Cryptocurrency Knowledgebase – Mining

How Does Cryptocurrency Mining Work?

Chapter 4.1

Cryptocurrency mining is the process of securing cryptocurrency networks by solving cryptographic problems.

In layman’s terms, cryptocurrency mining involves using your computer’s processing power to decipher a math problem. By solving these mathematical problems, cryptocurrency “miners” create cryptographic proofs. Miners compete to provide the first cryptographic proof to a specific problem. Then, the first person to provide cryptographic proof will receive a reward.

Confused? That’s okay. To put things in even more basic terms, crypto mining involves dedicating your computer’s resources to solving really hard math problems. The first computer to solve that problem will get a reward in the form of bitcoin.

Mining Increases in Difficulty Over Time

In the early days of cryptocurrency mining, the math problems were relatively easy to solve. They still took an enormous amount of computing power to solve – but anyone with a high-powered gaming PC could compete for block rewards. You didn’t need to have a specialized mining rig.

Today, bitcoin mining is significantly harder. The difficulty of the bitcoin network has increased over time. That means the math problems are harder to solve than ever before. Today, bitcoin mining is virtually impossible for a single user with a gaming PC. Instead, most individual users will join a mining pool with dozens or hundreds of other users, then agree to split the reward.

Difficulty increases in the bitcoin network are deliberate. The difficulty increases approximately every two weeks. That means every two weeks, it gets even harder to mine bitcoin. That may seem silly – but the reason is simple: computing power has steadily increased over time (remember Moore’s Law?). The bitcoin network raises its difficulty to keep pace with the growing processing power.

Mining Hardware Has Changed Over Time

The equipment we use to mine has also changed over the years. In the early days, miners used gaming PCs and high-powered PCs to mine bitcoin and other cryptocurrencies. Today, we have specialized “miners” – like the popular Antminer S9.

These miners are special chips devoted specifically to mining cryptocurrencies. They’re hundreds of times more efficient than an average gaming PC because they’re devoted exclusively to that task.

Today’s mining often takes place in enormous warehouses in countries like China, which has cheap electricity and easy access to mining hardware.

Someone – like a corporation – will purchase dozens, hundreds, or even thousands of bitcoin miners, then dedicate the entire space to cryptocurrency mining. Today, approximately 80% of bitcoin mining capacity comes from China. The Czech Republic (10%), Iceland (2%), Japan (2%), Georgia (2%), and Russia (1%) are the other major sources of bitcoin mining operations.

Is Centralized Mining Good for Bitcoin?

When you look for information about mining pools online, you’ll find the same names popping up frequently, including BTC.com, Antpool, ViaBTC, Slush, and F2pool. All of these, with the exception of Slush, are Chinese-based bitcoin mining pools. They’re the top 5 biggest mining pools in the bitcoin network. They control a huge proportion of bitcoin mining capacity.

The bitcoin community struggles with the idea of centralized mining.

If you read the original bitcoin whitepaper written by Satoshi Nakamoto, you’ll learn that the bitcoin network was designed so one node = one vote. The vision, in the eyes of Satoshi, was to create a network of computers worldwide that contribute to the bitcoin network for rewards, then participate in a democratic voting system.

Today, the bitcoin network still works on a one node = one vote system. However, centralized corporations like Bitmain (which runs Antpool and mines 25% of all bitcoin blocks) control thousands of nodes. This concentrates power in the hands of a few privately-run corporations.

Projects like Ethereum have countered this problem (somewhat) by introducing ASIC-resistant features. It remains to be seen how centralized bitcoin mining capacity will become.

How Does Bitcoin Mining Work?

Approximately every ten minutes, mining computers – or miners – collect a few hundred pending bitcoin transactions together. This collection of transactions is called a block.

Your mining software turns this block into a mathematical puzzle.

The first miner to solve this mathematical puzzle will announce the solution to other miners on the bitcoin network. At this point, the other miners will check the solution and then plug it into the puzzle to verify that the solution is correct. These puzzles are designed to be incredibly difficult to solve – but very easy to verify.

If the majority of blocks on the network grant their approval and verify the solution, then the block of transactions is cryptographically added to the ledger. The miners then move onto the next set of transactions.

The miner who processed the block – the miner who found the solution – will receive 12.5 BTC as a block reward.

What is Hashrate? Why Do We Use Hashrate to Measure Mining Capacity?

Some people describe bitcoin mining like it’s a computer solving a really complicated math problem.

That’s sort of true. Up to this point, we’ve told you that bitcoin miners are solving complex math problems to compete for rewards.

However, there isn’t really a math problem involved in bitcoin mining. There’s no math or computation involved in the process. Instead, miners are trying to be the first to create the correct 64-digit hexadecimal number. This is called a “hash”. Essentially, it’s guesswork.

Basically, the goal of bitcoin mining is to come up with a 64 digit hexadecimal number. That number will look like this:

0000000000000000057fcc608cf0130d95e27c5819203e9e968ac56e4df498ee

When you compare different mining hardware, you’ll probably notice people talking about “hashrate”.

Hashrate is simply a measure of a bitcoin miner’s power. The higher the hashrate is, the more mining power a bitcoin rig has, the better it will be at mining bitcoins.

Hashrate is measured in terms of megahashes per second (MH/s), gigahashes per second (GH/s), and terahashes per second (TH/s).

Each of these numbers refers to the number of hashes your computer can input each second. The more numbers the bitcoin miner is inputting, the more likely you are to earn a block reward. The miner that enters more numbers more quickly than other machines is more likely to earn a block reward.

Why Do We Need Bitcoin Mining? What’s the Point of Bitcoin Mining?

Bitcoin mining secures the network. The bitcoin network – and most other cryptocurrency networks – is secured with cryptography. Cryptography is basically just a really complicated math problem. It takes an enormous amount of computing resources to solve that math problem. A computer needs to try millions of numbers each second before finally arriving at the correct solution. The miner that solves the problem first will receive a bitcoin block reward.

Once a miner discovers the cryptographic hash, and that hash is verified by other nodes, that hash is used to secure the block of transactions being added to the blockchain. The hash is added to the block, and the block is added to the blockchain.

Why do miners do this? Why would someone contribute their PC’s valuable resources and electricity towards mining bitcoin? They do so because of the block reward.

Today, the bitcoin block reward is 12.5 BTC per block. That means the miner that solves the block will receive 12.5 BTC delivered directly to their bitcoin wallet. The block reward has gradually decreased over time. When bitcoin first launched, the block reward was set at 50 BTC. The reward gets cut in half approximately every four years.

By 2020, the number of bitcoins rewarded to miners for each block will drop to 6.25 bitcoins, before dropping to 3.125 bitcoins in 2024.

These bitcoins aren’t sent from one bitcoin user to another.

Instead, these bitcoins are released from the bitcoin network itself. Picture the bitcoin network like an ordinary coal mine. You’ve already extracted, say, 17 tons of coal from the coal mine – but you know there’s still 4 tons of coal remaining inside that mine. You continue mining until all the coal has been extracted.

The bitcoin network works in a similar way. There’s a total supply of 21 million bitcoins. As of 2018, approximately 17 million bitcoins have been mined. That means there are just 4 million bitcoins remaining.

Miners earn more than just the block reward. Bitcoin miners also receive the sum of all transaction fees within the block of transactions. So your reward includes the 12.5 BTC block reward in addition to the small transaction fees of every transaction within your block.

What Happens When All the Bitcoins Are Mined?

What happens when all of the bitcoins are mined?

Well, everyone reading this will be dead by then. The bitcoin blockchain will likely mine the last bitcoin over 120 years from now – all the way in 2140.

Yes, 80% of the world’s bitcoins have already been mined and just 20% of the total supply of bitcoins remain to be mined. However, since the block rewards continue to decrease over time, the emission of blockchains continually decreases. Based on current trends, the last bitcoin will be mined in 2140.

The bitcoin network won’t suddenly crash when the last bitcoin is mined. At this point, the network will still require miners to process transactions. The only difference is that miners will not receive a block reward for mining. Instead, they’ll exclusively receive transaction fees. Transaction fees would likely rise to cover the costs of mining.

Today, miners who successfully mine a block will receive two rewards bundled together, including the block reward (12.5 BTC) and every transaction fee within the block. Once the last bitcoin is mined, miners will only receive the transaction fees.

