Bitcoin Guides

Top Cryptocurrency Trading Bots & Bitcoin Software Platforms [2018]

Understanding How Trading Bots Work

A trading bot is a software program that interacts directly with financial exchanges using Application Programming Interfaces (API) to determine whether to buy or sell a currency pair at a given point in time, depending on the interpretation of the market data.

The bots make these decisions by monitoring the market’s price movement and reacting according to a set of predefined and pre-programmed rules. Typically, a trading bot will analyze market actions, such as volume, orders, price, and time, bots can also be programmed to suit traders’ preferences

Table Of Contents

It should be noted that there is no such thing as a “holy grail” for trading systems. The most important thing to highlight when it comes to cryptocurrency trading bots is that they are not a one-stop passive income solution that will brings riches while in sleep. The bots that promise you that will, most likely turn out to be scams and will probably end you up losing you money.

Common Strategies used by the trading bots

The major media used by these bots include Browser plugins, OS clients, trading servers and cryptocurrency exchanges.

It should be noted that trading isn't only based on technical analysis alone, but also factors including the fundamental analysis. It's difficult for a computer program to react to fundamental market conditions such as rumors on social platforms, hack on exchange platforms, or the decisions of some governments on cryptocurrency. This means there is a little bit of work needed from the user’s end to tweak the software to suit the current situation, and thus require a little bit technical know-how from the end of the trader.

Arbitrage

Since the cryptocurrency market is yet to be matured as other markets, there are still lots of arbitrage opportunities due to the inefficiency. There were often large differentials between prices offered on various exchanges, meaning, profits could be made through arbitrage. The bot can be pre-programmed to buy low in one place and sell high in another at the same moment in time, and this can be done several times when there is a big gap in trading volumes between different markets or exchanges.

Additionally, arbitrage can also be utilized by traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a future’s contract and its underlying asset, by considering future’s contracts that are traded on different exchanges.

Market Making

A trading bot can also be programmed to simultaneously place both buy and sell orders in an attempt to profit from the bid-ask spread. The bot will be programmed to make both buy and sell limit orders near the existing marketplace. As prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread.

Since it is a fairly simple strategy there's a lot of free trading bots that one can download and configure to perform market making on a wide variety of exchanges.

The Ping Pong Trading Strategy

The Ping Pong trading strategy uses the Range Bars which makes it easy to calculate the entry and exit points. This strategy works best when it is clear that the market is moving sideways. Under these circumstances, profit is made by buying at the bottom of the troughs and selling at the crest of the charts.

A clear set of rules about the price range is in place such that as an order is executed, the exit order is immediately placed at a price predetermined by the profit range defined by the rules of the strategy, and a predetermined stop order is also a placed for unexpected movement of prices against the order.

Technical Analysis (TA) Tools

Other technical analysis (TA) tools often used include:

Exponential Moving Average (EMA)

Many bots are designed to work with the EMA. The EMAs track markets over a set of time and bots are programmed to react to that price’s change or act further when the price behaves in a certain way such as moving beyond certain thresholds.

Double Exponential Moving Average (DEMA)

Some bots were programmed to trade based on the measure of a security's trending average price that gives the most weight to recent price data. Bots programmed using DEMA are more reactive to price fluctuations than those designed with EMA, thereby bringing more value to short-term traders attempting to pinpoint trend changes.

Triple Exponential Moving Average (TEMA)

The TEMA is a composite of all the three mentioned averages. Bots designed with TEMA smooths price fluctuations and filters out volatility than any other.

Bolinger Bands(BB)

Bollinger Bands are a technical indicator that has three lines. An upper, middle and lower. Day Trading Uptrends with Bollinger Bands Bollinger bands help assess how strongly an asset is rising, and when the asset is potentially losing strength or reversing. Day Trading Downtrends with Bollinger Bands help assess how strongly an asset is falling, and when the asset is potentially strengthening or reversing.

Ideal Bollinger Bands setting vary from market to market, and may even need to be altered over time even when trading the same instrument. Bots built with trading are much more efficient in capturing the Up & Down trends.

Top 6 Cryptocurrency Trading Bots

The cryptocurrency market is growing and evolving on a daily basis. Hence, trading strategies need to be updated and adjusted to function in new market conditions as well. The more sophisticated crypto trading bots allow traders to set specific parameters at which the bots execute trades on his behalf. These parameters need to be adjusted as you go along. It also needs to be noted that trading bots can easily turn out to be scams when due diligence is not made before making a selection.

The number of trading bots in the market is increasing on a daily basis. They range from free software that anyone can use to expensive subscription-based bots for professional crypto day traders. However, even the most popular cryptocurrency trading bots vary in quality, usability, and profitability. This is why we present you with the tested and trusted ones in the market.

The following are the few recommended ones while selecting a trading bot:

-

GEKKO

Gekko [found at https://gekko.wizb.it/] is a free open-source bitcoin trading bot that supports an almost large number of exchanges. It is written in JavaScript language. Gekko is a straightforward trading app that allows users to execute basic cryptocurrency trading strategies. The bot aggregates live price data, calculates indicators, executes live orders, and can simulate live markets using historical price data for the backtesting of trading strategies.

Additionally, Gekko has a number of plugins available that always keep traders updated. While its functionalities are somewhat limited compared to some of its peers, Gekko can be a good option for those new to the cryptocurrency markets who want to test out different automated trading strategies.

-

The CryptoTrader

CryptoTrader [found at https://cryptotrader.org/] is a cloud-based trading bot that provides users with fully automated trading solutions which are hosted on the platform. The software supports multiple currencies and exchanges and allows users to buy their favorite trading strategy, or alternatively to sell strategies developed by themselves using the backtesting tools that allow users to review how their strategies would work under different market conditions.

CryptoTrader offers five different subscription plans, with fees ranging from 0.006 BTC to 0.087 BTC per month. The separate packages include a number of differences, including the number of bots operating on the user’s behalf as well as the maximum equity limit. Although some knowledge of coding is beneficial when setting up strategies in the CryptoTrader bot, there are a number of free and paid strategies available for users that are not experienced in coding.

-

ZenBot

ZenBot [found at http://zenbot.org/index.html] is another open-source cryptocurrency trading software. As an open-source project, Zenbot is freely available for users to download and modify the code as necessary. Zenbot supports multiple digital assets and uses a technical analysis-focused approach to execute trading strategies. It also offers high-frequency trade execution, extensive backtesting, and a paper trading function to test strategies in real-time.

-

Haasbot

Haasbot [found at https://www.haasonline.com/] trades Bitcoin and many other altcoins, it is probably the most popular crypto trading bot on the market today. The bot provides several customizable technical analysis tools users to develop advanced crypto trading strategies, and it is supported by major bitcoin exchanges.

Although Haasbot is probably the most complete of the trading bots that are currently available, doing much of the labor with relatively minimal input required from the user, in order to provide this service, it is pretty expensive, with costs ranging from between 0.028 to 0.08 BTC for a three-month period. The bot is recommended for advanced traders.

-

Gunbot

The Gunbot trading bot [found at https://www.gunbot.com/] has many inbuilt strategies including Bollinger Bands(BB), Gain, Step Gain and Ping Pong. The trading bot has three different price package plans currently ranging between 0.006 BTC and 0.129 BTC. depending on the trader’s ability. Like some other trading bots, Gunbot is also supported by many cryptocurrency exchanges including Bittrex, Kraken, Poloniex, and Cryptopia. It’s recommended that users of this bot pay attention to their trades since it’s configured to deal with large market volatility. In case of large volatility turn it off, and leave the order on the books.

-

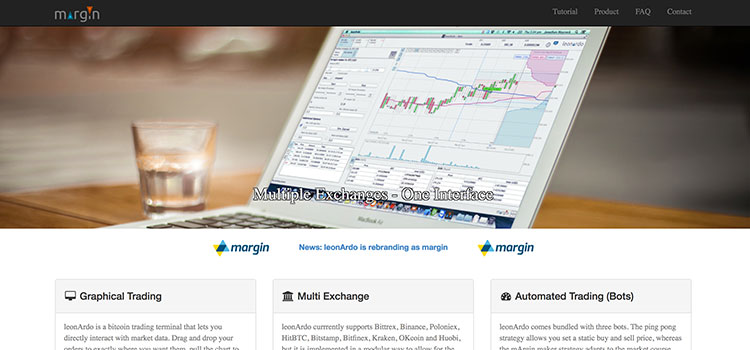

Margin

Formerly known as leonArdo, Margin [found at http://marginsoftware.de/product.html] has been developed from the ground up as an object-oriented C++ application making it responsive and completely intuitive to use. It is built with the ping pong strategy that allows you set a static buy and sell price. Margin currently supports Bittrex, Binance, Poloniex, HitBTC, Bitstamp, BitFinex, Kraken, OKcoin and Huobi, and its developers are currently working towards supporting decentralized exchanges. It currently costs $129 for a lifetime license.

