Cryptocurrency Knowledgebase – Wallets

What is a Bitcoin Wallet?

Chapter 3.1

Before we start listing specific bitcoin wallets, it’s important you understand what a bitcoin wallet is and how it works.

As mentioned above, bitcoin wallets are not like ordinary wallets. The two types of wallets have very little in common. Although both traditional wallets and crypto wallets store your funds, they do so in vastly different ways.

What Are Bitcoin Wallets?

Bitcoin wallets are like bank accounts for the bitcoin community. Like a bank account, your bitcoin wallet stores your bitcoin in a convenient place. You can open multiple bank accounts to spread your funds around.

Just like a bank gives you an account number, a bitcoin wallet will give you an address. Your address will be a string of numbers and letters that looks somrthing like this:

1BoatSLRHtKNngkdXEeobR76b53LETtpyT

Think of this address as like your domain name on the internet. Anyone can view your bitcoin wallet address and check the blockchain to view that address. This address is public: you can give it out to anybody. They’ll be able to send bitcoin to your address simply by entering that address into their bitcoin transaction client – like their own wallet app.

You can’t store your bitcoin without a bitcoin wallet. However, a bitcoin “wallet” is just any type of bitcoin storage system. Sure, you can buy hardware wallets from specific manufacturers. However, a piece of paper with secret words written on it can also be your bitcoin wallet. Both types of wallets are effective forms of bitcoin storage.

There’s even something called a “brain wallet”, where your bitcoin fortune is literally stored “in your brain”. As long as you can remember 12 secret words, you’ll always have access to your bitcoin.

There Are Two Broad Types of Bitcoin Wallets

There are a number of different types of bitcoin wallets. However, they can all be separated into two broad categories, including:

- Hot Wallets

- Cold Wallets

Hot wallets are wallets that are connected to the internet. They’re “hot” because they’re online, which means they’re more accessible (and thus, less secure).

Cold wallets, also known as cold storage wallets, are not connected to the internet. They’re offline. A cold wallet can be a USB stick stored in your safety deposit box. It can also be a piece of paper with 12 or 24 words written on it.

Some wallets function like both. A Trezor is only a cold storage wallet when it’s disconnected from your PC, for example, but it becomes a hot wallet when you’re connected to the internet and accessing your bitcoin funds.

Types of Wallets

All of the wallet types listed below can be categorized as hot wallets or cold wallets. Keep reading to find out the most popular types of bitcoin wallets available today:

Web Wallets

Web wallets are some of the easiest and most popular bitcoin wallets available today. They’re hot wallets because they’re constantly connected to the internet. You don’t need to have any physical device to access your web wallet. Instead, all you need is an internet connection and a login – like a username and password.

Web wallets are similar to PayPal: you’re trusting someone else’s servers with your bitcoin private keys. When you leave your bitcoins in an exchange, you’re trusting your bitcoins to that exchange’s web wallet. There have been infamous cases where hundreds of millions of dollars’ worth of bitcoin has been stolen from web wallets. In many cases, these hacks occur because of a vulnerability within the server or the code.

Pros:

- Access your bitcoin from anywhere with an internet connection

- Easy to use

Cons:

- One of the least secure bitcoin storage options

- You’re trusting your bitcoins to a third party, like an exchange or online server

Software Wallets or Mobile Wallets

Software wallets consist of software you download for your computer or mobile device. Today, there are a number of major software developers – like Mycelium – that build Android apps, iOS apps, and computer software designed to store your bitcoins.

These software wallets can function in different ways. Some people use software wallets as cold storage, for example, by installing the software on an offline (air-gapped) computer. Other people use an old, offline mobile device to store cryptocurrencies.

In most cases, however, software wallets are hot wallets. They’re on your daily-use mobile device. They’re installed on your normal PC. They leave your bitcoins accessible at all times. Your bitcoins are as safe as your computer or smartphone is. For some people who are careless about device security, this can be a huge problem. For other people who are careful with their phones, have multiple PIN and backup options, and have a remote wipe function enabled, software wallets can be highly secure.

