchain. Etherscan is a read-only GUI (graphic user interface) to the Ethereum blockchain.”

Such statements are not obligatory for a block explorer project, yet made onsite in a bid to steer users through what is essentially an ebook version of a blockchain.

Etherscan Ethereum's Blockchain Explorer Conclusion

Clearly listening and looking out for users, the site’s ethos is well met by its overall build and the convenience it provides. Statements such as “As much as we wish to help, Etherscan.io would not be able to recover or aid in the recovery of your funds,” the project’s tone is emblematic of the best of blockchain technology rolled out for the world’s citizenry.

With a visible willingness to aid users beyond their call, Etherscan’s team have built a block explorer that is so far faultless, easy to use and quick about it as well.

Any user looking for access to the Ethereum blockchain’s history would do well to employ Etherscan. Not only is the essence of the app immediately available, users are also surrounded by helpful, relevant information while on the site.

BlockChain & Smart Contact

How Bitcoin Transactions Work: Signed, Verified & Confirmed?

Unlike fiat currencies, Bitcoin transactions work in a way that should amaze most. At first glance, a transaction may appear to be a simple money transfer between wallets, but that isn't the case by any means. Your Bitcoins aren't held anywhere, and your Bitcoin wallet is just a list of credentials consisting of a public and private key.

As absurd as that sounds, the technology behind Bitcoin – known as blockchain – enables seamless transactions, and everything happens automatically without any person or institution having a say in your financial matters whatsoever.

Bitcoins Aren't Stored Anywhere

How Bitcoin works require a fundamental understanding of blockchain, the technology behind this and many other cryptocurrencies. Just imagine the blockchain as a ledger for each and every transaction that was ever performed within the Bitcoin network, with new transactions being added continuously to the chain upon verification. This record of past transactions allows Bitcoin “miners” – people who verify transactions through the use of dedicated computing equipment – to determine the current balance of a public key used to initiate a transaction, and that in itself negates the requirement to hold Bitcoins digitally anywhere.

The blockchain is continuously updated at specific mining nodes around the world, thereby eliminating any concerns about the safety of the data stored within. Hashes are used to encrypt each block present throughout the blockchain, which further safeguards it from any kind of modifications.

What a Transaction Looks Like

A Bitcoin transaction is very simple to perform and requires the public key to a wallet with authorization performed via a private key. Once you insert the number of Bitcoins that you want to transfer and the Bitcoin address of the payee, your request is sent to a pool of transactions for verification. Bitcoin miners then begin processing your transaction, with your address being double-checked via the blockchain to ensure that sufficient funds are present to complete the transaction.

A block of transactions is supposed to take just ten minutes to verify, though the massive amount of orders flowing through the Bitcoin network mean that transfers may take significantly longer to process. Most vendors require you to wait for verification before you can gain access to your purchases, but certain merchants don't make you sit it out for low-value transactions.

Transaction Fees

Bitcoin miners are automatically compensated for every solved block of transactions in the form of newly created Bitcoins, but that doesn't necessarily mean that you don't pay any transaction fees when sending money. The extreme popularity of the cryptocurrency has led many Bitcoin miners to place a high priority on transactions that include fees – most wallets have settings on how much transaction fees to include within a transfer, and if you want to send some money in a hurry, be prepared to pay a hefty fee to be able to do that.

Safety of Transactions

Due to the strength of the technology and cryptography behind Bitcoin, transactions are very safe to perform. Authorization requires a private key, so unless someone else has knowledge of it, there's practically no reason to worry about unauthorized transactions. The Bitcoin network also allows for anonymity – while your public key is visible on the blockchain to almost everyone, there simply is no way to identify anyone with just a string of random letters and numbers.

However, you must keep in mind that transactions are permanent and cannot be reversed unless refunded by the payee – if you are about to complete a high-value transaction, you may want to confirm the legitimacy of the receiver beforehand.

Weighing the Pros and Cons

Always keep in mind that unlike a normal money transfer, Bitcoin transactions are very different. You have complete anonymity and faster transfers overall, and the encryption protocols behind the cryptocurrency allow for extremely secure transactions.

However, the unregulated nature of the market can cause significant issues when it comes to high-value transactions, especially since you are solely responsible for the safety of your Bitcoins. Combine that with the rapidly fluctuating values of cryptocurrencies, and Bitcoin payments aren't feasible for every situation by any means.