Cryptocurrency (Coins)

OmiseGO (OMG): Crypto Exchange & Blockchain Payments Network?

With the stated aim of “Unbanking the Banked,” OmiseGO might have a strange name, but the company is rolling out a purist offer of cryptocurrency transactionality to the world.

Claiming that “OmiseGO enables financial inclusion and interoperability through the public, decentralized OMG network,” the project’s core, undiluted focus is on becoming a “next-generation financial network and decentralized economy.” Ambitious plans, but the company is finding a niche tying into the Ethereum network to hasten and improve user experience.

Essentially a scaling solution for Ethereum-based financial transactions, the platform enables real-time P2P transactions with greater speed and transparency. The OmiseGO decentralized network provides rapid, sovereign financial services across applications, geographies and asset classes.

Employing OmiseGO’s white-label SDK, developers can build apps that enable wallet-to-wallet conversions from crypto to fiat currencies, game credits, loyalty points and other currencies.

Billing itself as a “Digital Asset Gateway,” users can also employ OmiseGO to interact with various digital assets that are securely stored on the chain.

Employing Ethereum smart contracts and blockchain consensus, rapid and secure funds clearing is also possible on the network. Users can also entertain diverse crypto interests on the platform, as it enables a decentralized exchange mechanism providing cross-chain and multi-asset interoperability. Secured by Proof of Stake, the project is also confident in the value of the scalability built into the core design.

Benefits of The OmisGO Network

Wallet providers, employing the white-label SDK (software development kit), can access the public network to engage users who want to transact with any digital assets that include many crypto and most fiat currencies.

Essentially a fintech player, security on the platform is watertight, and tying into the Ethereum blockchain makes for safe custody and known validation. Scalability nearly floored Bitcoin in its earlier days and remains an issue with all cryptocurrencies, one that OmiseGO has anticipated and built for.

The Plasma architecture affords unlimited scalability that comes with really fast speeds:that can accommodate “millions, and potentially billions of transactions per second,” according to the developers. When one considers that Visa can handle around 55,000 transactions a second, OmiseGO is emblematic of a new breed of blockchain project that has emerged post the digital coin scalability issues of years past.

OMG is truly decentralized, not being privately owned by a central authority. Rather, it is controlled by the platform’s users and validators (stakers). When staking, token holders validate network transactions while also earning fees thus accrued.

The token value is tied into the network’s uptake, and is expected to grow alongside user statistics for OMG. Apps like wallets are able to interact seamlessly with each other on the OMG network. Users are able to trade diverse crypto assets on the platform, swapping for example Bitcoin for other altcoins or fiat currency, in spite of differing blockchain protocols for each coin.

Plasma Power

OMG has had the pioneering of Ethereum’s Layer 2 Plasma architecture scaling solution firmly in mind in building the platform. Noting that “the OMG network is a proof-of-stake and infinitely scalable Plasma blockchain with a decentralized exchange built into its core consensus layer,” the project’s developers have justifiably made much of their ability to move beyond scaling as an issue at all.

That said, scalability is only demonstrated on demand, yet from Ethereum’s own data as well as current usage data for OMG, it would appear that there can be no stalling on the platform. By adopting the Plasma construction, OMG has enabled a relatively low-cost experience of scalability, security and settlement in financial transactions among its users.

Further to their lengthy white paper, the company’s roadmap outlines the focus post the initial OMG token distribution. Thinking of an ecosystem in which OmiseGO becomes the go-to platform of the cryptosphere, the company is in the process of developing the wallet SDK and DEX, developments seen as vital for the utility of OMG network.

Incorporating Plasma, the OMG platform is a secure, high-speed and cheap option for developers and end-users alike. OMG has collaborated with a number of strategically chosen global investors including leaders of the fintech arena who are strategically positioned to enable global adoption of the OMG network.

The OmiseGO Team

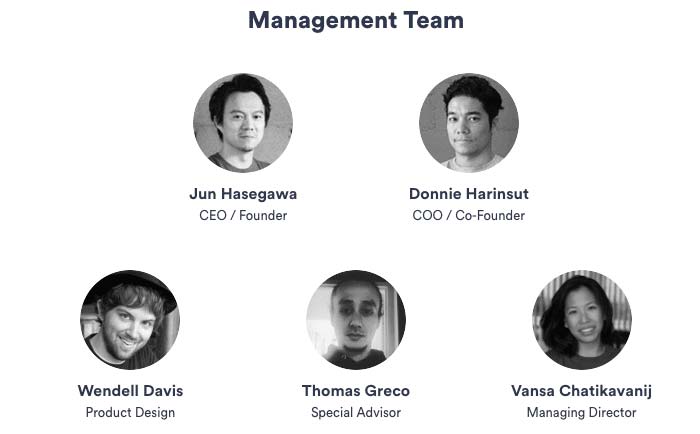

The CEO and founder Jun Hasegawa is joined by a long list of developers and business managers on the team. The COO Donnie Harinsut is also a co-founder, and with CFO Luke Cheng and MD Vansa Chatikavanij, forms the company top tier.