Pros

- Easy to use

- Can be installed on virtually any desktop computer (Mac OS, Windows, Linux) or mobile device (iOS or Android)

- Free (typically)

- Keeps your bitcoins accessible and secure

Cons

- Your bitcoins are only as secure as your computer or smartphone

- Vulnerabilities within the software can lead to attacks when using the software as a hot wallet (say, if a crypto-stealing virus is already installed on your PC)

Hardware Wallets

Originally, there were two main bitcoin hardware wallet brands, including Trezor and the Ledger Nano S. These two devices function in a similar way: they look like USB sticks. You can store these devices in a safety deposit box, a safe in your home, or in your desk drawer. When they’re disconnected from your computer or phone, they act as cold storage bitcoin wallets. Then, when you connect them to your computer – say, to spend your funds at an online retailer – they become hot wallets.

Today, there are more hardware wallet brands than just Trezor and the Ledger Nano S. There are a growing number of manufacturers seeking to provide the next safest solution for bitcoin storage.

The Ledger Nano S and the Trezor wallet are the two most popular options on the market today. Both are priced at around $100. However, alternatives like KeepKey are gaining market share.

Pros

- Made by reputable (often Europe-based) manufacturers with a long history of protecting bitcoin funds

- Affordable (priced at around $100 for most wallets)

- Easy to store

- Easy to access your cryptocurrencies

- Can switch between hot storage and cold storage as needed

- Can be placed in a safe or other secure storage solution

Cons

- Not free

- Not indestructible

Brain Wallets

One of the coolest things about cryptocurrencies is that you don’t need any type of physical or software wallet to securely store your cryptocurrencies. In fact, all you need to do is remember 12 words. These 12 words provide secure access to your bitcoin. When you memorize these 12 words – say, by memorizing a mnemonic phrase – you can gain access to your bitcoin at literally any time you need to. This is called a “brain wallet” because you’re securing your cryptocurrency in your brain.

As long as you remember those 12 or 24 words (depending on your desired level of encryption), you’ll have complete access to your bitcoin funds at all times.

Brain wallets and the 12 word passphrase system are based on the BIP39 encryption. Most bitcoin wallets – like software wallets, hardware wallets, and apps – will support this type of encryption when you setup your wallet for the first time. Your wallet will display your 12 or 24 word passphrase. You can choose to write this phrase down. Or, you can memorize it in your head.

BIP39 encryption only requires you to input the first four letters of each of the 12 or 24 word passphrase. So if your first four words are CHILI, DUMPLING, TOKYO, and MAIZE then you’ll only need to memorize CHIL, DUMP, TOKY, and MAIZ. As long as you remember the first four letters of each word, then you’ll always have access to your crypto funds.

Typically, you setup BIP39 passphrases using your existing bitcoin wallet. You transfer your bitcoin to that wallet, then generate a BIP39-encrypted passphrase. You memorize that passphrase or write it down. Then, you can use those words to recover your passphrase at any time. At this point, you can delete the software and rely exclusively on your passphrase to gain access to your bitcoins. Or, you can keep your passphrase as a second layer of defense.

Obviously, brain wallets can be one of the least secure ways to store your bitcoins – or they can be one of the most secure ways. It depends on how much you trust your brain. There are obvious drawbacks – like the fact that nobody will be able to access your bitcoins if you die or lose your memory. However, some people view these as major advantages.

Pros

- It’s as secure as your memory or brain

- Regain access to your cryptocurrency funds at any point simply by recalling 12 or 24 words

Cons

- It’s as secure as your memory or brain

- Can make it difficult to quickly access your bitcoins

Paper Wallets

We talked about the 12 or 24 word passphrases up above in the brain wallet section. A paper wallet is like a brain wallet, but instead of memorizing the 12 or 24 words, you write them down in a secure place – like a piece of paper stored in a bank vault or safe within your home.

Typically, your software or hardware wallet will ask you to setup a paper wallet when you first setup your wallet. This paper wallet will ensure you always have access to your funds – even if the device with the installed software gets destroyed or if you lose your hardware wallet in a house fire.