- We understand bitcoin mining is a bit confusing, so here’s a summary of everything we learned above:

- Bitcoin mining used to be a profitable way for hobbyists – like gamers with high-end graphics card – to make money from their machines

- Today, bitcoin mining is dominated by industry giants like Bitmain that control thousands of specialized “miners”

- Bitcoin “miners” include rigs like the Antminer S9, a high-end computer built specifically to mine cryptocurrencies

- By running these bitcoin miners next to a cheap, renewable source of electricity, you can still generate enormous profits through bitcoin mining

- In the early days of bitcoin, miners received 50 BTC every time they processed a block (which occurred every 10 minutes)

- The block reward drops every 4 years; since the bitcoin network launched in 2013, the block reward has dropped to 25 BTC every 10 minutes and then to 12.5 BTC every 10 minutes

- There’s a total of only 21 million bitcoins that can ever be created

- 80% of the world’s bitcoins (17 million bitcoins) have already been mined

- The last bitcoin will be mined in the year 2140

That’s a basic overview of how bitcoin mining works and why we need it. Next, we’ll look at how someone like you can mine bitcoins.

How to Mine Ethereum?

Chapter 4.3

In the previous chapter, we explained how bitcoin mining works. We explained that bitcoin miners buy ultra-powerful, specialized computers. They run bitcoin mining software on their computers, leave their computers running, then generate a small amount of bitcoin every few days.

In this chapter, we’re explaining everything you need to know about Ethereum mining, including how Ethereum mining works, how it’s different from bitcoin mining, and how you can start mining Ethereum today using any ordinary PC.

How Does Ethereum Mining Work?

Ethereum, like bitcoin, uses the proof of work (PoW) consensus mechanism. At the most basic level, this means Ethereum, like bitcoin, requires significant computer processing power to verify transactions. That means the Ethereum mining process is very similar to bitcoin mining: people run Ethereum mining software on their computers, and that software uses the computer’s processing power to verify transactions while cryptographically securing the Ethereum network.

Ethereum miners, like bitcoin miners, use their computer’s GPUs to mine the blockchain. However, as you’ll learn below, there are several major differences between the two mineable cryptocurrencies.

What’s the Difference Between Ethereum and Bitcoin Mining?

The first and most obvious difference between mining Ethereum and mining bitcoin is the reward. Instead of earning bitcoin as a reward, Ethereum miners earn Ether, or ETH. Ether is the digital token fueling the Ethereum network. It’s also important to note that the total supply of ETH is indefinite. Unlike bitcoin, there’s no cap of 21 million tokens. ETH will be emitted every year as long as miners continue to mine ETH.

Another difference is the fact that you can use dedicated mining hardware to mine bitcoins – but you can’t use dedicated mining hardware to mine Ether. That’s because Ethereum is built with an “ASIC Resistant Framework”. This prevents users from using Application Specific Integrated Circuits (ASICs) to dominate the Ethereum mining space. Ethereum did this on purpose to ensure no miners had an unfair advantage. We’ve seen bitcoin mining power concentrated in the hands of a few people with bitcoin. Ethereum wanted to avoid that problem.

Of course, someone with a higher-end GPU or multi-GPU configuration is inevitably going to mine more ETH than someone using a laptop or low-end rig. As mentioned above, the vast majority of Ethereum mining, like original bitcoin mining, is performed using GPUs.

Another major difference is the fact that Ethereum mining continues to be accessible for hobby miners. If you have a high-end gaming PC, then you should be able to generate a small profit with Ethereum mining. Bitcoin mining via your GPU is virtually impossible today. With Ethereum, it’s still accessible.

What You Need to Mine Ethereum

If you want to start mining Ethereum, then you’ll need the same basic supplies as you would when mining bitcoin, including all of the following:

- Ethereum mining hardware (i.e. a PC with a strong graphics card or GPU)

- Ethereum mining software

- An Ethereum wallet

- An Ethereum mining pool

All of these things can easily be found or purchased.

Ethereum Mining Hardware

Ethereum mining hardware isn’t like bitcoin mining hardware. You don’t need to purchase special ASICs like the Antminer S9. Instead, you can simply buy a high-powered PC with a strong GPU.

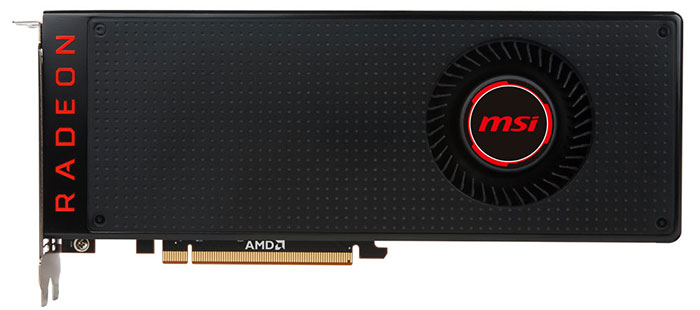

Ideally, your GPU has at least 3GB of RAM. When it comes to GPUs, you have two basic options: Nvidia or AMD. AMD tends to be the preferred choice for Ethereum miners.

Beyond the AMD versus Nvidia debate, you can compare GPUs based on performance (their hashrate), power consumption, and price.

We’ll explain more in our Ethereum mining hardware chapter.

Ethereum Mining Software

Ethereum mining software is the connection between the hardware and the user. The software performs the actual mining process using your hardware. You can also use the software to get valuable statistics on your mining operation – like your GPU temperature.

Just like with bitcoin mining software, there are plenty of Ethereum mining software options available. You can download Ethereum mining software for Windows or Linux.

There’s nothing stopping you from downloading Ethereum mining software on your Mac. However, you’ll find that Ethereum mining is very inefficient even on high-end Macs. That’s why you’ll rarely see anyone mining Ethereum outside of Linux and Microsoft setups.

An Ethereum Wallet

You’ll need to setup an Ethereum wallet to begin mining Ethereum. We explained more details about Ethereum wallets in our previous chapter. However, suffice to say that there are plenty of different Ethereum wallets from which to choose, including MyEtherWallet, Mist, and others.

Your wallet allows you to store your Ether – including any Ether you’ve mined.

Ethereum Mining Pools

Like bitcoin, Ethereum has become virtually impossible for individual miners to mine. That’s why most Ethereum miners join a mining pool.

Like other pools, an Ethereum pool will distribute mining profits based on your contribution to the pool. The more processing power (hashrate) you contribute to the pool, the greater your reward will be.

A quick Google Search for Ethereum mining pools will reveal hundreds of options. Enter your pool details into your Ethereum mining software, then start mining Ethereum.

That’s it! Once you’ve got these four components, you can begin mining Ethereum.

How to Mine Monero?

Chapter 4.4

Monero is one of the world’s largest and best-known altcoins. Today, many people – including hobby miners and big mining farms – mine Monero to generate a consistent profit.

Do you want to mine Monero (XMR)? Whether you’ve got a high-powered PC at home or an entire server farm, we’re going to explain everything you need to know about mining Monero.

How Does Monero Mining Work?

Monero is a popular privacy-focused cryptocurrency. The cryptocurrency is famous for its anonymity. Unlike bitcoin, you can’t track Monero coins during transactions. However, Monero still allows the two trading parties to easily verify details of the trade. Over the years, many dark web services have migrated to using Monero. Of course, Monero can also be used by any privacy-focused individuals for legitimate, legal purposes.

Monero, like bitcoin and Ethereum, is built on a cryptographically-secured PoW blockchain. That means you can mine Monero using your computer’s resources to compete for a block reward and transaction fees.

Monero, like Ethereum, has special ASIC-resistant features built into it. This was done on purpose to ensure someone with a bunch of ASICs couldn’t grab control of the network – similar to what we’ve seen with bitcoin’s network and the concentration of mining power.

The fact that Monero is ASIC-resistant is great news for anyone with a high-powered GPU – or multiple high-powered GPUs. Anyone with a CPU or GPU can mine Monero.

What You Need to Mine Monero?

If you want to mine Monero, then you need the same four basic things you need with any crypto mining operation, including:

- Monero mining hardware

- Monero mining software

- A Monero mining pool

- A Monero wallet address

Once you have these four things, you can begin mining Monero – and hopefully start generating positive ROI.

Monero Mining Hardware

Monero doesn’t require any special hardware. It’s not like bitcoin mining, which pretty much exclusively takes place on ASICs. Instead, anyone with a CPU or GPU can mine Monero.

Just like Ethereum mining, Monero mining works best with AMD cards. However, anyone with one or more high-powered GPUs should be able to successfully mine Monero. Certain software also works best with Nvidia cards – so whether you’re using AMD or Nvidia, you should have no trouble mining Monero.