A further 27 core team members and a dozen advisors complement the core team. Well-known Ethereum founder and crypto commentator Vitalik Buterin is also on the advisory panel, with a special focus on Plasma and overall security issues.

Final Thoughts On OMG Platform

The OMG platform sits squarely as an answer to many crypto users who want a diversified platform, and is emblematic of an emerging cryptosphere that sees altcoins enjoying transaction and scale relief in a hitherto unknown way. In many ways a logical upshot of the big scaling “Oops!” that faced many altcoins during 2016 and 2017, OMG is a new generation company focusing on user and tech issues, a far cry from the blunt realities digital currencies faced in past years.

Aiming at offering citizens a new way of effecting financial transactions – indeed “unbanking” the banked – while eliminating the stranglehold established banks have on everyone’s cash flow and indebtedness. Although there are many smart projects out there populating the cryptosphere, the participation of Buterin as well as the host of academic and business leaders on board OMG all points to a project destined to become a household name in coming years.

Price Analysis

Bitcoin Price Starting to Recover After Sharp Drop; Top Alts Ethereum and Litecoin Are Struggling

Bitcoin BTC/USD Forecasting

From yesterday's open at $12317 the price of Bitcoin increased to $12761 but then fell below its opening price as it came down to $12100 level. After this retracement, the start of another rise has been seen with the price reaching $13055 at its highest point today before falling nearly $800 in an hour.

The price momentum has been stopped out after an increase of 7.76% measured from yesterday's low at $12100 as the price started encountering resistance around the vicinity of the prior high on the ending point of the 5th wave of the upward impulse.

Looking at the 15 min chart, you can see that the price got close to the 0.618 Fib level but there hasn't been an interaction before the price found resistance and has started to flat out, forming a horizontal resistance point. As we are seeing the ending wave of the five-wave impulse its further development would be expected to end around the vicinity of the 0.618 Fib level and proper interaction with the price potentially exceeding it on the spike up.

This would be the completion of the five-wave impulse which started on the 7th of July and is the third wave out of the upward structure from the 2nd of July. Previous to the five-wave increase a corrective triangle has been seen forming which was according to my count the B wave out of the upward ABC three-wave move. This three-wave move would be the X wave of the higher degree count which is why after its completion which is set to develop very shortly I would be expecting a move to the downside as the third wave Y should develop.

Another possibility would be that the correction ended on the first three-wave move which are only the sub-waves of the W wave according to the current count. If that is true, then we could be seeing the development of another five-wave move instead of the three-wave ABC correction to the upside. In either way, from here I would be expecting a move to the downside and if the price falls below the lower interrupted blue horizontal level on the retracement I would indicate that the move to the upside has ended on the third wave and is corrective and not impulsive.

Ethereum ETH/USD Forecasting

From yesterday’s high at $317.62 the price of Ethereum has decreased by 4.61% measured to its lowest point today which is at $302.98. The price has recovered since and came up to around $314 after, but is currently being traded at $309.

Looking at the 15 min chart, you can see that the price is currently retesting the 0 Fib level for support as a minor breakout above occurred. The price is likely to find support at the present levels as a breakout occurred on the prior high as well and has shown the absence of strong seller’s pressure.

As we are seeing the development of a five-wave impulse to the upside from 5th of July its ending wave’s development would now likely mean further increase but only for a short while as the next significant horizontal level is getting close. This is the ending point of the prior high and the support point of the impulsive move’s ending point and now serves as significant resistance.

If we are seeing a three-wave ABC to the upside out of which the mentioned five-wave impulse from the 5th of July is the C wave, the price is set to start moving to the downside after its completion, below the ending point of the first ABC to the downside which is at $276.

Upward ABC would be the second wave out of the higher degree three-wave correction which is why the third one would be expected to end on a lower low compared to the first ABC correction which would be its first wave. The most optimal target point of the expected decrease would be around the intersection of the lower ascending level which represents an uptrend support level and the 0.236 Fib level which is at $260.5.

There is a possibility that instead of the price ending its increase from the 5th of July on the third wave, we see it developing in a five-wave manner which will indicate impulsiveness instead of the currently presumed corrective momentum.

In that case, the price of Ethereum cannot go below $296 which is the territory of the 2nd wave on which the price cannot enter on the 4th if we are seeing a five-wave increase which is why the level is serving as a significant pivot point.

Litecoin LTC/USD Forecasting

From yesterday's high at $124.6 the price of Litecoin decreased by 5.37% as it came down to $117.9 at its lowest point today. The price came down to the same low level after a recovery attempt has been stopped out at $119.95, but the price is currently being traded around $119.180.