Pros

- Easy to use – as long as you can write words on a piece of paper, you can setup a paper wallet

- Provides an easy backup option if you lose access to your main software or hardware wallet

- Can be securely stored in a bank vault, safe, or locked filing cabinet

- More secure than brain wallets because there’s no risk of forgetting your words

Cons

- Paper is flammable and destructible

- Paper can get wet or disintegrate when stored improperly, making it impossible to decipher your words in the future

Other Physical Wallets (Like Metal Wallets)

In 2017 and 2018, we’ve seen a number of manufacturers release more advanced, hardcore versions of “paper wallets”. These wallets function like paper wallets in that they display your 12 or 24 word passphrase. However, instead of writing your phrase down on a flimsy, flammable, destructible piece of paper, these alternative wallets let you inscribe your phrase in a piece of stainless steel or other durable material.

The advantage is obvious: you can lose a piece of paper in a flood or fire. However, stainless steel will survive virtually any situation. Even if your house burns down, you’ll be able to sift through the wreckage and find your indestructible wallet inside.

Pros

- Highly-secure form of passphrase storage

- Your passphrase is on indestructible material

- Someone can still access your crypto funds if they see your passphrase (say, if they see your wallet and your words)

Cons

- Not free

- Limited number of options on the market (it’s a relatively new phenomenon)

Multi-Signature Wallet

A multi-signature wallet isn’t really a type of wallet. However, you’ll still see multi-signature wallets mentioned on a list of bitcoin wallet types.

Multi-signature support – also abbreviated as multi-sig – is a feature found on many of the bitcoin wallets listed above. If you’re enabled multi-sig, then you’ll be required to input two signatures to access your cryptocurrency funds.

Some ICO projects use this approach to protect raised funds. Accessing company funds might require 4 signatures from the 5 members of the founding team, for example. This prevents one rogue member from disappearing with all the raised funds.

Other people use a multi-signature wallet for their own protection. You might store your private keys in two separate locations to give an extra layer of cryptographic security.

Pros

- Easy to enable on most bitcoin wallets

- Adds an extra layer of protection

- Makes it difficult to spend or access your funds impulsively

- Can protect funds – especially funds stored as a group or as part of a company pool

Cons

- Increases the risk of losing a private key or signature

- You don’t have full control over your funds if you don’t have full control over the private keys or signatures

Hierarchical Determinist (HD) Wallets

Just like multisig wallets, HD wallets are more of a feature than a specific type of wallet. A hierarchical determinist (HD) wallet lets you generate multiple addresses from within a specific bitcoin address. You can create a subwallet, for example, that hides your public address behind another public address.

This wallet type is also known as BIP 0032. Many major hardware and software wallets have HD support. With HD wallets, the seed is a random, 128-bit value presented to the user as a 12 word mnemonic using common English words – similar to the seed used to protect your ordinary bitcoin funds.

HD wallets can be useful for adding new addresses to your account. Most people use them for privacy purposes. Other people use them to conveniently separate their funds.

Pros

- Easy to setup

- Available on most major software and hardware wallets

- Useful for creating an extra layer of privacy

Cons

- Doesn’t provide added security

Conclusion

Ultimately, most cryptocurrency users use a blend of multiple wallets. Most cryptocurrency users have at least some funds stored in an online bitcoin wallet – like an exchange wallet.

Many cryptocurrency users also store funds in a software wallet – like the Mycelium mobile app. Plus, bitcoin users may choose to add an extra layer of protection to that software using a paper wallet. You might use a paper wallet as a backup plan if you lose your mobile device or computer, for example. Some people might backup their funds even further by memorizing their passphrase using a brain wallet, in which case they memorize their 12 word passphrase.

Ultimately, there’s no right or wrong way to store your bitcoins. It’s up to you to decide on your desired balance between security and convenience.

What is the Best Bitcoin Wallet?

So you’re ready to securely store your bitcoin. Now, you need to pick the right wallet.

Which wallet is best for storing bitcoin? Which bitcoin wallet should you choose? Today, we’re explaining everything you need to know about picking the best bitcoin wallet.

Chapter 3.2 – Best Bitcoin Wallets

Trezor

Trezor, along with the Ledger Nano S, is one of the two most popular bitcoin wallets on the market today. Trezor is secure, easy-to-use, and locks your bitcoin away while still making them easy to access. Trezor is popular with new crypto users and advanced users alike.