Monero Mining Software

There are a variety of different Monero mining software programs available today. The most popular software programs include:

- XMR Stak

- Wolf’s Miner

- CC Miner

- Monero Spelunker

XMR Stak and Wolf’s Miner are ideal for those with AMD cards. However, you’ll pay a 2% fee to the developers when using XMR Stak (unless you’re compiling it yourself). Meanwhile, Nvidia card users can use XMR STak (they’ll pay the same 2% fee) or CC Miner.

Finally, those mining via a CPU can use Monero Spelunker, XMR Stak, or Wolf’s Miner.

Most of the software above is available for Windows, Linux, and Mac OS. You download the software for free online, unzip to your desired location, then run the executable file inside to fire up your Monero mining software. Your antivirus software will likely trigger an alert when you download the Monero miner – so make sure you’re downloading the mining software from the correct source.

Join a Mining Pool

Most Monero miners will join a mining pool. You enter the details of the mining pool into your mining software, then receive the pool address. For most people mining Monero with high-powered gaming PCs, joining a mining pool is your best option. You pay a small fee, but you’ll typically come out ahead in the long run because you have a higher chance of earning block rewards.

There are several major Monero mining pools available to be joined today, including:

- MineXMR

- Moneropool

- Nanopool

- Dwarfpool

Check these Monero mining pools and others to find one that meets your needs. These pools have different fees, payout restrictions, and locations. MineXMR, for example, only has servers available in France, Germany, and Canada, while Nanopool has multiple US-based servers.

A Monero Wallet

You’ll need a Monero wallet to store your mining profits. Once you’ve setup a Monero wallet, you enter the public address of that wallet into your mining software or pool.

The most popular Monero wallet is the MyMonero web wallet. The official Monero GUI wallet is also easy to use. You can view the official Monero wallets for Windows, Mac OS, and Linux here: https://getmonero.org/downloads/

Alternatively, more advanced users will want to use the command line interface (CLI) wallet for Monero or a cold storage solution for maximum security.

Once you’ve setup all of these things, you’re officially ready to begin mining Monero!

How to Mine Litecoin?

Chapter 4.5

Litecoin was one of the first major altcoins to challenge the dominance of bitcoin. Unlike Dogecoin, Litecoin was built as a serious competitor to bitcoin when it launched in 2011.

Litecoin was actually built on the original bitcoin code. The developers expanded, improved, and modified that code to create a new cryptocurrency. Some of the key improvements with Litecoin included a faster block time: Litecoin reduced transaction time (block time) from 10 minutes to 2.5 minutes. They also quadrupled the total supply of coins.

Today, hobby miners and large bitcoin mining corporations continue to mine Litecoin using popular ASIC rigs like the Antminer L3+. Let’s take a closer look at everything you need to know about Litecoin mining.

How Does Litecoin Mining Work?

Litecoin is a decentralized, peer-to-peer, blockchain-based, cryptographically-secured currency. Litecoin was designed with the goal of facilitating payments between individuals. Overall, Litecoin is very similar to bitcoin. The name is a reference to the fact that Litecoin is a “lighter weight” and “faster” version of bitcoin.

Just like bitcoin, there’s no central organization that verifies Litecoin transactions. Instead, the Litecoin network is secured by a group of nodes called miners.

Another important difference between Litecoin and bitcoin is the total supply. Just like there’s a fixed supply of 21 million bitcoins, there’s a fixed supply of 84 million Litecoins.

One final major difference is the algorithm. Bitcoin uses the SHA-256 algorithm, while Litecoin uses Scrypt for proof of work (PoW) hashing. Both blockchains are based on PoW algorithms, but the algorithms work in different ways.

Ultimately, Litecoin has been around since 2011, making it one of the oldest altcoins available today. It was originally called blockchain 2.0 due to its improvements over bitcoin’s code. However, many people have begun using blockchain 2.0 to refer to Ethereum – although Litecoin mining continues to be popular.

What Do You Need to Start Mining Litecoins?

If you want to start mining Litecoins, then you’ll need the same basic ingredients as any other bitcoin mining operation, including:

- Litecoin mining hardware

- Litecoin mining software

- A Litecoin mining pool

- A Litecoin wallet

Litecoin Mining Hardware

Litecoin mining hardware has evolved like bitcoin mining hardware. Originally, you could mine Litecoin with either a GPU or CPU. Over time, the power of GPUs made them the preferred choice for Litecoin mining. Today, virtually all Litecoin mining is performed by dedicated ASIC devices.

Bitcoin and Litecoin are built on the same basic code. However, they use different PoW algorithms. You shouldn’t use bitcoin ASICs to mine Litecoin. If you have a bitcoin ASIC, it will likely be more profitable to mine bitcoin, although your mileage may vary.

There’s only one major ASIC available for Litecoin mining, and that’s the Antminer L3+. The L3+ hit the market in 2017. It provides 504 MH/s of hashing power. At launch, the Antminer L3+ was generating returns as high as 0.5 LTC per day for some miners.

Alternatively, if you can’t find an L3+, or if you want a dual-purpose miner, then you may want to buy the Antminer S9, which can be used to mine bitcoins or Litecoins. In general, however, Litecoin mining is performed exclusively with the Antminer L3+.

The L3+ can be used to mine other Scrypt coins as well – so if you’re not making as much profit mining Litecoins, then you can switch to other Scrypt-based cryptocurrencies. Other popular cryptocurrencies based on Scrypt include Verge (XVG), Gulden (NLG), and Dogecoin (DOGE).

Litecoin Mining Software

Litecoin mining software isn’t as widespread as other cryptocurrency mining software. However, you can find several popular programs dedicated specifically to mining Litecoin.

The most popular Litecoin mining software is CGMiner, although GUIMiner is another popular option. Other major names in the Litecoin mining software community include SGMiner, CPUMiner, CudaMiner, BFGMiner, and MultiMiner.

Most Litecoin mining software is available for Windows and Linux. All of the above software is available as a free download online. Certain software is designed specifically for CPU and GPU mining, while other software can do both.

Litecoin Mining Pools

The best way to make a positive ROI with Litecoin mining is to join a Litecoin mining pool. Litecoin mining pools vary in terms of credibility, reward payments, pool fees, and geographic location.

The most popular Litecoin mining pools include LitecoinPool.org, PoolMining.org, GiveMeCoins, OzCoin, LitecoinRain, CoinRelay, and WeMineLTC, among others. Make sure you compare Litecoin mining pools carefully before you sign up. Some pools charge fees of 0%, while others charge fees of 2%.

Litecoin Mining Wallet

You’ll need a Litecoin mining wallet to store your Litecoin mining proceeds. There are a number of popular Litecoin wallets available for users, including desktop software, mobile apps, and cold storage solutions.

You can store your Litecoin in a hardware wallet like the Trezor or Ledger Nano S.

Alternatively, software wallets like Jaxx, Exodus, and LitecoinWallet have always been popular.

Once you have your Litecoin wallet, just input that wallet address into your LTC mining pool or LTC mining software. Then, you’ll receive your block rewards directly into your Litecoin wallet.

That’s it! Once you have Litecoin mining hardware, software, a pool, and a wallet address, you can begin mining Litecoin. Litecoin mining remains profitable and popular for those with the Antminer L3+ and other miners.

How to Mine Siacoin?

Chapter 4.6

SiaCoin is the cryptocurrency that powers Sia, a decentralized cloud storage-style system. Today, SiaCoin is a popular cryptocurrency to mine. Its difficulty is low compared to larger cryptocurrencies. Sia is also one of the most promising cryptocurrency projects in the space – which means many investors expect the value of SiaCoin to continue rising.

No matter why you want to mine SiaCoin, we’re here to explain everything you need to know about the popular storage system and its cryptocurrency.

How Does SiaCoin Mining Work?

SiaCoin exists because of Sia, a blockchain-based, decentralized storage network. Sia works in a similar way to cloud storage service providers. However, instead of storing data in centralized servers, Sia chops up the data and spreads it across its decentralized, blockchain-based network.

People who store data on the SiaCoin network receive SiaCoins as a reward. Meanwhile, anyone can pay money – in SiaCoins – to store data on the network.

Why would you use SiaCoin instead of a traditional cloud storage service provider? The two main advantages are uptime and price.

Sia is cheaper than virtually any other storage option available today. You can get 1TB of storage space for approximately $2 per month. Similar storage space from Microsoft, Google, Amazon, and other major cloud storage providers is priced at $10 to $25 per month.