On the 15 min chart, you can see that the price of Litecoin came down to the first significant horizontal support level which is the lower outline level off of the horizontal range in which the price action is bouncing from 5th of July. Including the price action from the day before we have seen the formation of a cup and handle pattern with the price continuing to form the handle structure from yesterday's spike abode the significant horizontal level at $122.32 which is considered as the median point of the higher degree resistance range.

On the 15 min chart, you can see that the price of Litecoin came down to the first significant horizontal support level which is the lower outline level off of the horizontal range in which the price action is bouncing from 5th of July. Including the price action from the day before we have seen the formation of a cup and handle pattern with the price continuing to form the handle structure from yesterday's spike abode the significant horizontal level at $122.32 which is considered as the median point of the higher degree resistance range.

As the price failed to keep up the upward momentum and instead left a spike to the upside falling down fast below the significant horizontal level indicating strong resistance is present above, we have seen a retest of the lowest support level from the mentioned pattern. The price has recovered slightly but again failed to exceed the median point of the horizontal range from 5th which got broken in the second half of yesterday's trading session.

The recovery has developed a retest of the median point and another retest of the support level from the horizontal range with the price currently holding above its half range line. I would be expecting another minor increase which could be another retest of the today's high after which another downfall below today's support level. Even though the handle still hasn't been broken we have seen the price retracing back to the cup's support level which could be viewed as a breakout.

In either way, I would be expecting a retest of the $114.31 horizontal level which was low from the 2nd of July and was the ending point of the five-wave impulse to the downside after which a corrective ABC to the upside has been seen. This is why I think that a breakout from the downside would lead to the formation of another impulsive move which would set to push the price of Litecoin back inside the lower range below the resistance zone at $109.

Conclusion

The price’s of the major cryptos are starting to reach their significant resistance point on the corrective increase whos continuation we’ve seen in the last 24 hours. As the prices are approaching their signifiant resistance levels, after an interaction I would be expecting another downturn in the market.

Price Analysis

Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) Price Prediction for Today’s Top Cryptocurrencies

BTC/USD

From yesterday's high at $13212 the price of Bitcoin decreased by 21.23% as it came down to $10407 at its lowest point today. Yesterday's high was an interaction with the significant 0.618 Fibonacci level which ended as a rejection and caused the price to start moving to the downside in an impulsive manner.

Looking at the hourly chart you can see that the price came below the 0.5 Fibonacci level and stopped out at the minor ascending trendline from the from 10th of June from when the last five-wave impulse started developing. As the price found support there an immediate recovery has started which managed to pull the price back above the 0.5 Fib level and is currently being traded at $118816, slightly below today's high at $12012.

Looking at the hourly chart you can see that the price came below the 0.5 Fibonacci level and stopped out at the minor ascending trendline from the from 10th of June from when the last five-wave impulse started developing. As the price found support there an immediate recovery has started which managed to pull the price back above the 0.5 Fib level and is currently being traded at $118816, slightly below today's high at $12012.

The price recovered by over 14% today measured to the lowest spike to the highest point today but it appears that strong resistance has been encountered as indicated by the last hourly candle. This recovery appears to be correctional and is most likely the 2nd wave out of the starting downtrend. I wouldn't expect it to go above $12451 which would be a 0.618 Fib from the impulsive decrease if the corrective movement is in play.

We've seen the completion of the five-wave impulse from 10th of June which could have been the 5th wave from the higher degree count which I believe that it was. If this is true, then we are going to see further downside for the price of Bitcoin in the upcoming period as a correction of the same degree should develop.

On the hourly chart, you can see that I've projected a target to around $6914 but the price of Bitcoin could go significantly lower as it would be only the first wave to the downside. The five-wave move might not develop and we could instead see a three-wave correction to $8500 before further upside continuation but considering the seller's momentum seen from yesterday, I don't believe that Bitcoin's price is going to continue increasing further.

ETH/USD

From yesterday’s high at $336.1 the price of Ethereum has decreased by over 18% measured to the lowest spike the price has been which is at $275.45, but the hourly candle closed above $290.7.

The price is currently being traded at around $304 and was in an upward trajectory until it reached the significant Fibonacci level at $308.59 where it found resistance on the interaction.

As a rejection occurred the price has started moving to the downside again and looking at the hourly chart you can see that its minor uptrend line still hasn’t been broken.

The increase still might continue to the significant ascending trendline which was broken but the price fell immediately inside the territory of the ascending channel, ending as a fakeout. This is why the level might get retested again on the current recovery but we are yet to see how strong is the momentum behind today’s increase.

For now, it looks weak as the Fibonacci level was able to stop it out, so now that the price started moving to the downside we could see the price starting to move below the minor ascending trendline from today’s low.