Some amazing properties of Margin include:

- In-built automatic trading strategies

- Unified and configurable interface to multiple exchanges

- Margin trading support

- Indicators: MACD, Bollinger bands, VWAP, EMA, SMA etc.

- Multiple operating systems support including Windows, OS X, and Linux

Bitcoin Guides

Bitcoin Price History: Bitcoin (BTC) Crypto Market Timeline – MyBitcoin

Bitcoin Reaches its 5 Month Peak – April 23rd, 2019 – $5,599

Bitcoin has managed to shrug off the initial losses from last month and managed to reach a major high point of $5,598 as of April the 23rd. This has been one of the first times that Bitcoin managed to successfully rise above the $5,500 price point clocked in November of last year. This marks a five month record high for Bitcoin.

Bitcoin Pushes Above the $5,000 Marker – 10th of April 2019: $5,412

Bitcoin has, as of this point in Early April, managed to undertake an unprecedented surge in its price point. Putting this in perspective, it managed to push above the $4,200 mark and rapidly blasting past $5,000 within 48 hours. After it had begun the month at $4,152, the price of Bitcoin had managed to sit on a strong $5,412 by this date in April.

Bitcoin Manages to Conclude March at Above the $4,000 Margin – March 31st: $4,152

Throughout the course of March, Bitcoin had managed to enjoy a white hot streak of performance after it endured a sluggish if optimistic beginning to the year. Successfully ending March on a more positive margin of above $4,100.

Bitcoin Maintains a 10 Percent Incremental Rise Month Over Month – February 28th, 2019: $3,867

Bitcoin had commenced February just below $3,500 before ending February 10 percent higher than it began. Meaning that, by the end of February, it had closed at approximately $3,867.

CBOE Officially Withdraws its Bitcoin ETF Proposal Before Resubmitting – January 31st, 2019: $3,461

CBOE, in partnership with VanEck and SolidX, officially withdrew its proposal to create and launch a Bitcoin Exchange Traded Fund as of late January, in light of fears regarding the prolonged government shutdown which begun in the United States causing the cancellation of its proposal anyway.

By the end of January (31st to be exact), the CBOE had officially resubmitted its Bitcoin ETF. There are those that believe that this VanEck and SolidX Bitcoin ETF has the highest likelihood of being the very first BTC ETF that will be approved by the Securities and Exchange Commission.

Bitcoin Starts the Year Below the $4,000 Mark on January 1st, 2019: $3,773

Bitcoin made a start of 2019 underneath the previous $4,000 high level. Starting off at the price point of $3,773 and a total market cap of $66 billion. The month was a negative one for Bitcoin, dropping to a low of $3,468 by the close of January.

Bitcoin Mining Becomes Unprofitable – December 3rd, 2018: $3,469

According to research from Morgan Stanley in 2018, the profitability of mining ceased at any value below $8,600. By this point from the past few years, difficulty, in conjunction with the chronic non-profitability of Bitcoin conspired to hammer the value of Bitcoin.

For the second time in its history, Mining difficulty fell by 15 percent in order to accommodate the depreciation in value and support miners.

Bitcoin Cash Officially Commits Hard Fork – Creating ABC and Satoshi's Vision (SV): November 15th, 2018: $4,275

After a series of disagreements and very incendiary arguments among core developers operating within Bitcoin Cash, officially completed a hard fork. Thus resulting in the creation Of Bitcoin Cash ABC and Bitcoin SV. This then resulted in a hash war which would last several months with Bitcoin Cash ABC emerging as the dominant currency.

It was during this same span of time that the price of each of these tokens violently fluctuated, having the additional knock-on effect of hitting Bitcoin prices, causing it to drop to $4,275.

Bitcoin's Whitepaper Celebrates its Tenth Birthday, October 31st, 2018: $6,415

The Bitcoin community officially celebrated its tenth birthday since the launch of Bitcoin's whitepaper back in 2007. It was over this span of time that bitcoin's price managed to steadily grow over the days prior to this anniversary, resulting in a total of 5 percent in growth over this week.

Fidelity Officially Launches its own Crypto Trading Solution For Institutional Investors: October 15th, 2018: $6,497

While Bitcoin has sustained a bad number of weeks, Fidelity provided a desperately needed shot of financial B12 to the market with the announcement of Fidelity Digital Assets – which operates as an enterprise level custodial service for financial entities that are interested in investing in cryptocurrencies. Because of this new entrant, Bitcoin's price rose sharply over the weeks.

Cryptocurrency Exchange, Zaif Falls Victim to a $60 Million Hack, September 18th, 2018: $6,539

Zaif, a cryptocurrency exchange based in Japan officially lost approximately $60 million worth of various crypto assets during a hack. This, in turn, had a knock-on effect of pushing Bitcoin prices into recession, reaching below $6,000 before rallying.

Goldman Sachs Announces it is Dropping its Plans to Launch a Bitcoin Based Trading Desk – September 5th, 2018

While the company had begun and sustained the exploration of launching a Bitcoin trading platform for the majority of 2018, Goldman Sachs officially announced that it would be dropping its plans to launch a desk. For many investors, they have blamed the ongoing bear market for the diminishing interest from Goldman Sachs. Because of this announcement, Bitcoin prices continued to fall.

SEC announces Decision to Delay on Bitcoin ETF Ruling – August 7th, 2018: $6,366

What came off as a surprise decision for some in the Crypto trading world, the Securities and Exchange Commission announced that it would be exercising its right to delay its decision on several proposed Bitcoin ETFs that had since been proposed to the regulatory agencies.

As a result of this news, the value of Bitcoin continued to plummet, with investors enduring a pessimistic climate that no ETF would never be approved.

Intercontinental Exchange Officially Announced the Launch of Bakkt: August 3rd, 2018: $6,337

The parent company of the internationally known New York Stock Exchange – the Intercontinental Exchange [ICE] among a number of other exchanges announced the launch of a Cryptocurrency startup known as Bakkt. Backed by the likes of Microsoft, Starbucks and a number of other big corporate names.

Bakkt had the underlying goal of appealing to institutional investors through a legitimate market for Bitcoin.

The Securities And Exchange Commission Rejects the Gemini Bitcoin ETF Proposal by the Winklevoss Twins for the Second Time – July 26th, 2018: $7,275

The Security and Exchange Commission officially rejects an ETF proposal from the company owned by the Winklevoss Twins. This is the second time that the proposal was rejected by the SEC, citing that the markets were still in a perpetual immaturity, making them a non-conducive environment for an Exchange Traded Fund.

The SEC expressed a particular concerned regarding the price manipulation. After a few days of good momentum from the market, Bitcoin's value depreciated.

Blackrock Announced Intent to Explore Cryptocurrency and Bitcoin Related Fund, July 16th, 2018: $8,227

It was made widely public through the news online that one of the world's largest investment fund managers – Blackrock – had officially set up a working group in order to examine the prospect of a crypto and / or Bitcoin related fund. The Chief Executive Officer of Blackrock would go on to confirm the report during an interview which took place days after with Reuters.

While Blackrock has yet to launch any kind of fund of this kind, the value of Bitcoin managed to rise significantly thanks to this news.

Facebook Announced Broader Ban on Cryptocurrency Related Adverts: June 26th, 2018: $6,656

Facebook announced that it would be reversing its previous ban on cryptocurrency related advertising which was initially announced back during the beginning of the year. During this time, Bitcoin's value managed to rise ahead of this news, with investors theorizing that the bearish trend for Bitcoin was over.

Cryptocurrency Exchange – Bithumb – Was Hacked, June 20th, 2018: $5,928

Operating within South Korea, Bithumb was officially hacked, resulting in the loss of over $31 million worth of various crypto assets. In light of this news, Bitcoin decreased significantly over this month, making the second quarter of this year one of the worst on record.

The US Commodities Futures Trading Commission Files Subpoenas Against Four Cryptocurrency Exchanges, June 11th, 2018: $6,709

The United States Commodities and Futures Trading Commission officially filed and submitted Four subpoenas to the international crypto exchanges – Bitstamp, Kraken, ItBit and Coinbase. The subpoenas demanded a broader explanation about potential market manipulation.