Sia also offers better security and uptime. Since your data is stored across a decentralized network, your data is always accessible. Centralized cloud storage services can periodically go offline, causing chaos across the network. The only way your data on Sia becomes inaccessible, meanwhile, is if there’s a global or regionwide internet outage.

Privacy, price, uptime, and security are all good reasons to use Sia as your storage provider. However, why does SiaCoin need to be mined? How does mining work on Sia?

Sia’s network is based on the Sia blockchain. Anyone who rents storage space in Sia will pay with SiaCoins. You can get SiaCoins from the open market – buying them at market prices from cryptocurrency exchanges – or mine SiaCoins from the Sia blockchain.

Sia launched its own currency to ensure the network isn’t dependent on any other digital currency or blockchain. The developers have avoided bitcoin and Ethereum due to fears of network congestion. By launching their own SiaCoin currency, they maintain full control over their network.

SiaCoin is primarily mined with GPUs. Anyone with a high-end graphics card can mine SiaCoin.

You don’t need to be interested in the Sia platform to mine SiaCoins. Many miners simply mine SiaCoin because it’s a simple way to diversify your crypto investments. They have no interest in using the Sia platform, and they can sell the coins on cryptocurrency markets at any time. Of course, other miners mine SiaCoins specifically because they want to use the Sia platform. It’s up to you to decide how you want to spend your mined SiaCoins.

What You Need to Mine SiaCoins

Mining SiaCoins requires the same four basic components as other cryptocurrencies, including:

- SiaCoin mining hardware

- SiaCoin mining software

- A SiaCoin wallet

- A SiaCoin mining pool

SiaCoin Mining Hardware

SiaCoin mining hardware typically consists of high-end graphics card. However, in late 2017, an ASIC device was developed for SiaCoins, so future SiaCoin mining may be dominated by ASIC. The SiaCoin ASIC chip can mine the equivalent power of 100 GPUs – so the difference is significant.

That ASIC was created by Obelisk. It’s called the SC1. The Obelisk SC1 mines at a hashrate of 300 GH/s and runs on the Blake2b algorithm while consuming a maximum of 500W of electricity. One of the unique advantages of the SC1 ASIC miner is that you don’t need external cooling. Instead, the ASIC operates perfectly fine at room temperatures.

If you’re serious about mining SiaCoins, and you believe the currency and platform has a future, then the SC1 may be a worthwhile investment. It’s priced at around $2500.

Nevertheless, you can still mine SiaCoin using ordinary GPUs. The Nvidia GTX 1080 series is particularly popular for SiaCoin mining.

SiaCoin Mining Software

SiaCoin mining software comes in two broad forms. If you’re using an Nvidia GPU, then you’ll need to install CUDA. If you’re using an AMD GPU, then you need to install OpenCL. Both of these are full-featured SiaCoin mining software programs that will run on your GPUs.

Marlin is another popular option for SiaCoin mining software.

SiaCoin Mining Pool

Joining a SiaCoin mining pool is typically the best way to maximize mining profits. As with other pools, SiaCoin mining pools consist of a group of users who collectively contribute processing power to increase the chances of earning block rewards.

There are a number of popular SiaCoin mining pools. However, the two most popular mining pools tend to be Nanopool and Siamining.

Make sure you understand the terms of each mining pool before you join. SiaCoin mining pools have different terms, conditions, withdrawal limits, and other requirements.

SiaCoin Wallet

Once you have all three of the items listed above, it’s time to get your SiaCoin wallet.

There aren’t as many wallet options as you have with Ethereum, bitcoin and other major cryptocurrencies.

Typically, SiaCoin users hold their coins in an exchange or in the Sia-UI wallet. Exchanges like Bittrex let you receive SiaCoins at your address, which means you can input your public address into the mining software or pool to get your block rewards delivered to your wallet.

Alternatively, you can download the Sia-UI Wallet, which was created by the main Sia developers. It’s the only Windows wallet available for Sia.

Now that you have your SiaCoin mining software, hardware , a wallet, and a pool, you can begin mining SiaCoin! Whether you’re using GPUs or the SiaCoin ASIC (SC1), you may be able to earn consistent profits by mining SiaCoin. At the very least, it’s an easy way to diversify your investment and mining activities across multiple cryptocurrencies.

How to Mine ZCash?

Chapter 4.7

Zcash is one of the world’s most popular cryptocurrencies to mine. Listed under the acronym ZEC, Zcash was originally based on the same code as bitcoin, but with added anonymity features. Today, Zcash has a similar reputation to Monero: it’s a privacy-centric cryptocurrency where you can make secure transactions without disclosing the balance of your wallet.

Zcash was introduced in 2016. Today, Zcash continues to be one of the more popular cryptocurrencies to mine. Keep reading to discover everything you need to know about mining Zcash.

How Does Zcash Mining Work?

Zcash is similar to bitcoin, but uses zk-snarks to ensure that no information regarding user transaction can be leaked. All user transaction information is securely encrypted. The two users completing a transaction can decrypt transaction details, but these details are private to everyone else involved.

Thanks to zk-snarks, Zcash allows for secure cryptocurrency transfers with no risk of double spending. Zk-snarks relies on zero knowledge proofs and the Equihash hashing algorithm, a PoW algorithm.

The entire Zcash protocol is very innovative. The project was funded by major venture capital firms worldwide. The Zcash protocol relies heavily on the research of the Zerocoin Electronic Coin Company, which developed the Zerocoin cryptographic protocol in 2014. That protocol was designed to create a privacy-centric but secure cryptocurrency. Top cryptographers from MIT, Tel Aviv University, and the Israel Institute of Technology all contributed to the project.

Zcash’s unique protocol relies on a unique transfer mechanism. When you transfer funds using Zcash, your coins are first converted into the project’s original currency, Zerocoins. Then, the Zerocoins are transferred to the recipient, then transferred back into Zcash. This might seem like a convoluted process, but it creates secure and anonymous transactions between Zcash users without significant added cost.

How does Zcash mining differ from other cryptocurrency mining? Well, Zcash mining is much more RAM-dependent than other types of PoW mining. Another difference is that there’s no GUI miner available for Zcash, which means mining Zcash can be less user-friendly than mining other cryptocurrencies that have existing software.

Fortunately, anyone can follow a guide online to start mining Zcash – so even if you have limited cryptocurrency mining experience, you can mine Zcash with an ordinary GPU and CPU. In fact, Zcash is one of the easiest currencies to mine. If you have basic computer skills and can follow an online tutorial, you can start mining Zcash in about 20 or 30 minutes.

Zcash is particularly popular among hobby miners – including anyone who has a high-end PC or gaming PC that wants to mine cryptocurrencies. That’s because Zcash is an ASIC-resistant cryptocurrency. There are no ASICs available for Zcash, which means ordinary GPU mining is the most profitable way to mine Zcash.

With that in mind, let’s take a look at what you need to start mining Zcash.

What You Need for Zcash Mining

Mining Zcash is straightforward. You’ll need the four basic components:

- Zcash mining hardware (your PC)

- Zcash mining software

- A Zcash wallet

- A Zcash mining pool

Zcash Mining Hardware

Zcash mining is performed with CPUs or GPUs. There are no ASICs available for Zcash, and the Zcash blockchain is purposely ASIC-resistant.

Unlike Ethereum and other cryptocurrencies where AMD GPUs dominate, Zcash is best mined using Nvidia GPUs. The reason is that Ethereum is based on the Ethash algorithm while Zcash is powered by Equihash. Nvidia tends to be the superior card for mining all Equihash cryptocurrencies.

Another major difference is that you don’t need a massive 3GB video card to mine Zcash. Instead, you can mine Zcash with as little as 1GB of memory on your GPU. Obviously, the more powerful your card is, the more successful you’ll be while mining Zcash.

Some of the specific popular GPUs for mining Zcash include the Nvidia GTX 1060, 1070, and 1080 series (including the 6GB Nvidia GTX 1060 card), as well as the AMD RX 470, 480, 570, 580, R9 series, HD 7990, and HD 7950.

Zcash Mining Software

One of the more popular Zcash mining software programs is the EWBF Cuda miner, available as a free download from the Bitcointalk forums here.

However, many Zcash users continue to use Zcash 1.0, created by the official Zcash team. That software lets you run a full Zcash node and mine with your CPU. The software also includes a built-in wallet that lets you send and receive Zcash.