If you have more money invested in cryptocurrency than you can afford to lose, then you owe it to yourself to get a hardware wallet like the Trezor or Ledger Nano S. You can pick up the Trezor for around $100.

The device itself looks like a USB stick. You plug it into your phone or computer when you need to access your bitcoin, at which point you can access your funds through the Trezor web client. This Trezor software allows you to access your bitcoins – say, if you want to make an online purchase or transfer your bitcoins to an exchange.

Ledger Nano S

The Ledger Nano S is the most popular bitcoin wallet made by Ledger. However, Ledger does offer a number of other bitcoin wallet options – including a cheaper option and a more expensive one. The Ledger Nano S is the mid-range solution, priced at around $100.

Like Trezor, you can use the Ledger Nano S as a cold storage solution or a hot storage solution. You can leave the wallet tucked away in a safe or locked drawer, then connect it to the internet when you need to access your funds.

KeepKey

KeepKey is the third most popular bitcoin hardware wallet. It was released after the Trezor and Ledger Nano S hit the market, so it’s not quite as popular as its two larger competitors. KeepKey, however, offers similar functionality at approximately the same price. For about $100, you’ll get a device that’s easy-to-use, easy to access, and provides secure bitcoin storage.

Mycelium

Mycelium is a popular mobile app used to store bitcoin. Mycelium is available for iOS and Android. It functions as a hot wallet (in most cases) because it’s installed on an internet-connected phone. However, you may choose to use it as a cold storage solution by disconnecting your phone from the internet (you might install the app on an old phone, for example).

Mycelium is user-friendly and secure. The app prompts you to setup a BIP39 passphrase when you setup your wallet for the first time. As long as you have this 12 word passphrase, you’ll be able to claim your bitcoin funds at any point in the future. You can write this passphrase down or memorize it. Then, if your phone gets lost, damaged, or stolen, you can still recapture your funds at any point in the future.

Mycelium also makes it easy to accept payments. The app has a QR code you can use to accept bitcoin payments. Additional features – like hierarchical deterministic (HD) support – make this wallet one of the best bitcoin wallets available today.

Mycelium is totally free to use.

Electrum

Electrum is another popular type of software wallet. The main difference between Electrum and Mycelium (they’re two of the most popular wallets) is that Electrum is available for Windows, Mac, Linux, and Android – but not iOS.

Electrum provides features like two factor authentication over a convenient software interface. The UI looks surprisingly similar to Mycelium, and the two apps provide very similar functions and features.

Both Mycelium and Electrum let you customize your bitcoin fees. You can choose to pay a low fee if you’re not rushing to complete your transaction. Or, you can pay high fees to complete your transaction as quickly as possible.

Bitcoin Core Wallet

Found online at Bitcoin.org, the Bitcoin Core wallet is one of the best wallets for users looking for a desktop-based bitcoin wallet solution. It functions like ordinary computer software: you download the client, then store your bitcoin on your computer.

Bitcoin Core was the wallet most people used in the early days of bitcoin. Today, it’s relatively large compared to other wallets on this list because you’re download the full bitcoin client (over 130GB in size). While other software on this list function as lite clients, this is a full bitcoin client.

Jaxx

Jaxx is one of the most popular bitcoin wallets available today. It’s particularly popular with users who hold both bitcoin and Ethereum and want to hold both coins in the same place. Launched in 2014 by Ethereum co-founder Anthony Diiorio, Jaxx is available for iOS, Android, Windows, Mac, and other platforms as a free download.

Some of the useful features with Jaxx include its browser for value transfers. Using Jaxx, you can hold, control, and trade cryptocurrencies like bitcoin, Ethereum, Litecoin, Dash, ZCash, Augur, Salt, Civic, Qtum, and others.

Jaxx is totally free to download and use.

Armory Bitcoin Wallet

Armory is a cold storage hardware wallet that comes with a hardware device and a desktop app. The desktop app is a hot wallet (connected to the internet), while the hardware wallet stores your bitcoins securely offline. The unique thing about Armory is that you have full control your bitcoin even if you lose the hardware device. If someone steals your wallet, you still have control of your bitcoins via the desktop app.