It was in the aftermath of these legal proceedings, it was revealed that the majority of these crypto exchanges were, in fact, engaged in a high level of wash trading along with other manipulative strategies. These include a number of more well known, reputable and regulated crypto exchanges like Coinbase.

The United States Justice Department Officially Launched Criminal Probe Into the Allegations of Bitcoin Price Manipulation, May 24th, 2018: $7,609

It was made official that the United States Justice Department has launched a new criminal probe into whether or not cryptocurrency exchanges were participating in the manipulation of crypto prices through the application of underhanded tactics like spoofing, Pump and Dump methods and wash orders.

Prosecutors in South Korea Raided UpBit, May 11th, 2018: $8,372

Known as one of the largest cryptocurrency exchanges in operation within South Korea, Upbit was subject to a raid by legal prosecutors under suspicions that it was conducting fraud to some capacity.

The overall cost of Bitcoin fell by 5.5 percent to $8,511 in light of this news before falling further downwards to hit lower support of $8,372 as of the end of the week.

Goldman Sachs Begins exploration of Launching of Bitcoin Trading Solution, May 2nd, 2018: $8,729

It was reported by the New York Times that Goldman Sachs, the International financial company was exploring the prospect of launching a bitcoin trading platform. The creation of this service would allow for clients of Goldman Sachs to conduct trades of Bitcoin from within their already operational investment accounts.

Twitter Launches Ban on Cryptocurrency Advertisements, March 26th, 2018: $7,127

Following in the wake of decisions made by both Facebook and Google, Twitter went on to announce that it will be imposing a ban on Cryptocurrency related and Initial Coin Offering Advertisements. The only way that it would remove this ban is once it clarifies its policies.

Google Announces Ban on Cryptocurrency Advertisements, March 14th, 2018: $8,570

Google became the second major multinational company to impose a ban on cryptocurrency advertisements and Ads for Initial Coin Offerings. Google also provided a full range of crypto specific terms within its broader ‘bad advertisements' policy.

The Securities and Exchange Commission Requires new and Existing Cryptocurrency Exchanges to Register, March 7th, 2018: $8,344

It was made clear through the reiteration that crypto exchanges are under legal obligation to register with the Securities and Exchange Commission if the intention to do business and operate within the United States.

Facebook Implements new Ban on Cryptocurrency Adverts, January 31st, 2018: $8,211

The Social Media giant, Facebook, officially unveiled its new ban against cryptocurrency and Initial Coin Offerings within the platform. This decision was made after a large volume of complaints regarding ICO fraud, malware due to Phishing sites using crypto as incentive, and a range of other scams.

Coincheck Announces Freeze of any Withdrawals From the Platform After Falling Victim to Largest Hack of Bitcoin on Record, January 26th, 2018: $8,775

One of the largest known crypto exchanges operating within Japan officially halted all withdrawals after being subject to the single largest hack on record. Attackers had managed to vanish with approximately 123 million dollars worth of XRP, and 500 million NEM.

These losses totaled more than 600 million dollars stolen. The crypto attack against Coincheck is the single largest in the history of cryptocurrencies.

80 percent of the Total Supply of Bitcoin Has Been Mined, January 13th, 2018: $8,776

Spanning a lifespan of less than a decade by this point since the genesis block of BTC was mined, nearly 80 percent of all known Bitcoin has since been mined.

Priced undergo Decline Thanks to Regulatory Proceedings Within Korea, January 8th, 2018: $10,685

Within the space of a night, CoinMarketCap suddenly removed price forecasts and analytics related to cryptocurrency exchanges operating within South Korea, causing a dramatic fall in Bitcoin sales, panicking investors as a result.

Peter Thiel, Silicon Valley Venture Capitalist and Investor is Buying Up Large Numbers of Bitcoin, According to Reports, January 2nd, 2018: $13,870

Reports disclosed at this time demonstrate that the Silicon Valley based Venture Capitalist, Peter Thiel has allegedly bought millions of dollars worth of Bitcoin as of the beginning of this year, according to major news sources. According to further reports, his already existing Founder Fund was allegedly valued at hundreds of millions of dollars by the beginning of 2018.

South Korea Muses Over a Wider Shut Down of Cryptocurrency Exchanges in the Country, December 28th, 2017: $17,163.38

After a surge of very positive momentum for Bitcoin and its investors, Regulatory and financial authorities in South Korea worked to dampen further enthusiasm by suggesting a new raft of financial regulations against the country's cryptocurrency exchanges. Regulatory justify these actions as being in light of concerns about the drastic overheating of crypto positions: “cryptocurrency speculation has been irrationally overheated in Korea”.

Bitcoin Manages to Reach its all Time High Value, December 18th, 2017: $19,783

Today marks the day that Bitcoin manages to reach an all time high value point at approximately $19,783. This is a record peak that has not been matched or surpassed to date.

CBOE Introduces Bitcoin Futures Contracts, December 11th, 2017: $17,010.53

The announcement by CBOE regarding the launch of its Bitcoin futures contracts caused the price of Cryptocurrencies to surge dramatically upwards, reaching an all time high value during Mid December. This massive surge was so dramatic that it resulted in the temporary halt to crypto trading in order to try and calm down the futures markets. CBOE in the meantime, announced the launch of its own futures contract after its competitor – CME – launched its own futures product.

Segregated Witness Proposal (SegWit2x) Officially Cancelled, November 8th, 2017: $7,844

Bitcoin core developers officially put into schedule its own upgrade package for November 16th. This was known as Segregated Witness 2x (SegWit2x). This was followed by a sudden falling away of support for the range of proposals, leading it to be cancelled.

CME Introduces and Launches its own Bitcoin Futures Contract, October 31st, 2017: $7,255

The CME, otherwise known as the Chicago Mercantile Exchange announced its intention to launch a Bitcoin Futures contract by the . final quarter of 2017. This represented one of the first major institutions to become interested in . the world of cryptocurrencies, especially Bitcoin as a viable investment tool.

It was in light of this news that Bitcoin begun the month surging to a record high of $6,601, meaning that it also managed to hit an all time high market cap of approximately $110 billion. In light of this announcement by the Chicago Mercantile Exchange, its rival, the Chicago Board of Exchange also announced that it would be launching of a Bitcoin futures contract of its own shortly after.

Bitcoin Manages to Break Past the $5,000 Value Marker for the First Time, October 13th, 2017: $5,943

While the Cryptocurrency begun the year at a price point of $966, Bitcoin has been continuing on its strong performance, hitting an all time high value of $5,243. Successfully breaking through its $5,000 value point for the first time.

Chinese Bitcoin Crypto Exchanges Undergo Massive Shutdown, September 15th, 2017: $3,714

All China based cryptocurrency exchanges undergo widespread shut down as ordered by Chinese authorities. This immediately created wider spread panic across the entire industry, sending the price of Bitcoin downward.

JP Morgan, Chase's CEO – Jamie Dimon condemns Bitcoin as a ‘Fraud', September 12th, 2017: $3,807

The highly outspoken Co-founder and CEO of JP Morgan Chase and Co – Jamie Dimon made his opinions about Bitcoin pretty clear to his employees and investors across the world when he said that he would fire any employees that proved “stupid enough to buy bitcoin”.

Along with these comments about Bitcoin, he would go on to call Bitcoin a fraud of a currency, arguing that, for investors would not “end well' for those getting themselves deep into crypto. The price of Bitcoin was nowhere near the kind of negative reactions that it had felt in other situations, with many investors merely shrugging off that CEO's statements.

China Officially Bans Initial Coin Offerings, September 3rd, 2017: $4,224

With the emergence of ICO in popularity over the span of 2017, China took the initiative in taking a hard-line approach towards this cryptocurrency based method of fundraising. A broad range of regulators eventually took approach of leveraging a widespread ban on Chinese companies, preventing them from raising money through the use of this method.

Bitcoin Officially Splits Into Two Currencies – Bitcoin and Bitcoin Cash Through Hard Fork, August 1st, 2017: $3,384

With its early emergence over the course of 2017, there were some major and turbulent challenges over the middle of the summer that year when it came to the matter of scalability within Bitcoin. These teams of developers finally decided upon an official split, thus creating Bitcoin and Bitcoin Cash, with each of these cryptocurrencies taking a differing approach towards the matter of scalability.

Japan Officially Recognizes Bitcoin as a Legal Currency, April 1st, 2017: $1,215.69

After months of deliberation by Japanese authorities, the country officially recognized Bitcoin as a legal method of payment according to the country's legislature. It is within this newly developed regulatory scheme, the Bitcoin exchanges within the country would need to operate in conjunction to newly introduced regulatory practices, such as anti money laundering policies and Know Your Customer rules.