Prior to the impulsive decrease, we have seen the completion of the five-wave impulse to the upside which could have been the ending wave of the higher degree with now a downturn starting to develop as the bullish period ended.

If we are seeing the development of the higher degree correction we are likely to see a five-wave move to the downside in an impulsive manner which would only be the first wave out of the potential three-wave move of the higher degree.

In that case, the price of Ethereum would be expected to go for a retest of some major resistance point, broken on the way up, out of which the first significant one would be between $187 and $174.

LTC/USD

From yesterday's high at $130.322 the price of Litecoin has decreased by 13% coming to $113.36 at its lowest point and even spiked further to the downside coming to $110.69 but the hourly candle closed above $133 leaving a wick on the hourly chart. The price is currently being traded at $117.69 slightly below today's high at $119.7 as a minor recovery has been made.  On the hourly chart, you can see that the price of Litecoin fell inside the territory of the lower horizontal range between the $122.32 level and the $109.356 horizontal pivot. This area is highly significant as it was considered to be the support area from the first half of the bear market and managed to hold the price of Litecoin but was eventually broken on the 10th of June 2018. Out of this support/resistance, the $137 horizontal level was its furthest level and considering that the interaction with it ended as rejection with an impulsive downside move seen after, we have likely seen a retest of the broken support for resistance before further downtrend continuation.

On the hourly chart, you can see that the price of Litecoin fell inside the territory of the lower horizontal range between the $122.32 level and the $109.356 horizontal pivot. This area is highly significant as it was considered to be the support area from the first half of the bear market and managed to hold the price of Litecoin but was eventually broken on the 10th of June 2018. Out of this support/resistance, the $137 horizontal level was its furthest level and considering that the interaction with it ended as rejection with an impulsive downside move seen after, we have likely seen a retest of the broken support for resistance before further downtrend continuation.

From 5th till 12th of June we have seen the development of the five-wave move to the upside which was most likely the ending wave of the higher degree as immediately after its completion we've seen a sideways range forming before a straight downfall. This impulsiveness to the downside indicates that the sellers are taking control. If we are seeing the development of the downtrend and from 26th its first wave in a five-wave manner the price is set to go below the last horizontal support level at $109 and would enter the lower range below the support zone.

If this occurs we could view it as a confirmation of the starting downtrend as the price of Litecoin was continuously increasing from 29th of April and made an increase of 112% without a major correctional movement. That this might not be a correction and instead of a starting downtrend we are yet to see from the development of the last move to the downside, but if it were to develop in a five-wave manner with the price going below the last horizontal level the possibility of the starting downtrend would increase significantly.

Conclusion

The cryptocurrency market has experienced a recovery today but the prices of the major cryptos have shown early signs of weakness around their first minor resistance points. We are yet to see if the recovery continues but as the impulsiveness was exhibited by the sellers in the last 24 hours I believe that the prices aren’t headed further up and that we are seeing the start of the downtrend.

Ripple (XRP)

Ripple Price Analysis: XRP/USD Primed For Further Gains

Ripple price surged higher recently above $0.4400 and $0.4600. XRP to USD is currently correcting lower, but the $0.4255 level is likely to act as a strong support and buy zone.

Key Takeaways: XRP/USD

- Ripple price traded to a new monthly high at $0.4625 and recently corrected lower against the US Dollar.

- XRP/USD is testing the $0.4320 support and a major bullish trend line on the 2-hours chart (data feed from Bitstamp).

- Bitcoin price is also correcting lower from well above $9,400 and Ethereum price is currently below $270.00.

Ripple Price Analysis

Earlier this week, bitcoin price extended gains above $9,300 and $9,400. It helped ripple and its price recently started a strong rise above the $0.4200, $0.4320 and $0.4400 resistance levels. XRP even broke the $0.4500 level and traded to a new monthly high.

Looking at the 2-hours chart, ripple price even traded above the $0.4600 level and settled well above the 50 simple moving average (2-hours, purple). A high was formed at $0.4625 and recently, the price started a sharp downside correction.

There was a break below the $0.4520 support and the 50% Fib retracement level of the recent wave from $0.4254 to $0.4625. Moreover, the price broke the $0.4400 support level.

It is currently testing the $0.4320 support and a major bullish trend line on the 2-hours chart. The 76.4% Fib retracement level of the recent wave from $0.4254 to $0.4625 is also acting as a support.

If there is a downside break, the price could test the main support near the $0.4255 level. As long as ripple price is above $0.4255, it is likely to bounce back in the near term.

An initial resistance is near the $0.4400 level, above which ripple is likely to continue higher towards the $0.4480 and $0.4500 levels. If the bulls regain strength, XRP price could even retest the $0.4625 swing high.

Overall, ripple price is trading with a strong bullish bias above $0.4255 and $0.4150. Therefore, there are high chances of a fresh increase above the $0.4400 and $0.4480 resistance levels in the coming sessions.