Copay Wallet

Copay is another popular bitcoin wallet with a wide variety of features. The main unique selling feature of Copay is that multiple users can share a single wallet. This can be useful if users are launching a collective mining pool. As you might expect, Copay has multisig support, which means you can setup Copay to require multiple signatures to access your funds. It’s like a joint checking account but for bitcoin.

Conclusion

Ultimately, there are more bitcoin wallets available today than ever before. Talented hardware and software developers are regularly releasing new and exciting new options. The bitcoin wallets above, however, are some of the best bitcoin wallets available today.

What is the Best Ethereum Wallet?

Chapter 3.3

Ethereum is the second most popular cryptocurrency and it continues to grow every year. Today, it’s easier than ever to find a good Ethereum wallet – including hardware wallets and software wallets.

What’s the best Ethereum wallet? Keep reading to find out.

Ledger Nano S

Many people associate the Ledger Nano S with bitcoin storage. However, the Ledger Nano S can store much more than just bitcoin: it can also store Ethereum, Litecoin, and other cryptocurrencies. If you’re using the Ledger Nano S to store Ethereum, then you can expect a similar experience to using it as a bitcoin wallet. There’s a small OLED screen that gives you tidbits of information about each transaction. Your private key is stored on the device itself along with your Ethereum.

The Ledger Nano S lets you access your funds through MyEtherWallet, the popular web-based extension. You can attach your Ledger Nano S to your computer at any time to access and spend your ETH funds.

You can buy the Ledger Nano S for around $100.

Trezor

Like the Ledger Nano S, the Trezor wallet can store bitcoin, Ethereum, and other cryptocurrencies. It’s one of the most popular Ethereum wallets available today. Priced at around $100, Trezor can be paired with software wallets like MyEtherWallet. You connect your Trezor to your computer whenever you want to spend your Ethereum (say, when you’re investing in ICOs). Then, you can easily transfer it to MyEtherWallet and disconnect your Trezor.

Trezor is also durable and water-resistant. It comes with a built-in display that makes it easy to verify transactions.

MyEtherWallet

Both the Trezor and Ledger Nano S are hardware wallets. MyEtherWallet, however is a web-based wallet. Unlike most web-based wallets, however, MyEtherWallet doesn’t store your private key in some online server like an exchange. Instead, MyEtherWallet is a browser extension – which makes it more of a software wallet than an online wallet.

MyEtherWallet lets you set a password to access the extension. Then, the extension will provide you with a downloadable file. You can download that file locally to your PC. Then, any time you need to access MyEtherWallet, you upload that file. The file acts like the key that unlocks your funds. You can easily transfer the file between computers.

Another unique feature of MyEtherWallet is that you can create smart contracts within the extension. The open source nature of MyEtherWallet also means that developers will often pair their apps or services with MEW. That’s why both Trezor and the Ledger Nano S are accessible through MyEtherWallet.

Ultimately, the only real issue with MyEtherWallet is that it has a clunky interface not overly friendly to beginner users. You’ll want to have some basic cryptocurrency experience before you start using MyEtherWallet. You also need to make sure not to delete your MyEtherWallet file – or else you risk losing your entire stash of ETH.

Jaxx

Jaxx is another popular Ethereum wallet. You also saw Jaxx on our list of the most popular bitcoin wallets. In total, Jaxx supports the secure storage of 13 different cryptocurrencies.

There’s a desktop version of Jaxx as well as a mobile app. When using Jaxx, your private keys are stored locally on your device.

Overall, Jaxx is user-friendly and great for beginners. It walks you through the Ethereum storage process while maintaining a high level of privacy and security.

Exodus

Exodus is a surprisingly-stylish desktop wallet for bitcoin, Ethereum, and other major currencies. When launched, Exodus was the world’s first multi-cryptocurrency desktop wallet. The wallet is free to use and download.

The main dashboard of Exodus lets you view your entire portfolio value at a glance. You can also see individual breakdowns of all seven supported cryptocurrencies. Another unique advantage is that ShapeShift, the popular crypto-to-crypto exchange service, is built right into the platform. That means you can easily swap between cryptocurrencies to balance your portfolio.

Other nifty features include one-click email recovery and backup seed keys that let you restore your wallet if you ever lose access. Like MyEtherWallet, Exodus also supports smart contracts.