The biggest limitation of the Zcash 1.0 software (and it’s an important limitation) is that you can only use your CPU to mine. If you’ve created a GPU-based miner, then download the Zcash 1.0 software is pointless. Nevertheless, CPU miners can install the software from the Zcash Github page here.

Other miners available for Zcash include Optiminer, Claymore, and the Genesis SGminer, all of which are built for AMD GPU mining, as well as EWBF Cuda, Nicehash EQM, and NEHQ, all of which are built for Nvidia GPU mining.

Zcash Mining Pool

A Zcash mining pool gives you the best possible chance of winning a Zcash block reward. The more resources you contribute to the mining pool, the larger your reward will be. Don’t expect to see as many Zcash mining pools as you see bitcoin and Ethereum mining pools. However, you can still find various options available.

Popular Zcash mining pools include Flypool and Nanopool, which are the two biggest names in the space.

Bitcoin Mining Hardware

Chapter 4.8

Bitcoin mining can be extremely profitable – or extremely expensive. Today, many inexperienced people dive into bitcoin mining with little knowledge. These people can end up losing a significant amount of money – especially if they purchased dozens or hundreds of ASICs at $2,500 apiece.

The most important aspect of bitcoin mining is the hardware. Your hardware determines whether or not you’re going to generate a profit.

In the early days of bitcoin mining, bitcoin was mined using CPUs or GPUs – two basic hardware components that are inside any PC. Your CPU or GPU used its processing power to compete for a block reward, and you received a reward whenever you successfully mined a block.

Today, things are vastly different than they were during the early days of bitcoin in 2009. Bitcoin’s difficulty increases every two weeks. This is done on purpose to ensure the network is secure. Otherwise, computer processing power would continue to grow while the difficulty remained stable.

As bitcoin’s difficulty grew, miners started to migrate to specialized mining rigs called Field Programmable Gate Arrays, or FPGAs. Initially FPGAs seemed destined to be the future of bitcoin mining. They delivered similar hashrates to GPU-powered rigs, but at a significantly lower electricity cost.

Eventually, FPGAs fell out of fashion when the industry created Application Specific Integrated Circuit (ASIC) devices. ASICs are chips designed specifically to mine bitcoins. They can’t be used for any other purpose.

Today, ASICs blow GPU-based bitcoin miners out of the water. ASICs provide up to 100 times the hashing power of a GPU. That’s why the vast majority of bitcoin mining today is done using ASICs.

There’s nothing stopping you from buying one or more ASICs to use as your own bitcoin mining hardware. They’re freely available for purchase online from companies like Bitmain. However, even with one or more ASICs, you’re still going to have to join a mining pool if you want to compete for block rewards. Otherwise, you’re unlikely going to make much money mining bitcoin.

Here’s what we’ve learned: bitcoin mining has changed significantly over the years. Today, anyone who is serious about bitcoin mining will purchase an ASIC. Next, we’ll talk about the specific ASIC options available today.

Bitcoin Mining Hardware Companies

There are three major bitcoin mining hardware companies available today, including:

Bitmain: Bitmain makes the popular Antminer line of bitcoin miners. The China-based bitcoin hardware manufacturer also runs one of the world’s largest bitcoin mining pools.

Halong Mining: Halong Mining is a new and popular bitcoin mining hardware company. The company quickly sold out of its first batch of miners on release. Halong is best-known for its Dragonmint T16 ASIC, advertised as the world’s most powerful and efficient bitcoin mining ASIC.

BitFury: BitFury, along with Bitmain, is one of the best-known names in the mining space. They produce bitcoin mining hardware and chips, but their hardware is not available for purchase.

Bitcoin Mining Equipment: What Do You Need to Mine Bitcoin?

You need three basic hardware components in order to start mining bitcoin, including:

- A Bitcoin Mining ASIC

- A Power Supply

- Cooling Fans

ASICs can use 1300W of electricity and more, which typically means you need a high-end power supply. The ordinary 500W or 1000W power supply on your gaming PC isn’t likely to get the job done. Meanwhile, all of that processing power is going to generate a lot of heat, which is why you need cooling fans or some other type of cooling equipment.

The Best Bitcoin Mining Hardware

Here’s our list of the most popular bitcoin mining hardware – including ASICs:

Antminer S9 Bitcoin Miner

This is the most popular and best-known ASIC bitcoin miner available today. The S9, at one point, was delivering a positive ROI within just 90 to 120 days of purchase. In fact, some miners were earning about 1 BTC every two months with their S9. Some key stats behind the S9 include:

- Release Date: June 2016

- Power Consumption: 1375W

- Power Efficiency: 0.098 J/GH

- Hashrate: 12.93 TH/s

- Price: $2,000

Dragonmint T16

The cryptocurrency mining community was shocked in late 2017 / early 2018 when new startup Halong Mining claimed to have created the world’s most efficient bitcoin mining ASIC. Halong Mining backed up that claim with proof and a successful launch. Today, the Dragonmint T16 is the most powerful ASIC miner for bitcoin, producing an incredible 16 TH/s of hashing power.

The T16 is also remarkably power-efficient, consuming just 0.075 J/GH, significantly lower than the Antminer S9.

Another advantage of the Dragonmint T16 miner is that it uses ASICBOOST, a bitcoin algorithm exploit that can boost efficiency by as much as 20%.

Ultimately, the Antminer S9 has been the most popular ASIC for a long period of time. However, the Dragonmint T16 is quickly making a name for itself with incredible performance results.

- Release Date: March 2018

- Power Consumption: 1480W

- Power Efficiency: 0.075 J/GH

- Hashrate: 16.0 TH/s

- Price: $2,700

Other Bitcoin Mining ASICs

The two ASIC miners listed above are the cream of the crop. If you want to mine bitcoin at maximum efficiency with a legitimate bitcoin mining operation, then you’ll need to purchase either the Dragonmint 16T or the Antminer S9.

However, there are other options available. These options are cheaper and come with lower hashrates and worse efficiency. Nevertheless, some miners use these to complement their existing mining operations or to try bitcoin mining for the first time. Other popular bitcoin miners include:

- Antminer S7 (4.7 TH/s for around $500)

- Avalon 6 (3.5 TH/s for around $600)

- Antminer R4 (8.6 TH/s for around $1,000)

What to Consider Before Buying Bitcoin Mining Hardware

If you’re shopping for bitcoin mining hardware, then it’s crucial you consider a number of different things before you buy. Here are some of the important things to consider when comparing different ASICs:

Hardware Costs:

If you spend $20,000 on an ASIC, then you’re going to have to mine significantly more bitcoin to ever make a profit than if you spent $2,000. The cost of hardware obviously plays an important role in profitability. Hardware costs are so important that serious mining companies will buy hundreds or thousands of ASICs in bulk to lower the cost-per-unit.

Hashrate and Efficiency:

The primary way to measure the power of bitcoin mining hardware is by looking at the hashrate and efficiency. The top miners have hashrates of 13 to 16 TH/s. No other ASICs come close to the Antminer S9 and the Dragonmint 16T. However, efficiency is nearly as important. How much power does the ASIC use to achieve its hashrate? The less power spent, the better. The top ASICs have power efficiency rates of 0.075 J/GH (on the Dragonmint 16T) and 0.098 J/GH (on the Antminer S9).

Electricity Costs:

A Dragonmint 16T will generate approximately $10 per month in profit if you’re paying 12 cents per kWh for electricity. This number rises as high as $100 per month, however, in areas where you’re paying 3 or 5 cents per kWh for electricity. The cost of electricity should play a big role in your bitcoin mining hardware purchase decision.

Cost of Other Equipment:

You’ve spent $2,000 to $3,000 on an ASIC bitcoin miner. However, the costs don’t stop there. There’s other equipment you need to purchase, including some type of cooling system.

The Risk of Bitcoin Price Volatility:

You need to consider the risk of bitcoin price volatility before you buy an ASIC miner. Bitcoin’s price is very volatile. Periodically, the price will plummet and thousands of ASIC miners will go on sale. Mining companies that invested millions of dollars in ASICs will try to offload supply to generate cashflow. Are you prepared to deal with bitcoin price volatility? Make sure you consider the price of bitcoin before you buy.

Block Rewards:

Originally, bitcoin block rewards were set at 50 BTC per block. At $10,000 per BTC, that means one miner was making $500,000 in revenue every 10 minutes. Over time, the block reward gets cut in half. It dropped to 25 BTC, for example, before settling at today’s 12.5 BTC. The block reward will be cut in half again to 6.25 BTC per block in 2020. Miners need to prepare for this.