SEC Denies the Wiklevoss Bitcoin Exchange Traded Fund – March 10th, 2017: $1,038

It was made official by the US Securities and Exchange Commission that the Bitcoin Exchange Traded Fund (ETF) application set forward by the Winklevoss twins was rejected, citing that the immaturity and lack of stability of the cryptocurrency market meant that an ETF was not possible.

Bitcoin manages to break through the $1,000 For the First Time in Nearly Three Years, January 3rd, 2017: $807

After a period of rallying over the course of 2016, Bitcoin had managed to break the $1,000 price point for the first time in the matter of years.

Stock Markets Plummet as a Result of Donald Trump's Shock Election Victory – Bitcoin Prices Rise, November 9th 2016: $749

In a dramatic and startling victory for the Republican Party, the now president Donald Trump officially defeated Democratic hopeful Hillary Clinton. The announcement caused massive shocks across global stock markets. US Markets, for example fell by approximately 1 percent, Japan's own Nikkei fell by 5.4 percent, Hong Kong's Hang Seng slid by 2.1 percent.

Meanwhile, Gold increased by approximately 3 percent while Bitcoin enjoyed a significant rise in contrast to major global markets, increasing by 5 percent. Traders and institutional investors also began to see the intrinstic value of using Bitcoin as a hedge against broader market movements.

Bitfinex Loses 72 Million Dollars in Cyber Attack, August 2nd, 2016 – $591

The Cryptocurrency exchange, Bitfinex made the announcement that it had officially lost more than 120,000 of its customers Bitcoins due to a catastrophic security breach of the system. This equaled a total of 72 million dollars worth of Bitcoin lost at the time, Overall, the value of Bitcoin managed to decrease by over 20 percent, causing the price to recede to $480 after the announcement by Bitfinex.

The hack had a broader scope of repercussions within the Bitcoin community as a whole, and Bitfinex had contributed to a broader decline of prices over the last month. This was all before the Bitfinex announcement was made. This indicated that there were parties within Bitfinex that had prior knowledge that this hack was going to take place.

Bitcoin Halves for the Second Time – July 9th, 2016: $674

This date commemorates the second time in the history of Bitcoin that the Bitcoin block reward was halved from 25 Bitcoin per block to 12.5

Craig Wright Declares That he is Satoshi Nakamoto, May 2nd, 2016: $454

Within a blog post on his website, the Australian Craig Wright announced that he . is the true developer behind Bitcoin – Satoshi Nakamoto. As a kind of evidence fro this, he provided a private key signature demonstrating that he had control over the walled off Bitcoin that had been stored back in 2009 /2010.

This same evidence was subsequently debunked by the community within the same day. This same claim by Wright is continually debated and attacked to this day.

Steam Accepts Bitcoin Payments, April 27th, 2016: $461

The gaming platform developed by Valve, Steam announced that it would go on to accept Bitcoin as a medium of payment for a range of video games and digital content on the platform. In order to achieve this, Valve announced that it will be putting to use the Crypto Payments solution – Bitpay in order to provide this service for users.

OpenBazaar Launches and becomes one of the first Decentralized Marketplaces, April 4th, 2016: $426

OpenBazaar launches and becomes the very first digital and decentralized marketplace. It's objective is to create an open peer to peer market which removes the need for any kind of middlemen, fees or restrictions on digital trade. The company would go on to announce that they had successfully received over 1 million dollars worth of seed funding from major nationally active venture capital firms such as Union Square Ventures as well as Andreessen Horowitz

Segregated Witness Was Proposed by a Range of Bitcoin Core Developers and Miners, February 21st, 2016:

Members of the Bitcoin community descended upon Hong Kong in order to discuss Bitcoin and its future goals. One of the proposals designed to redress the challenges related to scaling was known as Segregated Witness otherwise known as SegWit, which was proposed during the body of the meeting in order to deal with ongoing congestion as it related to transactions. The group had finally agreed to scale Bitcoin in order to make it into an international solution for payments.

Wired Reports That Craig Wright is Satoshi Nakamoto, December 8th, 2015: $461

Wired officially published an article at this time claiming that Dr Craig Wright was officially the developer of Bitcoin – Stoshi Nakamoto – arguing that either the Australian businessman was either Nakamoto or a ‘brilliant hoaxer'.

Gwern Branwen had cited a series of emails, deleted blog posts along with a wide range of leaked court documents within the article in order to provide evidence that Wright is Nakamoto.

In order to further attempt to substantiate his own claim to being Nakamoto, Wright would go on to provide proof to a small pool of researchers that he was, in fact, Nakamoto. Even if this was the case, the proof is still very much disrupted by the community behind Bitcoin.

Bitcoin's Symbol Officially Accepted Into the Unicode, November 3rd, 2015: $334

Bitcoin has been steadily growing in influence, as it evidenced by the Unicode Technical Committees decision to accept the Bitcoin symbol into the Unicode Standard – providing it with the slot – U+20BF SIGN.

Bitcoin Makes the Front Page of The Economist For the First Time, October 31st, 2015: $366.67

Under the headline “The Trust Machine,” Bitcoin officially appeared on the front page of the internationally renowned financial news magazine. The article itself discussed the principles behind what we know as economic liberalism, as well as the kind of utility provided by blockchain technology, including the prospect of national and international banks making use of blockchain in order to create and launch its own take on a cryptocurrency for internal or international use.

The European Union Officially Declares that No VAT Will be Imposed on Bitcoin Trades, October 22nd, 2015: $318.43

According to a ruling made by the European Court of Justice, it ruled that Bitcoin, along with other cryptocurrencies will not be subjected to any kind of Value Added Tax (VAT) within the European Union. This ruling officially means that Bitcoin would be given a similar kind of treatment that currencies enjoy as opposed to a commodity or property – This is a position which is in stark contrast to the position taken by the regulatory agencies of the United States.

The Gemini Exchange is Officially Launched by the Winklevoss Twins in New York: October 5th, 2015: $268

While previously known as the twins assiduously involved in the development of the social media platform Facebook. Cameron and Tyler Winklevoss announced the launch of their own Bitcoin exchange which is based in the United States and well regulated.

With its launch, Gemini was provided with licenses in order to effectively operate within 26 of the States and, thanks to its existing partnership with a bank in New York, customers that deposit assets through the company will have their assets secured through an FDIC insurance – much like customers of a normal bank.

Commodity and Futures Trading Commission Declares that Bitcoin is a Commodity, September 18th, 2015: $238.15

In contrast to later rulings by the European Union, the United States' Commodity Futures Trading Commission (CFTC) announced that it had settled charges against a specific Bitcoin exchange which allowed users to trade various options contracts.

It was as a consequence of this ruling that the CFTC would go on to deem that “bitcoin and other virtual currencies are properly defined as commodities.”

New York Introduces its new BitLicense for Crypto Exchanges Trading Within the State's Jurisdiction, June 3rd, 2015: $232.05

New York officially became one of the single most progressive states within the United States when it comes to cryptocurrency regulation with the introduction of its own regulatory scheme known as the ‘BitLicense'. Through this license, any cryptocurrency exchange platform will be able to do business by acquiring one of these licenses from the New York Department of Financial Services.

In order to accomplish this, exchanges would need to pay an application fee of $5,000, along with biometric information for the FBI, as well as provide written approval for any and all new business activities. A large number of older exchanges have since ceased operations within the state as a result of their hesitance towards this license.

Coinbase Officially Launches Itself as a US Bitcoin Based Trading Platform, January 26th, 2015: $222.85

Backed by a series of Venture capital companies, Coinbase announced its launch of its own dedicated Bitcoin trading solution after spending months attempting to receive regulation from states and federal financial agencies. During this launch, Coinbase was able to successfully and legally accept trades on Bitcoin from customers across 25 states across America.

Bitstamp Subjected to Hack, Lost 5.2 Million Dollars in the Process, January 4th, 2015: $198.59

This period of time represents one of the worst bear markets that Bitcoin has sustained in its history so far. And it was about to get worse when Bitstamp was subject to a malicious hack, resulting in the theft of approximately 18,866 Bitcoin, which was worth a total of 5.2 million dollars through the use of a range of social engineering strategies against the exchanges administrator.

For eight days, the Bitstamp platform was shut down before it was able to re-open again. While this represented a significant loss for the company, Bitstamp's more extensive cold storage was left completely untouched, while customer balances were also left unscathed, with this amount of Bitcoin representing only a ‘small fraction' according to the team.