The one major drawback to using Exodus is that the software needs to be constantly connected to the internet. However, your private keys remain stored locally on your computer at all times.

Mist

Mist is the official Ethereum wallet. It’s one of the best and most popular Ethereum wallets available today – and obviously, it’s the wallet that’s officially developed by the Ethereum Foundation.

When you first install Mist, it will take some time to fire up. That’s because Mist needs to synchronize with all Ethereum nodes. Once that sync is complete, Mist will ask you to setup a secure password.

Mist has no backup password: the password you setup here is the only way to access Mist. There’s no other option, so make sure you don’t forget it.

In terms of security, Mist works like most other Ethereum wallets listed here. Your private keys are stored on your local device.

Mist, like Exodus, has ShapeShift built-in, allowing you to easily trade cryptocurrencies and balance your portfolio. You can hold Ethereum and all ERC20 tokens in your Mist wallet.

MetaMask

MetaMask is the final best Ethereum wallet on our list. MetaMask is not just a wallet: it’s an entire browser that lets you access the Ethereum network. You can use MetaMask to store and send Ethereum, but you can also use it to access any decentralized apps (dApps) on the Ethereum network.

With MetaMask, your private keys are encrypted and stored locally on your machine. You can export your private keys at any time.

What is the Best NEO Wallet?

Neo, formerly known as Antshares is one of the most popular cryptocurrencies available today. NEO’s surging popularity has been accompanied with a growing number of NEO wallets.

NEO is similar to Ethereum: it’s a decentralized ecosystem with smart contracts and its own token standards. That’s why many of the NEO wallets on our list aren’t just crypto wallets: they’re also browsers that let you access the NEO ecosystem.

With that in mind, let’s take a closer look at the best NEO wallets available today.

NEON Wallet

NEON is one of most popular NEO wallets on the market. Like most of the other wallets on this list, NEON supports GAS and NEO. It’s desktop-based wallet software that can be downloaded and installed for free.

Like other desktop crypto wallets, your private keys are stored locally on your computer. Your key is stored on your PC. You don’t need to trust any third party. However, your key is only as secure as your PC: so if your PC gets an infection, or if you get hacked, then your NEO could be at-risk.

NEON is available for Windows, Mac OS, and Linux. It’s not available as a mobile app. It’s also not the official NEO wallet software offered by the core Neo development team.

NEO Wallet

The NEO Wallet is a web-based wallet that lets you quickly and easily access your NEO.

Despite the name, the NEO Wallet isn’t the official wallet offered by the NEO team. instead, it was built by an open source community of Neo users.

Although the NEO Wallet is a web-based wallet, your information is not transmitted online. It’s stored locally within your browser files.

Another helpful feature of the NEO Wallet is the ability to create a backup wallet. If you ever lose access to NEO Wallet – say, if you delete browser files or lose access to your computer – then your backup wallet can ensure you don’t lose your funds.

The NEO Wallet allows you to store and send NEO and GAS. Today, the wallet is available for Google Chrome and Microsoft Edge. It’s available in English and Chinese.

NEO GUI

There are two official NEO wallets, including the NEO Command Line Interface (CLI) and the NEO Graphical User Interface (GUI). The NEO CLI is ideal for those who have experience with command lines and executing commands. The NEO GUI, however, is designed for most users who want a more beginner-friendly experience.

NEO GUI is the official wallet. It’s also the most user-friendly wallet, featuring a colorful interface and an easy-to-use menu system. The only drawback is that the wallet is exclusively available for Windows. You can download it for free on Windows 7 systems and above.

NEO Tracker

![]()

NEO Tracker is an open-source, JavaScript-based wallet that lets you easily store and transact NEO and GAS tokens. It’s an offline wallet that users your PC’s browser to store files locally. No information is stored on NEO Tracker’s servers.

NEO Tracker is a popular NEO wallet available for Google Chrome and Microsoft Edge. Although it’s based in your browser, it can function as an offline wallet.