By considering all of the factors above, you can make an informed decision on your next bitcoin mining hardware purchase.

Bitcoin Mining Software

Chapter 4.9

Bitcoin mining software is a crucial element of mining bitcoins. You can have the greatest bitcoin mining hardware in the world – but it’s going to be restricted if you’re using bad mining software.

The hardware – like your GPU, CPU, or ASIC – does the actual mining. The bitcoin software, however, connects your hardware to the blockchain and to the mining pool. Without the software, your hardware has no way to connect to the blockchain.

When people talk about bitcoin software, they can refer to one of several different things:

- Bitcoin wallets

- Bitcoin nodes

- Bitcoin mining software

In this chapter, we’re specifically dealing with the final component – bitcoin mining software. However, some of our bitcoin mining software functions as a wallet and full node as well.

Obviously, you know the importance of bitcoin mining software. Now, let’s take a closer look at how bitcoin mining software works – and which software is the best choice for you.

How Does Bitcoin Mining Software Work?

Bitcoin mining software acts as a link between your mining rig, the blockchain, and your pool.

Your hardware provides the processing power, but the software organizes that processing power in a meaningful way. The software is the brains of the operation, so to speak, and the hardware is the muscle.

Some bitcoin mining software is as simple as a command line interface, or CLI. CLI mining software was common in the early days of bitcoin mining – although it’s still used by plenty of miners today. In fact, two of the most popular bitcoin mining software programs available today, BFGminer and CGminer, use basic command line interfaces.

We also have graphical user interface (GUI) miners, which build a complete interface or dashboard on top of a command line miner. These miners are more user-friendly. They’re the preferred choice for most beginner or intermediate miners.

Depending on which type of mining software you have, it might display statistics about your mining operation. Some software displays the temperature of your video card, for example, your current hashrate, your fan speed, and other crucial information about your bitcoin mining hardware.

You can use the software to tweak these things. Some software tweaks these settings automatically, while other software requires manual input.

Typically, bitcoin mining software on this list runs on Linux, Microsoft Windows, and Mac OS. However, some bitcoin mining software is unavailable for Mac OS (virtually all software is available for Linux and Windows).

Certain software is also available for less popular operating systems. Some developers have ported bitcoin mining software to Raspberry Pi, for example. You can also find bitcoin mining software on mobile operating systems like iOS and Android.

A Word of Caution: Make Sure the Software Supports ASIC Mining

Certain older bitcoin software doesn’t support ASIC mining. If you’re serious about bitcoin mining, then you need to only use software that supports an ASIC miner. In 2018 and beyond, it’s virtually impossible to make money mining bitcoin without an ASIC miner.

Make sure the software you choose supports ASIC mining. Some software – particularly older programs and mining software that hasn’t been updated in a while – will only support CPU, GPU, or FPGA mining.

With that in mind, let’s take a look at some of the top bitcoin mining software available today.

The Best Bitcoin Mining Software

CGminer

CGminer is a popular bitcoin mining software that supports GPU, FPGA, and ASIC mining. It’s an open source mining software written in C.

You can download CGminer for all major desktop platforms, including Windows, Mac OS X, and Linux.

One of the reasons why CGminer is so popular is because it’s based on the original CPU Miner, one of the best miners from the early days of bitcoin. CGminer has been expanded to support modern bitcoin mining machines like ASIC devices.

Key features of CGminer include overclocking, monitoring, fan speed control, and remote interface capabilities. You’ll also access features like self-detection of new blocks with a mini database, binary loading of kernels, multi-GPU support, and CPU mining support (although you’ll most likely want to stick to ASIC mining, as mentioned above).

Don’t expect a flashy interface on CGminer. This is a CLI-style bitcoin mining software. The UI is straightforward, but all commands are entered through a command line interface.

You can download CGminer from the development team’s official Github page here.

BFGminer

BFGminer is an offshoot of CGminer, the software we just mentioned above. The main difference with BFGminer is that it’s specifically designed for FPGA and ASIC mining – the software doesn’t bother optimizing for GPU or CPU mining.

BFGminer dates back to the early days of bitcoin. The software has always been popular for features like vector support, integrated overclocking and fan control, ADL device reordering by PCI bus ID, and more. Although BFGminer doesn’t specialize in CPU or GPU mining, the software does support CPU mining and GPU mining via OpenCL.

One thing to note with BFGminer is that you may need to download certain “bitstreams” to make sure BFGMiner 3.0 and higher works with your device.

BFGminer and its official bitstreams can be downloaded from the official website here. As of May 2018, the software is on version 5.5.0.

Like CGminer, you won’t get a flashy interface with BFGminer. It’s a blue and white command line interface.

BTCMiner

BTCMiner is open source bitcoin mining software available for Windows and Linux. The software is designed to work with FPGA boards, including Spartan 6 USB-FPGA modules (Modules 1.15b, 1.15d, 1.15x, and 1.15y).

The software has a simple goal: to communicate and program via a USB interface while allowing users to build low-cost FPGA clusters using standard USB hubs.

If you decide to mine via USB, then BTCMiner may be the right choice for you. However, for most users interested in using ASIC devices, this software is outdated.

You can download BTCMiner today here. Be careful when searching for BTCMiner online. A number of scammy cloud bitcoin mining companies have tried to adopt the name and convince users they’re the real software.

EasyMiner

EasyMiner is a GUI-based bitcoin mining software that acts as a wrapper for CGminer and BFGminer. If you found the command line interfaces of CGminer and BFGminer too complicated, then EasyMiner might be the right choice for you.

EasyMiner can be used for both solo and pooled mining. One of the helpful features with this software is the performance graph that lets you easily visualize your mining activity.

EasyMiner is available for Linux, Windows, and Mac OS X.

Bitminter

Bitminter is a bitcoin mining software program available for Linux, Windows, and Mac OS X. This cross-platform software, unlike the two miners at the top of our list, comes with a user-friendly GUI.

The main drawback with Bitminer is that it only works with the Bitminter bitcoin mining pool. So if you’re trying to mine any pool aside from Bitminter, then you should skip this one.

However, if you are mining with the Bitminter pool, then you’ll find that this software offers a user-friendly and convenient experience. The software has a helpful stats section that lists information like the number of proofs of work that were accepted or rejected by the serer. You can also view the amount of time spent mining.

Bitminter is available online today at https://bitminter.com/

MultiMiner

MultiMiner is simply a wrapper for BFGminer – similar to EasyMiner. If you don’t like working within the command line interface of BFGminer, then you may want to use MultiMiner.

MultiMiner has an easy setup process. The software displays helpful tooltips that walk you through the process. If you’re a beginner or intermediate bitcoin miner, then this information can be very helpful.

Once setup is complete, MultiMiner will automatically scan for mining devices, then list their details in a helpful table – including the pool used and the average hashpower. You can also see your daily projected profit based on your current mining activity.

Another unique thing about MultiMiner is that the software comes with an optional 1% donation option. You can choose to donate 1% of your mining profits to the developer as a “thank you” for creating the software. This fee is voluntary, and you can enable or disable it at any time within the “Perks” section. Plenty of other developers do not make this fee optional, so it’s refreshing to see a developer take a different approach.

MultiMiner is available for Windows, Mac OS, and Linux.

Your Antivirus May Flag Bitcoin Mining Software

Bitcoin mining software can often trigger your antivirus software. Your antivirus software sees you downloading a suspicious .exe file from a shady website and assumes it’s going to harm your computer.

If your antivirus software flags your bitcoin mining software download, then don’t be alarmed. Double check to make sure you downloaded the bitcoin mining software from a legitimate developer and the legitimate developer’s official website. Then, ignore your antivirus software and proceed with the installation.

Ultimately, there are dozens of major bitcoin mining software programs available today. The software listed above tends to be the most popular software available, although your mileage may vary.

What to Look for When Comparing Bitcoin Mining Software

Not such which bitcoin mining software to download? Here are some of the most important features to look for when comparing software:

Operating System Compatibility:

First, make sure the software is compatible with your current operating system. Most software is compatible with Windows, Linux, and Mac OS, but this isn’t always the case.

Hardware Compatibility:

Some bitcoin mining software – particularly older software – can’t handle modern ASIC mining. That’s a huge problem because ASIC mining is the only real profitable option today. Check to make sure your software is compatible with your hardware before you download it. If the software only supports, GPU, CPU, or FPGA mining, then it probably won’t support your brand new $2500 ASIC chip.