Microsoft Officially Accepts Bitcoin, December 11th, 2014: $324.87

The international digital service provider, Microsoft becomes one of the first major companies to accept Bitcoin from customers within the United States, allowing users to spend them in order to buy apps, games and digital content through Windows and XBOX. In order to allow for these transactions to be completed, Windows employed the use of Bitpay as a Bitcoin Payments provider.

Bitcoin Transaction Known as BearWhale is Officially Filled by Bitcoin Exchange, October 6th, 2014: $387.40

Bitcoin markets officially rocketed upwards thanks to the sale of one of the largest selling orders in the . history of Bitcoin when an unknown trader put approximately 30,000 Bitcoin up for sale on the coin exchange BitStamp at a price of 300 dollars.

This position was known as ‘BearWhale' thanks to its total position value of 9 million dollars within the community. While the position was finally filled and sold, the price of Bitcoin deflated as a result.

Dell Officially Starts Accepting Bitcoin, July 18th, 2014: $528.88

The computer and technology giant, Dell announced its decision to accept Bitcoin as a medium of payment for customers from within the United States. Boasting a total annual revenue of 56 billion dollars at the time, Dell is the single largest company at the time accepting cryptocurrency as a payments solution.

The decision by Dell was made after a number of computer hardware providers such as TigerDirect, Overstock, Newegg and others launched Bitcoin payments through their platforms.

United States Government Sells off 30,000 Bitcoin Within An Auction, June 27th, 2014: $628.5

During October 2013, the United States Marshall's had seized approximately 30,000 Bitcoin during a raid of the dark net trafficking platform – Silk Road. The Bitcoin was auctioned off in June 2014 to the highest bigger. That of course turned out to be the billionaire and venture capitalist – Tim Draper – who purchased the tens of thousands of BTC, making him one of the biggest holders of Bitcoin to date.

GHash.io Gains Temporary Majority Control, or 51 Percent Control Over the Bitcoin Network, June 13th, 2014: $592.28

The cryptocurrency mining pool known as GHash.io managed to obtain 51 percent and majority control over the hashing power of the Bitcoin network, allowing them to theoretically launch a 51 percent attack against the network as a whole. In doing so, it would have the power to reverse bitcoin transactions.

In order to dissuade any financial confidence from the community, the mining pool announced that it would never, under any circumstances participate in a 51 percent attack, and would seek to limit its pools hash power to under 40 percent in the foreseeable future.

The People's Bank of China Conducts Widespread Shut Down of Bank Accounts Related to Exchanges, April 10th, 2014: $501.7

The deadline for Chinese financial institutions to demand the cease of dealings between cryptocurrency and Bitcoin exchanges was April 15th. On this date, a number of exchanges within China had their bank accounts closed down during this time, with many exchanges resorting to the use of off-shore banking to continue operation.

The IRS Announced that Bitcoin Will be Subject to Taxation Just Like Property: March 26th, 2014: $453.05

The centralized tax institution of the United States – the Internal Revenue Service, announced that it will be placing taxations on Bitcoin to the same style as property. Bitcoin, among other cryptocurrencies would not be treated in the same tax sense as currencies but more akin to property. This means that they would be subject to legal restrictions and logistical challenges such as Capital Gains forecasting and tax.

Newsweek Identifies the Retired Computer Engineer – Dorian Nakamoto as Being Satoshi Nakamoto, Bitcoin's Creator, March 6th, 2014: $631.25

Newsweek, which is a media outlet, saw one of its journalists – Leah McGrath Goodman – identified the computer engineer, Dorian Nakamoto as being the officially the creator of Bitcoin. While Dorian Nakamoto would go on to refute any claims that he was the creator of Bitcoin, further investigation would go on to prove that Dorian had no connection to the project whatsoever. The Bitcoin community would go on to raise approximately $23,000 for Dorian Nakamoto in light of the harassment he had received during the crpyto Cause Celebre.

Cryptocurrency Exchange – Mt. Gox Suddenly Shut Down, February 24th, 2014: $662

As of February 7th, the cryptocurrency exchange Mt Gox had halted all withdrawals after it was subjected to a DDoS atack. Over few weeks, Mt Gox would go on to permanently close its doors to traders. It was shown later on that Mt Gox resolved to shut down after it had found that nearly three-quarters of a million Bitcoin (744,000) were missing from its cold storage.

As a result of these reports, what was previously known as the worlds largest Bitcoin exchange platform officially went bankrupt, with the price of Bitcoin plummeting as a result, with some investors suffering catastrophic losses.

Mt Gox was subject to a Serious DDoS attack Along With Other Major Exchanges, February 7th, 2014: $626

Mt Gox, Bitstamp, BTC-E along with a wide range of other cryptocurrency exchanges were subjected to Distributed Denial of Service (DDoS) attacks, resulting in many of these exchanges being subject to temporary shut downs. Drastically harming the price of Bitcoin as a result.

The Chinese Government Issues Ban on Financial Institutions Using Bitcoin, December 5th, 2013: $839

With a tremendous amount of popularity being won in China for Bitcoin. The People's Bank of China took the unilateral decision to ban Bitcoin as a medium of currency, prohibiting any financial institutions from using it.

The Price of Bitcoin Surges to High Value of $1,242 on Mt Gox Exchange – November 29th, 2013: $921

With an increasing level of investment from China, the price of Bitcoin surges higher, allowing Bitcoin to reach an all time high value point on November 29th. Citizens within China decided to make use of the cryptocurrency as a safe source of storage of value from the Yuan which was undergoing dangerous inflation.

China Allows its Citizenry to Legally Trade and Own Bitcoin / Cryptocurrencies, November 20th, 2013: $1,075

In a statement provided by the People's Bank of China, citizens will officially be “free to participate in the bitcoin market”, paving the way for members of the Chinese public to buy, sell and own Bitcoin on a large scale. This would cause the price and trading volume of Bitcoin to skyrocket.

United States Senate Holds off on Hearing Regarding Bitcoin, November 18th, 2013: $1,072

In the aftermath of the arrest of Ross Ulbricht, the Senate of the United States hosted a talk known as ‘Beyond Silk Road', which discussed the “potential risks, threats and promises” of digital currencies. While there were a number of panelists and senators that regarded Bitcoin as a risky asset, there were others that saw it as having innovative potential.

The Dread Pirate Roberts – Arrested, October 1st, 2013: $135.12

The Federal Bureau of Investigation followed up on a series of clues in order to successfully arrest the ‘Dread Pirate Roberts' otherwise known as Ross Ulbricht, who worked as the mysterious owner of the Darknet Trading marketplace known as Silk Road.

This dark web site gained a notoriety as a place for users to buy and sell anything from guns, drugs, and other illegal goods and services in exchange for BTC. The Dread Pirate was charged with multiple charges of Narcotics trafficking, hacking, money laundering, as well as engaging and participating in a criminal cartel. With over 170,000 BTC were seized during this operation

TradeHill officially Ceases its Operations, August 30th, 2013: $126.94

Known as a business to business exchange platform, Tradehill officially ceased operations and returned its pool of funds after the Archive Federal Credit Union, the company's financial partner, decided that it didn't want to endure the regulatory issues for Bitcoin.

Department of Homeland Security Issues a Warrant Against the Crypto Exchange Mt.Gox, May 14th, 2013: $126.94

The Department of Homeland Security managed to seize over 3 million dollars from a Wells Fargo Bank account which belonged to Mark Karpeles, who worked as the CEO of Mt Gox. The investigation found that the CEO was found guilty of illegally transmitting money against the banks terms of service. Users, as a result, grew concerned about the future legal status of Bitcoin

The Increased Trading Volume Manages to Break Mt Gox Exchange, April 10th, 2013: $122.9

The trading volume of Mt Gox rocketed up in what was previously believed that it was a Distributed Denial of Service (DDoS) attack. What it turned out to be was a surge of users seeking to trade within the exchange – including a large number of users fleeing the faltering situation within Cyprus. Mt Gox had to issue a brief shutdown in light of this pressure, causing a great deal of panic within the community.

Cyprus' Bailout and Economic Situation Causes Major Surge in price of Bitcoin, March 25th, 2013: $131.07

The European Union had provided the government of Cyprus with a 10 million Euro bailout package in order to reress the country and its faltering economy. This bailout package came with the further condition that any account with more than 100,000 Euro would be subject to fees and transaction restrictions.

It was in light of these new restrictive measures caused the price of Bitcoin to spike from 80 dollars to more than 260 dollars as a wide number of wealth Cyprian citizens and foreign nationals fled the money system.