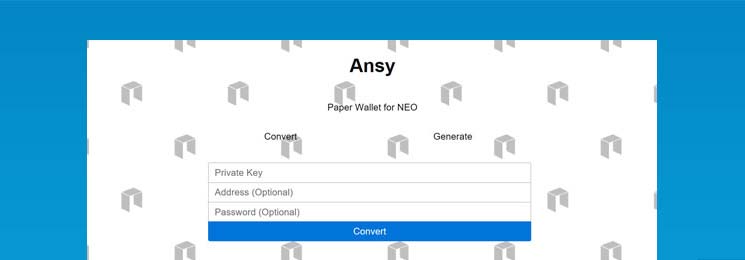

Ansy Wallet

All other wallets on this list are software wallets. Ansy, however, is a paper wallet. It’s a paper wallet designed specifically to store NEO tokens.

The piece of paper has a public and private address printed on it. Your public address can be scanned by any users who want to send NEO tokens to you. the private address, meanwhile, can be manually entered to scanned to verify a user’s identity during a NEO token transfer.

Overall, Ansy is viewed as a safe wallet because it’s offline and based on paper. However, it’s only as safe as you want it to be: your NEO tokens are safe as long as the piece of paper remains safe.

Ansy is ridiculously easy to use. Just visit the developer’s Github page here: https://snowypowers.github.io/ansy/

From there, you’ll be able to either generate a new private key or convert an existing private key. All conversions take place using the Ansy online UI. At the bottom, there’s a “Print” button. Click print when you’re ready to print your paper wallet. That’s it!

Ansy is available for free, although the developer has posted donation links to various crypto wallets.

Conclusion

The NEO wallets above all support NEP-5 tokens – just like most Ethereum wallets support ERC20 tokens. Today, the Neo ecosystem continues to grow and it shows no signs of slowing down. Use one of the NEO wallets above to securely hold your NEO tokens or NEP-5 tokens.

What is the Best Hardware Wallet?

Chapter 3.5

Hardware wallets are one of the most popular and secure ways to store cryptocurrencies. However, not all hardware wallets are built equal. There are popular options like Trezor and the Ledger Nano S – but which hardware wallet is the best choice for you? Keep reading to discover the best hardware wallets in the crypto industry today.

All of the wallets below are physical devices. Some describe them as “smart cards”. Basically, they’re a secure piece of electronic hardware – similar to a USB stick, but with more advanced features built-in.

The advantages of a hardware wallet include convenience, security, and the ability to store multiple cryptocurrencies. The most popular hardware wallets, for example, support storing bitcoin, Ethereum, Litecoin, and many other large-market-cap cryptocurrencies.

These hardware wallets have other things in common. Many have a basic display that lets you confirm or deny a transaction. You plug the device into your computer or smartphone. Then, to verify a transaction, you tap a button on the display after viewing the requested amount on that display. Some devices have touchscreens and advanced displays. Others have displays that look like a calculator from the 1980s.

One final thing these wallets have in common is a PIN, a password, or a passphrase. Many of these wallets allow you to setup a BIP39-encrypted passphrase. That consists of a series of 12 or 24 four letter words you can use to regain access to your cryptocurrencies at any time – say, if your hardware wallets gets lost or stolen. Meanwhile, the PIN lets you gain access to the wallet – like when you’re loading funds or verifying a transaction.

The Best Cryptocurrency Hardware Wallets

Ledger Nano S

The Ledger Nano S is one of the most popular cryptocurrency hardware wallets available today. Made by a Paris, France-based company, the Ledger Nano S lets you store bitcoin, Ethereum, Litecoin, Bitcoin Cash, Bitcoin Gold, Ethereum Classic, Dogecoin, ZCash, Ripple, and about a dozen other cryptocurrencies.

The Nano S is compatible with Windows, Mac OS, Linux, and Chrome OS. As long as you have one USB port to plug your Ledger Nano S into, you’ll be able to access your Ledger funds on your device.

The device itself is made from brushed stainless steel, making it one of the most stylish cryptocurrency hardware wallets on the market today. At the same time, the wallet is relatively nondescript: you could store $1 million on your Ledger Nano S and the average person wouldn’t be able to distinguish the Nano S from a USB stick.

The Nano S is priced at around $100, although Ledger has a cheaper and more expensive option available as well.