Coin Support:

Some software allows you mine a diverse set of cryptocurrencies from within a single interface. If you just want to mine bitcoin, then you can ignore this feature. If you want to diversify your crypto holdings, however, then you may want to choose software capable of mining multiple coins.

Mobile and Web Support:

Some bitcoin mining software comes with an optional web app or mobile app. You can check the status of your miner at any time by checking the app or web dashboard.

GUI or CLI:

Graphical user interface (GUI) software and command line interface (CLI) perform the same basic job but in different ways. GUI provides you with a user-friendly interface to interact with the software and its primary commands, while CLI software requires you to enter all commands via a command line. Neither software requires programming knowledge or advanced tech skills to use, but beginner and intermediate users typically prefer GUI bitcoin mining software.

Additional Features:

Some bitcoin mining software comes with an additional wallet. In most cases, the bitcoin mining software we listed above just mines bitcoins for you – but more advanced software might come with more advanced functions.

Ultimately, bitcoin mining doesn’t work without good bitcoin mining software. Download some of the bitcoin mining software listed above today to start your journey into bitcoin mining.

Ethereum Mining Hardware

Chapter 4.10

Ethereum is the world’s second best-known cryptocurrency behind only bitcoin. Built as more of a development environment than a currency, Ethereum is a popular digital asset among miners.

Ethereum has several unique features that make it an attractive option for miners. First, Ethereum is ASIC-resistant, which means hobbyists like you can mine cryptocurrencies at home without needing to buy expensive ASICs.

The lack of ASIC support means that Ethereum mining hardware doesn’t have to consist of highly-specialized chips that can only be using for mining; instead, Ethereum mining hardware consists of ordinary GPUs.

These GPUs can be used to mine Ethereum one day, then switch to high-end PC gaming or video editing the next day. ASICs, on the other hand, are only useful for mining cryptocurrencies.

With that in mind, let’s take a closer look at Ethereum mining hardware.

The Importance of Buying the Right GPU

Your Ethereum mining efficiency depends largely on your GPU. The GPU is your graphics processing unit or video card. Before cryptocurrencies, high-end GPUs were used for high-end gaming or video editing. Today, high-end GPUs are in huge demand because of the cryptocurrency mining boom.

Some gamers – or anyone else in need of a pricey GPU – will offset the costs of their GPU by mining cryptocurrencies. You might not be able to justify spending $1500 on three video cards for gaming, for example. However, if you can recapture that $1500 investment with 6 months of Ethereum mining, then the cost is justified.

When Ethereum first launched, most mining took place via CPU. Then, as mining became more difficult, miners increasingly began using GPUs. GPUs provided significantly more power – but with steeper power consumption and higher electricity costs.

Today, most Ethereum mining continues to take place using GPUs. As mentioned above, Ethereum is an ASIC-resistant network. There are no Ethereum ASIC devices. Today’s high-end GPUs are approximately 200 times more effective at mining Ethereum compared to high-end CPUs.

How to Choose the Best GPU for Mining Ethereum

Today, the best GPUs for mining Ethereum have between 6GB and 8GB of video RAM (VRAM). Most professional miners, however, would never be caught mining Ethereum with a single GPU. Instead, they build rigs with multiple GPUs running together.

You can find Ethereum mining rigs equipped with as many as 6 or 8 GPUs inside. This provides maximum power and efficiency for Ethereum mining – although the startup costs are obviously higher.

There are three important things you need to consider when shopping for GPUs, including hashing power, power consumption, and price. By carefully balancing all three of these things, you can purchase the best GPU for mining Ethereum:

Hashing Power (Hashrate):

Different GPUs mine Ethereum at different hashrates. Sometimes, the most expensive GPU isn’t the best option for mining Ethereum. Check the hashrate of a GPU before you buy. The higher the hashrate, the better mining power the GPU has.

Power Consumption:

If your GPUs consume too much power, then any profits you make from Ethereum mining might be negated by your electricity bill. When comparing GPUs online, you might find a stat that says something like “power consumption cost per day.” This is the cost of mining Ethereum over a 24 hour period based on a specific cost per kWh.

Price:

Most people don’t mine Ethereum for fun. Most people mine Ethereum to generate a profit. If you spend a lot of money on Ethereum mining GPUs, then you might never make your money back.

Another thing to consider is whether you want an AMD or Nvidia card. In most cases, AMD cards are the superior option for mining Ethereum. However, if you find a good deal on Nvidia cards, or use specific mining software, then you might be able to get better performance from an Nvidia card.

Got it? Good! Now, lets take a look at some of the best GPUs for Ethereum mining in 2018 and 2019.

The Best GPUs for Mining Ethereum

AMD Radeon RX Vega 64

Typically, AMD cards are better for mining Ethereum. The Radeon RX Vega 64 might be the most popular Ethereum mining GPU on the market. At stock settings, the GPU can mine Ethereum at around 33 MH/s while consuming 200 watts of electricity. However, with tweaking and cooling, you can increase hashrate to as much as 41 MH/s while dropping electricity consumption down to 135 watts.

AMD Radeon RX Vega 56

The AMD Radeon RX Vega 56 is slightly less efficient than the Vega 64, but it’s still a great option for many Ethereum miners. You can expect to get hashrates of approximately 31 MH/s using 190 watts of electricity.

Nvidia GeForce GTX 1080 Ti

Up until the release of the 1060, 1070, and 1080, AMD dominated the Ethereum mining space. Nvidia, however, managed to capture a slice of the market with its phenomenal performance on the GTX 1080 Ti. The GTX 1080 Ti keeps up with leading AMD cards by providing 32 MH/s of hashrate while consuming 200 watts of electricity. That puts it just behind the Vega 56 and Vega 64 in terms of Ethereum mining efficiency, but significantly ahead of the next options on our list.

AMD Radeon Rx 580

The AMD Radeon Rx 580 is a significant step down from the top three cards on our list. It uses slightly less electricity (175 watts), although it also produces a hashrate of just 25 MH/s.

AMD Radeon Rx 480

The Rx 480 delivers a hashrate of 24 MH/s while consuming 170 watts of electricity. Like the Rx 580, it’s a decent mid-range option, but you’re a step below the top miners listed above.

Nvidia GeForce GTX 1070

The GeForce GTX 1070 is the second Nvidia option on our list. The 1070 uses too much electricity and delivers too little hashrate to place it at the top of our list. However, the performance difference isn’t as significant as you might think. The 1070 consumes 200 watts of electricity while delivering 27 MH/s of hashing power.

Other Popular Ethereum Mining GPUs

New GPUs are being released every year. Both AMD and Nvidia have seen a surge in sales and demand due to cryptocurrency mining. They’re now designing cards with cryptocurrency mining in mind. While the Vega 64 and Vega 56 remain at the top of the list of best Ethereum mining GPUs for now, this list could be totally different before long.

- Nvidia GeForce GTX 1060

- Radeon Rx 570

- Radeon Rx 470

- Radeon R9 290x

Ultimately, Ethereum mining hardware is an understandably important part of mining Ethereum. Using the GPUs listed above, you may be able to mine Ethereum to earn big profits – or at least enough to offset the cost of your next gaming PC.

Bitcoin Cloud Mining

Chapter 4.11

Over the last 10 chapters, we’ve explained how to buy your own cryptocurrency mining hardware and begin mining different cryptocurrencies. We’ve explained how to choose the best mining hardware, how to download the right software, and how to make sure your mining operation is profitable.

But what if you don’t want to do any of that? What if you’d prefer paying someone else to mine bitcoin for you?

That’s sort of how bitcoin cloud mining works.

Bitcoin cloud mining takes place over the internet. Essentially, someone has a server full of bitcoin miners, then rents these miners out over the cloud. You might be able to purchase different cloud mining packages. Each package could guarantee a specific hashrate for a 2 or 3 year period. You pay a lump sum upfront along with ongoing maintenance fees. Then, you sit back and wait for the profits to roll in.

Of course, bitcoin cloud mining isn’t quite that easy. Profit is never guaranteed. Cloud mining companies can cancel your contract. Some cloud mining companies don’t even operate real bitcoin mining farms: they’re just online scams designed to steal investors’ money and disappear.

Today, the bitcoin cloud mining industry is filled with plenty of scams. However, there are several major companies that run legitimate bitcoin cloud mining operations – including Genesis Mining, Hashnest, and Hashflare. Keep reading to discover which bitcoin cloud mining service might be right for you.