Bitcoin 0.8 undergoes a Hard Fork Debacle, March 11th, 2013: $68.89

It was a rough and challenging week for the Bitcoin community after a range of transaction issues, causing a brief hard fork. Mt Gox had temporarily issued a suspension of operations, while the core development team conducted a “swift and co-ordinated response” in order to solve this issue within a matter of hours.

It was the updated iteration of Bitcoin, known as Version 0.8.2, was released quickly after in order to ensure that this issue would never emerge again.

Bitcoin Undergoes First Ever Block Halving, November 28th, 2012: $13.43

The number of Bitcoin awarded to miners with each Bitcoin block undergoes its first ever halving. Decreasing the reward for miners from 50 Bitcoin per block down to 25 Bitcoin per block.

WordPress Starts to Accept Bitcoin, November 15th, 2012: $12.46

According to a press release provided by the Content Management solution – WordPress made the announcement that it would begin . to accept Bitcoin as a means of financial transactions, citing the likes of PayPal and Visa for their uncalled for restrictions on it as a virtual currency. The company would go on to criticize the two financial giants for blocking transactions in more than 60 countries including emerging markets. “Our goal is to enable people, not block them,” wrote WordPress in the statement.

Bitcoin Savings and Trust Officially Halted Payments, August 17th, 2012: $11.18

Trendon T. Shavers is charged under allegations of defrauding investors on the digital platform Bitcoin Savings and Trust by the US Securities and Exchange Commission. Shavers accepted a range of virtual deposits from forum users of BitcoinTalk of up to 50 Bitcoin, they were then supposed to be paid out interest on a weekly basis.

It was on this day that Shavers put a halt to the operation, vanishing into the ether with anywhere from 86 thousand to half a million Bitcoin.

Linode Was Hacked, Losing Over 46,000 Bitcoin, March 1st, 2012: $4.89

A hacker managed to breach the servers of the web host known as Linode, successfully managing to access a wide range of wallets which contained a large number of bitcoin. In total, the hacker managed to steal approximately $228,000 worth of digital assets from Linode's range of customers. Some of the victims of this attack include the lead developer of Bitcoin – Gavin Andresen, Bitcoinica as well as the Mining Pool operator – Marek ‘Slush' Palatinus.

Paxum and Tradehill Drop Bitcoin After Discovery of BTC-E Bug, February 11th, 2012: $4.31

Over the week of Feb 11th, the online payments processing service known as Paxum announced that it would be ceasing all cryptocurrency transactions and processing regarding legal issues. After two days, the money transmitter service, TradeHill, announced that it would also be closing its operations and would sell off its bitcoin in order to refund both its population of creditors and customers.

BitcoinTalk forum user. Patrick ‘Phantomcircuit' Stratement took to the forums to disclose the fact that there was a BTC-E bug discovered on the cryptocurrency exchange.

“Bitcoin For Dummies” Episode Airs As Part of ‘The Good Wife” in December 19th, 2011: $4.22

Approximately 9.45 million viewers took to television to watch the bitcoin themed episode of The Good Wife with many investors believing that the episode would have a spectacularly positive effect on the value of Bitcoin during trading. Unfortunately for many, there were very few in the way of viewers bought into the excitement of Bitcoin, and activity remained muted.

Mt Gox Hacked, June 19th, 2011: $17.77

An Auditor working on behalf of the cryptocurrency exchange managed to hack the exchange by downloading a full copy of the user database which contained an range of insecure hashed passcodes. Through the use of Amin-level privileges, the Auditor managed to place a number of sell order onto the platform before going on to halt trading for one week while they sought to reverse these trades. In total, over 4,019 Bitcoin were stolen.

Gawker Officially Publishes New Article About Silk Road, June 1st, 2011: $16.88

Adrian Chen, one of the staff writers for the news platform – Gawker, published an expose article on the dark web website known as Silk Road. The article itself was titled “The Underground Website Where You Can Buy Any Drug Imaginable.” This article went into detail about how users could purchase any illegal black market substance or item on the market through the use of Bitcoin.

The article itself exploded in popularity, causing the price of Bitcoin to almost double. Within one week of the article being published, Bitcoin surged up to 31 dollars.

The controversial article described how you could purchase drugs, assassins, and virtually anything on Silk Road in exchange for bitcoin. The heavily-trafficked article caused the price of bitcoin to surge from $9.21 to $17.61. Within a week of publication, bitcoin peaked at a price of $31.

Three Bitcoin Exchanges Officially Launch, Accepting New Fiat Currencies, March 27th, 2011: $.072

Bitcoin was officially launched as a Crypto exchange in March 2011, the platform allowed a wide range of users to trade Bitcoin directly with the Pound Sterling for the first time in its history. Shortly thereafter, a Brazilian cryptocurrency exchange would become the second to do so successfully. Over early April, BitMarket.eu was also launched, giving customers within the European Union to trade Bitcoin in exchange for Euro. These three exchanges would open up the way for millions of new bitcoin users across the world.

Bitcoin Successfully Manages to Reach Parity with the US Dollar, February 9th, 2011: $1

Being only two years old by this point, Bitcoin had officially managed to reach parity with the US Dollar according to the Mt Gox cryptocurrency exchange. With the news that it had successfully matched the US Dollar, this caused the price to accelerate, as new investors jumped on board.

Bitcoin Protocol Bug Results in Hard Fork, August 15th, 2010: $0.07

In light of the computer number process error, a user had managed to create a fraudulent Bitcoin transaction process which allowed them to generate trillions of bitcoin. A further 99 thousand more than what is allowed to exist within the system.

Mt Gox Opens, July 18th, 2010: $0.06

Headed up and launched on July 18th by the senior programmer, Jed McCaleb, Mt Gox officially opened its virtual doors. Previously referred to and known as the developer behind the Peer to peer network solution known as eDonkey back in 2000.

The infrastructure of this cryptocurrency exchange was based on McCalebs previous code structure was based on his previously failed project known as Magic: The Gathering Online Card Exchange Platform (MTGOX). Over the next three years, this exchange would become known as one of the largest cryptocurrency exchanges in operation in the world. McCaleb would go on to sell this exchange on to Mark Karpeles on March 6th, 2011.

Bitcoin Officially Features in Slashdot Article, July 11th, 2010: $0.08

With the release of version 0.3 of Bitcoin, it was successfully featured in the popular news and technology platform known as Slashdot.org. Its readers because greatly interested in Bitcoin, allowing the price of the crypto to increase tenfold in just under a week.

Laszlo Pays for Two Pizzas, Making Them the First Items Bought Using Bitcoin, May 22nd, 2010: $0.0025

Laszlo, known more commonly as one of the active users of the BitcoinTalk Forum, manages to use 10,000 BTC in order to purchase two pizzas from local Papa Johns for approximately 25 dollars. These pizzas were ordered and paid for thanks to a fellow forum user known as Jercos.

Very First Bitcoin to Fiat Exchange Takes Place, October 12th, 2009: $0.001

Through the use of Paypal, the New Liberty Standard successfully purchased a total of 5,050 Bitcoin from the crypto user known as Sirius for the cash sum of 5 dollars, which roughly equals an exchange rate of $0.001 per Bitcoin. This is the very first known trade and exchange of Bitcoin for Fiat currency.

The New Liberty Standard Publishes the Very First Live Bitcoin Exchange Rate, October 5th, 2009: $0.0008

New Liberty Standard announces the launch of its own Bitcoin Exchange rate service with a preliminary exchange rate of 1,309 Bitcoin to US Dollar. This roughly equated to $0.0008 per one Bitcoin. New Liberty Standard found that this exchange rate was based on the underlying cost of electricity used in order to mine a single bitcoin.

The Very First Transaction of Bitcoin Takes Place From Between Satoshi Nakamoto to Hal Finney, January 12th, 2009: $0

This would come to be known as the very first Bitcoin transaction in History to take place on Janaury 12th. This transaction was between Satoshi Nakamoto, who would transfer 10 Bitcoin to the fellow Bitcoin Developer and Cryptography advocate and activist Hal Finney.

Finney would then go on to tweet about the interaction shortly after, and would go on to jokingly comment that he never paid Satoshi back.

Genesis Block is Officially Established, January 3rd, 2009: $0

This date marks the creation of the worlds first Bitcoin block, known as the Genesis block. This would go on to be mined by Satoshi Nakamoto, thus officially launching the Bitcoin blockchain and cryptocurrency.