Trezor

Trezor is another popular hardware wallet. It’s made by the same Prague, Czech Republic-based team, Satoshi Labs, that developed Slush Pool, the world’s first bitcoin mining tool, and Coinmap, a worldwide directory of bitcoin merchants. That company saw a demand for hardware wallets like Trezor. The word “Trezor” means “vault” in Czech.

Trezor has a basic display on top and buttons below it. The device itself, however, is purposely nondescript. It’s even less noticeable than the Ledger Nano S. It looks like a USB thumb drive.

The face of Trezor has a button that you’ll need to click to sync your cryptocurrency funds with your PC. Trezor also has you enter a code that has to match with your PC – similar to how a CAPTCHA works.

When setting up Trezor for the first time, you’ll be asked to create a PIN code. A passphrase will also help you regain access to your wallet in case your device gets lost or breaks.

Like the Ledger Nano S, Trezor supports a wide variety of cryptocurrencies, including bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Dash, ZCash, Dogecoin, and others.

KeepKey

Trezor and the Ledger Nano S are the two most popular hardware wallets available today. KeepKey, however, is a new challenger that’s been gathering market share.

KeepKey, like the other two options on this list, is priced at around $100. The main difference with KeepKey is that it’s catered to the intermediate or advanced cryptocurrency crowd – although the UI remains easy for anyone to access.

KeepKey was first introduced in 2015. The device features a full metal body with a large display. When you setup your KeepKey wallet for the first time, you’ll create a PIN and generate a passphrase – just like you do with Trezor and the Ledger Nano S. KeepKey, however, lets you customize your passphrase for added security. In addition to the basic 12 word option, for example, you can also setup a 10, 18 or 24 word passphrase.

KeepKey supports all major cryptocurrencies, including bitcoin, Ethereum, Dogecoin, Litecoin, Dash, and Namecoin, among others.

Bitbox

The three hardware wallets listed above have a commanding share of the market. Trezor, Ledger, and KeepKey are the three best-known names in the industry – and it’s not particularly close.

However, a growing number of hardware wallet manufacturers are attempting to challenge the throne.

Bitbox, formerly known as Digital Bitbox, is one such hardware wallet. It’s been labeled as a “minimalistic” bitcoin wallet because of the shape and size of it. At first glance, Bitbox could easily be mistaken for a microSD drive. You’d never know it can hold a fortune in cryptocurrencies. There isn’t even a display on the front – which some people appreciate, but others might dislike. The small form factor also makes Bitbox easier to lose than most other wallets on this list.

One of the unique selling features of the Bitbox is the fact that it comes with microSD card support for offline backup and recovery. The Bitbox software works with desktop operating systems, iOS, and Android.

Despite the small size and nondescript appearance, Bitbox comes with an advanced set of features. There’s two factor authentication (2FA), for example, along with multi-signature support, Tor support, and U2F, among others.

Bitbox has another advantage: it’s priced lower than the three options listed above. You can buy Bitbox from the Swiss-based manufacturer for 59 EUR (although international shipping can be as high as 19 EUR).

OpenDime

The other wallets on this list function like smart cards or thumb drives. OpenDime, however, works in a much different way: it functions like real, physical money. You can hand your OpenDime to someone in the streets and that person can know that you’re handing them $1,000 – or whatever amount of cryptocurrency you have.

OpenDime’s stick comes with a private key. That private key provides access to your cryptocurrency funds, although the private key can’t be revealed until the stick is broken. To verify that the stick is unbroken, OpenDime comes with a seal that needs to be snapped open. Once the seal has been snapped, the user can access the private key via a text document (private key.txt). The private key lets them spend and transfert he cryptocurrencies wherever they like.

Another nifty feature with OpenDime is that you can check the balance at any time without breaking the seal. You can plug OpenDime into a computer to view the balance – but to spend that balance, you’ll need to unseal.

Ultimately, OpenDime bends the definition of a hardware wallet – but it’s worth mentioning on this list if you’re looking for a unique way to store your cryptocurrencies.

Conclusion

There are more cryptocurrency hardware wallets available today than ever before. Trezor, Ledger, and KeepKey are three of the most popular options, but we’re seeing new products appear online regularly. Choose one of the hardware wallets listed above to securely store your cryptocurrencies on a reliable, physical device.