How Does Bitcoin Cloud Mining Work?

Today, a number of companies offer bitcoin cloud mining, Ethereum cloud mining, Litecoin cloud mining, and other cloud mining services.

Typically, these cloud mining services work in a similar way:

- You pay “rent” on your bitcoin mining hardware

- That rent covers the costs of the hardware and the electricity

- Someone else is responsible for maintaining and running that equipment at their own location; some bitcoin cloud mining companies charge an ongoing maintenance fee to cover these expenses, while others bundle the fee with their rent

- As long as you continue paying your fixed rent, you’ll be able to access any profits collected by that bitcoin mining hardware during the period of your cloud mining contract

- Some companies offer month-to-month contracts while others offer 1 year, 2, year, or longer contracts

- In most cases, the mining service reserves the right to cancel your contract if it becomes unprofitable; the company can’t be expected to run mining equipment at a loss

- As the user, you don’t need to worry about maintenance, cooling, electricity, upgrades, or anything else; all you need to do is keep paying your cloud mining “rent”

Do you want to participate in bitcoin mining with none of the hassle? Cloud mining might be the right choice for you. However, it comes with some major downsides. We’ll talk about those downsides next.

Bitcoin Cloud Mining Can Be Risky

A handful of major companies offer legitimate and trustworthy cloud mining services. However, for every 1 legitimate cloud mining company, there are 10 scam services trying to steal your money.

Scams are prevalent across the cloud mining industry, to say the least.

It’s obvious why scams are so common: there are plenty of people who want to get involved in bitcoin mining because they’ve heard about people getting rich. However, many of these people have no idea or desire to maintain their own mining rigs. Then, they stumble upon a website that promises huge ROIs with no risk: all you need to do is pay the company a bunch of money upfront, and they’ll do all the hard work. You get the profits sent to you.

Sometimes, that company doesn’t operate any mining farms in the real world. The company might just be taking money from users and then investing it in marketing. The cycle continues until customers get suspicious, at which point the scammers shut down the website.

In other cases, the bitcoin cloud mining scam could take the form of a pyramid scheme. Users might be asked to refer friends to the platform in exchange for big rewards. At some point, the entire scheme collapses and everyone loses their money.

Bitcoin Cloud Mining Can Be Unprofitable

At best, you’re going to make a small ROI with bitcoin cloud mining. Remember: someone else is doing all the hard work for you. You’re just providing the funding. You can’t expect to earn massive ROIs through such a process.

In most cases, your 2 year bitcoin mining contract might pay you 10% returns per year. Some companies advertise ROIs of 14%, although returns any higher than that will look suspicious.

If a bitcoin cloud mining company is offering suspiciously high returns – like ROIs of 0.5% to 1.0% per day, then it’s likely you’re being scammed. There are few legitimate businesses capable of guaranteeing such returns – especially in an industry as volatile as bitcoin.

Ultimately, bitcoin cloud mining is rarely the gold mine people expect it to be. It’s a fun way to dip your toes into the waters of bitcoin mining, but it’s far from a guaranteed income source.

And, as mentioned above, most bitcoin cloud mining companies will simply shut down your account if mining becomes unprofitable.

Even Legitimate Bitcoin Cloud Mining Companies Don’t Disclose their Farm Locations

One thing that makes bitcoin cloud mining difficult is the fact that legitimate companies rarely disclose the location of their bitcoin mining farms.

This is done for security reasons. These farms are home to millions of dollars’ worth of mining equipment. These locations might also hold enormous amounts of funds in cold storage.

We list a number of legitimate cloud mining providers below. However, even with these companies, you won’t see specific addresses or location information for their global mining centers. This is on purpose. The company is trying to protect itself. However, it also makes it easier for scammers to trick people into thinking they’re running a legitimate mining farm.

The Best Cloud Bitcoin Mining Companies

The list of good, legitimate cloud bitcoin mining companies is very short. At best, there are five legitimate companies in the space. The best-known company, Genesis, is a well-established and highly-popular firm. The other companies on this list don’t have the same strong reputation, but they do have a multi-year track record of providing cloud bitcoin mining to clients:

Genesis Mining

Genesis Mining is the best-known cloud bitcoin mining company available today. Genesis was founded in 2013 and maintains large cloud mining centers worldwide. At their official website, you can view a live feed of some of the company’s Iceland-based data centers. The company has based its operations in Iceland due to the cheap geothermal electricity.

When you buy a Genesis Mining cloud mining plan, you can choose to focus on one or more cryptocurrencies. You might choose to split your hash power between bitcoin and Litecoin, for example, and go 40% bitcoin and 60% Litecoin. You can actually customize your hash power on-the-go through your Genesis Mining dashboard.

Unlike other providers, Genesis Mining doesn’t exaggerate about how much money users can expect to make. They don’t fill customers’ heads with grandiose claims about getting rich quick. Instead, they provide a legitimate cloud-based crypto mining service.

Genesis Mining has frequently sold out of cloud mining contracts. In many cases, you’ll visit the Genesis Mining website and find no contracts are available to purchase. This is the only real downside of Genesis Mining: they’re so popular that it can be hard to buy a cloud mining contract for your desired cryptocurrency.

Hashnest

Hashnest is made by Bitmain, the well-known bitcoin ASIC hardware manufacturer. Bitmain is a China-based company responsible for Antpool, one of the world’s largest bitcoin mining pools.

Hashnest is newer than Genesis Mining, although the company has proven itself to be legitimate. Unlike Bitmain, Hashnest is not exclusively based in China. The company has mining farms worldwide in regions with low electricity.

Hashnest is well-known for its Payout Accelerated Cloud Mining Contract or PACMiC. PACMiC is a type of electronic contract structured in a way that Bitmain pays the maintenance costs of mining rigs (like electricity) while all mining revenue is used to pay back the owner of the PACMiC contract. If the principal is not paid back fully, then Bitmain will share profit with buyers.

With Hashnest, you can purchase hash power directly frm Antminer devices like the S9, which has a rate of around 125 TH/s. You can then pay a fixed maintenance fee depending on the device. If you’re renting an entire S9 from the company, for example, then you’ll pay a maintenance fee of $0.19/TH/day.

Like Genesis Mining, Hashnest lets you customize mining plans extensively based on your desired power and price.

Hashflare

Hashlare is another legitimate cloud bitcoin mining company. The company was launched by Hashcoins, a bitcoin mining equipment manufacturer founded in 2013. At the website, you’ll find a complete rundown of the firm’s data center, including pictures of the miners in operation.

Hashflare sells cloud mining contracts for a variety of different cryptocurrencies. You can choose to buy SHA-256 and Scrypt mining contracts, for example, that allow you to mine all SHA-256 and Scrypt coins. Hashflare also lets you choose your own mining pool.

Like the other two providers listed above, Hashflare is open and honest about its maintenance fees. They only offer 12 month contracts (although they used to offer unlimited-length contracts).

Conclusion

You’ll find plenty of bitcoin cloud mining companies available online today, but few of them are legitimate. The three companies listed above – Genesis Mining, Hashnest, and Hashflare, are all operated by legitimate companies who provide transparent information about their rates and contracts. We don’t recommend straying outside of these three major names because the cloud bitcoin mining industry is filled with scams.

That concludes our chapter on cryptocurrency mining. In Chapter 5, we’ll talk about cryptocurrency mining pools.

[vc_row full_height=”yes” css=”.vc_custom_1558532547039{margin-top: -50px !important;margin-bottom: 20px !important;}”][vc_column][rev_slider alias=”mining”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

BITCOIN MINING

Although other digital coins have at times diversified mining protocols from the original Bitcoin chain’s architecture, Bitcoin itself certainly exists and remains promising and viable as a currency, solely due to its miners. Energy costs deflated retail enthusiasm substantially during 2017, yet mining operations remain profitable with a bit of refined ingenuity, epitomized by standard model home mining kits.

Great strides have been made in factoring in all relevant metrics by ASIC mining rig suppliers, to aim at profitability for the retail user. Bitcoin mining remains an energy-intensive operation, with the bulk of the chain’s mining happening in China, but it both validates other users’ transaction as well as producing new bitcoin.

In a nutshell, mining is the backbone of the Bitcoin network, without which money supply issues would become immediately relevant while Bitcoin’s current digital asset status would be decidedly affected too. With that being said, for a moment in time during 2017 – before it became default behavior for individuals to pick up a prefabricated mining rig or two and commence mining – it seemed that mining would be co-opted by giant corporates looking for easy profits.