Bitcoin Guides

What Does the Future Hold for Cryptocurrencies – MyBitcoin User, Investor & Trader Knowledge Base

Chapter 8.2

The future of cryptocurrencies will include risks and opportunities. As we mentioned at the beginning of this chapter, there’s a chance the price of bitcoin will plummet to $0.25. There’s also a chance the price of bitcoin will rise to $1 million.

If the cryptocurrency industry is going to succeed, then it’s going to have to avoid risks and embrace opportunities. Here are some of the risks and opportunities facing the cryptocurrency industry in the future:

Government Regulations and Bitcoin

Risk: Governments Will Ban or Heavily Regulate Cryptocurrencies

Governments are well-aware of cryptocurrencies. Some governments have already regulated bitcoin and cryptocurrencies. China, for example, banned bitcoin trading in September 2017 and shut down bitcoin exchanges countrywide. Today, cryptocurrency continues to be a grey area in many jurisdictions. Most governments agree that cryptocurrencies aren’t securities. However, they’re not treated like currencies either. Eventually, major governmental institutions like the US SEC are going to announce regulations on cryptocurrencies – and these regulations could decide the future of crypto.

Opportunity: Regulated Cryptocurrencies Could Become Legal and More Widely-Accepted

Regulation isn’t necessarily a bad thing. Governments introduce regulation to protect citizens. Stricter regulations in the cryptocurrency industry could enhance the industry’s reputation. It could lead to a reduction in scams. It could help investors avoid ICO fraud. It would allow the highest-quality cryptocurrencies to rise to the top – at least in theory.

Risk: Tax Evasion and Money Laundering Will Force Governments to Shut Down Cryptocurrency Trading

The crypto industry is filled with money laundering, price manipulation, tax evasion, and other activities that governments can’t tolerate. Eventually, governments worldwide could put their foot down and end crypto trading.

Opportunity: Governments Could One Day Let You Pay Taxes in Crypto

It’s not unreasonable to assume that governments could one day embrace crypto – even to a point where you can pay taxes in cryptocurrencies. In February 2018 Arizona Senate passed a bill to Accept Tax Payments in Bitcoin.

Public Perception of the Crypto Industry

Risk: Cryptocurrencies Will Never Be Mainstream Because of Negative Public Perception

When you mention “cryptocurrencies” to the average person on the street, you’ll get a range of responses. To the average person, however, bitcoin is often associated with the dark web, internet scams, online drug deals, and anonymous transactions. Despite the fact that bitcoin is one of the least anonymous cryptocurrencies, it still has a reputation for being linked to shady online activities. There’s a risk that bitcoin and cryptocurrencies will never get past this reputation.

Opportunity: Cryptocurrencies Will Grow Into a More Positive Reputation

On the flip side, there’s a chance public awareness of cryptocurrencies will continue to grow, and that the public will learn that cryptocurrencies have enormous value outside of anonymous transactions and money laundering.

New Technologies Will Impact the Crypto Community

Risk: Future Cryptocurrencies Won’t Be Based on Blockchain Technology

When we talk about cryptocurrencies today, we’re talking about digital tokens built on blockchain platforms. Bitcoin introduced the idea of a blockchain, and other cryptocurrencies have expanded on that idea. But blockchain technology isn’t perfect. There is room for improvement. Directed acyclic graph (DAG) algorithms could introduce a new wave of digital currencies, for example. It’s naïve to assume that blockchain, a 10-year old technology, will be the king for years to come. A new technology could make cryptocurrencies a forgotten fad overnight.

Opportunity: New Technologies Will Allow Cryptocurrencies to Continue Growing

New technologies will be good for the cryptocurrency industry. New technologies – whether they’re DAG-based platforms or whatever – will enhance the usability and efficiency of cryptocurrencies, opening up crypto to a new world of investors.

Electricity Consumption

Risk: Electricity Consumption on the Bitcoin Network is Unsustainable

Bitcoin is notorious for its electricity consumption – and the problem continues to get worse over time. Electricity consumption on the bitcoin network – and other PoW networks – is unsustainable. There simply isn’t enough electricity in the world to continue providing the bitcoin network with the power it needs. In a world increasingly aiming for sustainability, the excessive consumption of the bitcoin network might be its worst enemy.

Opportunity: ASICs and Other Devices Make the Bitcoin Network More Efficient Than Ever

Electricity consumption of the bitcoin network has steadily increased over time, but efficiency of the network has also increased. Devices like ASICs are thousands of times more efficient than the miners we used during the early days of bitcoin. They spend less electricity to deliver higher hashrates.

Centralization in a Decentralized Ecosystem

Risk: Cryptocurrency is Becoming Too Centralized

Five bitcoin mining pools in China control the vast majority of hashpower on the bitcoin network. A handful of centralized corporations play an increasingly dominant role in the bitcoin network. Bitcoin mining used to take place on individual PCs. Now, it’s taking place in enormous data mining centers. The cryptocurrency industry is becoming too centralized – and this centralization could ruin the crypto industry as we know it.

Opportunity: Competition Will Reign Supreme

The crypto industry is very competitive. There are low barriers to entry. Any computer programmer can introduce a cryptocurrency online today. Someone might introduce an ASIC-resistant, centralization-resistant cryptocurrency that works in true, democratic fashion. The market might solve all of the problems faced by the bitcoin industry.

Quantum Computers

Risk: Quantum Computers Will Make PoW Systems Obsolete Overnight

Cryptocurrencies – particularly cryptocurrencies that use Proof of Work algorithms – are based on the concept of computers doing “work” by contributing processing power to the network. Moore’s Law has kept the increase of processing power relatively stable over the years (processing power has roughly doubled every year). Quantum computers, however, will blow Moore’s Law out of the water. The first person to build a quantum computer will be able to decimate PoW algorithms, threatening the security and stability of cryptocurrencies.

Opportunity: We’ll Build Algorithms for Quantum Computers

If and when a quantum computer gets developed, the market could build algorithms resistant to quantum computers. In fact, some cryptocurrencies today are designed specifically with quantum-resistance in mind. Quantum computers may be an issue for older cryptocurrencies, but it’s an issue that can be solved.

Apocalypse Scenarios

Risk: The Power Grid Collapses

If the power grid collapses, then bitcoin is dead. In an apocalypse-style scenario, bitcoin will not be a replacement for gold bars or cash. It’s an electronic form of cash. It only works with electricity.

Opportunity: We’ll Always Have Cold Storage and Paper Wallets

Bitcoin is useless without electricity. You need electricity to process transactions on the bitcoin network. However, we’ll always have paper wallets and other unique solutions. You don’t need electricity to store bitcoin long-term, but you’ll need electricity if you ever want to access that value.

Top 5 Bold Predictions for the Future of Cryptocurrencies

Wall Street Will Continue to Embrace Cryptocurrencies, But It Won’t Cause Prices to Skyrocket

Major Wall Street firms continue to embrace bitcoin and other cryptocurrencies. Eventually, these firms will offer cryptocurrencies to customers or open their own trading desks. Despite this development, however, it won’t cause prices to skyrocket across the market. As big-name investors continue to participate in the industry, it will cause markets to stabilize. Price manipulation will be reduced. There will be a small number of regulated crypto exchanges as opposed to hundreds of smaller, unregulated exchanges.

Bitcoin Won’t Be The Number One Cryptocurrency by Market Cap by the End of 2019

Bitcoin has been the world’s largest cryptocurrency since launch in 2009. It has never been surpassed at any point in its history. However, the dominance of bitcoin continues to decline. Eventually, bitcoin will be replaced as the world’s largest cryptocurrency by market cap. Ethereum and Bitcoin Cash are potential contenders, but a new cryptocurrency could emerge that topples Bitcoin completely.

Bitcoin Cash Will Eventually Be Worth More Than Bitcoin

Development on bitcoin (BTC) has stagnated over the past year. Developers are struggling to come up with a scaling solution. Transactions are piling up, transaction times are lengthening, and fees are rising. Today, BTC’s scaling solution is to implement an off-chain payment channel called the Lightning Network. It’s a complete (and deliberate) departure from the protocol mentioned in the original bitcoin whitepaper. Eventually, we believe that Bitcoin Cash – which has implemented efficient on-chain scaling based on the terms of bitcoin’s original whitepaper – will surpass bitcoin in value and market cap.

Bitcoin Will Never Rise Above $20,000

Bitcoin surged to an all-time high just under $20,000 in December 2017. Since then, bitcoin has plummeted as low as $6,500. While some experts claim bitcoin will be worth $50,000 or $100,000 within the next 2 to 5 years, we’re going to make a bolder prediction: bitcoin (BTC) will never rise above $20,000.

The Total Crypto Market Cap Will Surpass $1 Trillion By Mid-2019

The total market cap of the cryptocurrency industry sits at around $350 billion as of June 2018. The market cap climbed as high as $800 billion in January 2018. Since then, however, prices have plummeted and billions of dollars have been wiped from the market. Nevertheless, we believe crypto markets will rebound, surging to a value of $1 trillion by mid-2019.

Conclusion

Nobody knows what the future holds for cryptocurrencies. That’s what makes it so intriguing.

There’s a reasonable chance that bitcoin will eventually be worthless. There’s a possibility that nobody will recognize names like Litecoin, Ethereum, or Bitcoin Cash by the time 2050 rolls around.

There’s also a chance that bitcoin could be worth $1 million by 2025. There’s a chance that you could kick yourself for not buying bitcoin in June 2018 when bitcoin was only $7,000.

As with anything in life, we just don’t know what the future holds – and that’s what makes the crypto industry so exciting.

Bitcoin Guides

A Brief Timeline of the Cryptocurrency Industry – MyBitcoin User, Investor & Trader Knowledge Base

Chapter 8.1

The age of cryptocurrencies officially began in January 2009 with the launch of the bitcoin network. Since then, we’ve seen cryptocurrencies rise and fall. We’ve seen some cryptocurrencies launch and dominate the market. We’ve seen other cryptocurrencies fizzle out within weeks of launch.

We could write an entire textbook on the history of cryptocurrencies. However, we’ll start with a basic timeline. Here are some of the major events in the history of cryptocurrencies.

The Pre-Bitcoin Era (1983 to 2004)

Many cryptocurrency timelines start in October 2008 (when the bitcoin whitepaper was released) or January 2009 (when the bitcoin network launched and the first bitcoin transaction took place). The real history of cryptocurrencies, however, traces back to a pre-bitcoin era. Some of the notable events that took place in the leadup to the development of bitcoin include:

1983: American cryptographer and computer scientist David Chaum proposed an anonymous, cryptographically-secured, electronic money system all the way back in 1983. The idea for ecash was published in a paper in 1983. Ecash software stored money on the user’s local computer in a digital format, secured by cryptography.

1989: In 1989, David Chaum created DigiCash, Inc., expanding on his ecash concept. Digicash allowed for anonymous electronic money transfers online, with anonymity secured by cryptography. The company declared bankruptcy in 1998.

1997: British cryptographer Adam Back proposed a proof-of-work system called Hashcash in 1997. The proof-of-work system introduced the idea of forcing computers to “do work” to provide a “proof” before accessing a service. Computers were forced to provide proof of work prior to sending an email or posting a forum message, for example. This was designed to combat spam. A decade later, bitcoin would use a similar proof of work system as part of its mining algorithm.

1998: Chinese computer engineer Wei Dai proposed B-money as an “anonymous, distributed electronic cash system”. B-money relied on a proof of work function similar to the one introduced by Hashcash. 10 years later, Satoshi Nakamoto would reference B-money when introducing bitcoin online.

1998: American computer scientist and cryptographer Nick Szabo introduced what may be the best-known predecessor to bitcoin. Called Bit Gold, the project was more similar to bitcoin than any other project that had come before it. Bit Gold, however, was never actually implemented. It was just proposed. Szabo described Bit Gold as a decentralized digital currency involving the use of cryptographic puzzles, Byzantine fault-tolerant public registries, and private and public keys.

2004: Hal Finney created the first reusable proof of work system before bitcoin. Finney, who would eventually become the first person to receive a bitcoin transaction from Satoshi Nakamoto, published the idea of a reusable proof of work (RPOW) system that used Hashcash as its proof of work algorithm.

The Bitcoin Era (2008 Onward)

The cryptocurrency industry, up to this point, was a mix of different projects that had never got off the ground. Satoshi Nakamoto and the bitcoin project were the first to implement all of the above technologies into a full-fledged cryptocurrency. The bitcoin era officially began in October 2008 when Satoshi Nakamoto published the bitcoin whitepaper online.

October 2008: Satoshi Nakamoto introduced the bitcoin whitepaper online at Bitcoin.org. The whitepaper was titled, “Bitcoin: A Peer-to-Peer Electronic Cash System.” Although just 9 pages long, the whitepaper outlined the fundamental features of bitcoin’s blockchain-based payment system.

January 2009: The bitcoin mainnet launched in January 2009. The first bitcoin transaction – which was sent from Satoshi Nakamoto to American developer and cryptographer Hal Finney – also took place in January 2009.

January 12, 2009: The world’s first bitcoin transaction takes place. You can view that transaction here, at block 170 on the bitcoin block explorer. Satoshi sent 10 BTC to Hal Finney to test the network’s capabilities.

October 2009: The first bitcoin exchange rate is established. New Liberty Standard opens an exchange to buy and sell bitcoin. The exchange rate was initially set at 1,309.03 BTC to one USD, which meant each bitcoin was worth about $0.0007 apiece. New Liberty Standard calculated this price based on the cost of electricity used by a computer to mine a single bitcoin.

February 2010: The world’s first “real world” bitcoin transaction takes place. One early bitcoin adopter famously purchases two pizzas from Papa John’s in exchange for 10,000 BTC.

July 2010: The price of bitcoin increases 10x, jumping from $0.008 per BTC to $0.080 per BTC over an exciting 5 day period starting on July 12.

July 2010: Mt. Gox, which would grow to become the world’s largest bitcoin exchange, is established by Jed McCaleb.

August 2010: An exploit in the bitcoin network generates 184 billion extra bitcoins. The bitcoin blockchain had to be forked to “fix” the problematic chain and reverse the issue. The unusual transaction was spotted by long-time bitcoin developer Jeff Garzik, who posted online, “We’ve had a problem here.”

Altcoins Emerge (2011 Onward)

Up until 2011, bitcoin was the only cryptocurrency in the industry. When you talked about bitcoin, you were talking about the cryptocurrency industry. However, this wouldn’t hold true for long. Starting in 2011, a number of legitimate competitors started to emerge to challenge bitcoin’s reign.

2011

Throughout 2011, a number of alternative coins – altcoins – emerged on the scene, including Litecoin, Namecoin, and Swiftcoin.

January 2011: Non-profit group the Electronic Frontier Foundation began accepting bitcoin in January 2011, then stopped accepting bitcoin in June 2011 due to a lack of legal precedent. By 2013, they had resumed accepting bitcoins.

February 2011: Bitcoin reaches parity with the USD for the first time in history. 1 BTC was worth $1 USD.

June 2011: WikiLeaks and other organizations begin to accept bitcoin for donations, becoming some of the first organizations to officially accept bitcoin and allow bitcoin transactions.

July 2011: The first recorded bitcoin theft takes place. BitcoinTalkForum member Allinvain claims that 25,000 BTC had gone missing from his wallet. At this time, bitcoin had reached a price of around $14.50, which means the theft was valued at around $375,000.

September 2011: Vitalik Buterin co-founded Bitcoin Magazine at the age of 17.

October 2011: Litecoin is introduced by Charlie Lee, a Google employee, on October 13, 2011 via an open source client on GitHub. Litecoin was a fork of the bitcoin client and relied heavily on bitcoin’s code. Litecoin introduced faster transaction times (reducing block time from 10 minutes to 2.5 minutes), quadrupled total supply (from 21 million to 84 million coins), and used a different hashing algorithm (Scrypt instead of SHA-256).

2012

January 2012: Bitcoin begins inching its way into mainstream thought. CBS legal drama The Good Wife uses bitcoin as a central plot piece in its third-season episode called “Bitcoin for Dummies”.

September 2012: The Bitcoin Foundation launches with the goal of accelerating the growth of bitcoin “through standardization, protection, and promotion of the open source protocol.”

October 2012: By October 2012, bitcoin payment processing platform BitPay reported having 1,000 merchants in its network accepting bitcoin.

November 2012: WordPress begins accepting bitcoins. The popular online blogging platform became one of the first big names in the tech space to integrate bitcoin payments.

2013

February 2013: Coinbase, one of the most popular online payment platforms for bitcoin, claims to be selling $1 million worth of bitcoins every month.

March 2013: Bitcoin experiences its first major dispute leading to a fork. For six hours, two bitcoin networks operated at the same time, each with its own unique transaction history. Core developers called for a halt to transactions. The network was eventually downgraded to version 0.7 of the bitcoin software.

April 2013: The price of bitcoin rallies to a new all time high of $266 on April 11, 2013.